In the international market, the USD-Index rose by 0.11 points compared to last week, to 106.12 points, the highest level in more than 5 months (since the beginning of November 2023).

The USD increased sharply after the Chairman of the US Federal Reserve (Fed), Jerome Powell, stated that the US economy has not yet shown any signs that inflation will return to the central bank’s target of 2%. He indicated that it may take “longer than expected” before it is appropriate to cut interest rates.

The Fed Chairman’s “hawkish” stance on interest rates, along with the search for a “safe haven” amid escalating geopolitical tensions after Iran’s attack on Israel, further strengthened the USD, putting pressure on the USD/VND exchange rate.

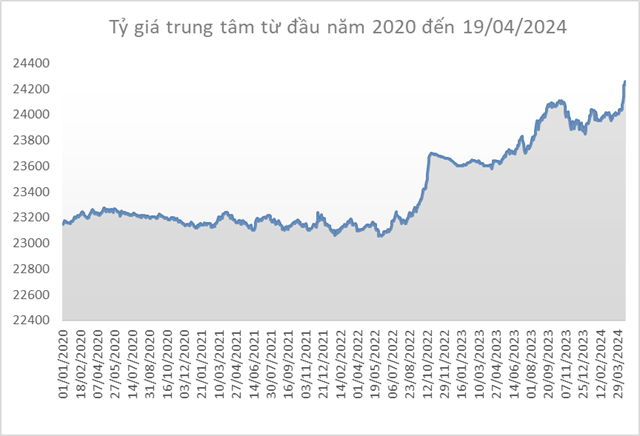

Source: SBV

|

In Vietnam, the central exchange rate between the Vietnamese dong and USD increased by 178 dong/USD compared to last week (on April 12), to 24,260 dong/USD in the session on April 19.

The State Bank of Vietnam (SBV) kept the spot buying price unchanged at 23,400 dong/USD. Meanwhile, the central bank increased the spot selling price by 214 dong/USD compared to April 12, to 25,450 dong/USD.

Source: VCB

|

Notably, the exchange rate quoted at Vietcombank increased strongly by 323 dong/USD in the buying direction and 293 dong/USD in the selling direction after just one week, continuously breaking records, setting a new peak at 25,133 dong/USD (buying) and 25,473 dong/USD (selling).

Source: VietstockFinance

|

In the same trend, the USD/VND exchange rate on the free market increased by 300 dong/USD in the buying direction and 320 dong/USD in the selling direction compared to last week, to 25,700 dong/USD (buying) and 25,800 dong/USD (selling).

Amidst the sharp increase in the USD/VND exchange rate, the State Bank of Vietnam announced that it had started selling USD to banks with negative foreign exchange status at a price of 25,450 dong, 23 dong lower than the ceiling, to intervene in the exchange rate.