Post-Election Impact on FDI in Vietnam: Analyzing the Trends

According to SSI Securities Corporation, the recent US elections have drawn attention to potential impacts on global trade, intellectual property rights, project investments, and FDI flows. As Vietnam is a significant manufacturing hub in the global supply chain, these considerations are particularly relevant to the country’s economic landscape.

A Look Back at FDI Under President Donald Trump:

In 2018, the Trump administration imposed tariffs totaling $50 billion on Chinese exports to the US, triggering a trade war. This policy prompted a shift in manufacturing bases away from China, benefiting Vietnam as a preferred regional destination for FDI. Companies like Luxshare, Goertek, Pegatron, and Compal Electronics chose to invest in the country.

Additionally, since 2018, conglomerates such as Samsung, LG, Hyundai, Lotte, Intel, Lego, Hyosung, and Foxconn have partially relocated their production to Vietnam to diversify their manufacturing bases and mitigate risks in the global supply chain.

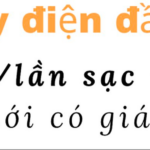

FDI inflows into Vietnam have maintained a growth trajectory since the US-China trade war erupted in 2018, fueled by this manufacturing shift. SSI Research attributes this to new waves of FDI from countries like Singapore, Taiwan, and China, attracted by Vietnam’s competitive advantages, including favorable investment policies and low labor costs.

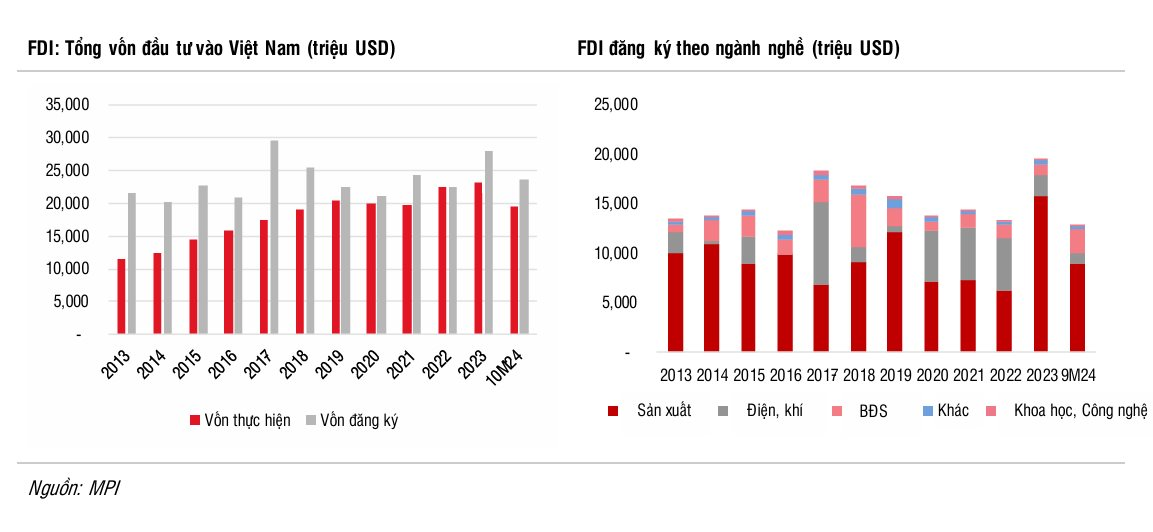

Ministry of Planning and Investment data reveals that industrial land leasing activities in Vietnam witnessed robust growth from 2019 to 2023, with the area of MOUs and new signings achieving a compound annual growth rate (CAGR) of 35%.

This growth is largely driven by prominent FDI enterprises seeking to diversify their manufacturing bases and mitigate supply chain risks. Consequently, average land rental prices have surged, with a 35% increase in industrial parks in the North and a remarkable 67% jump in the South from 2020 to the second quarter of 2024.

FDI Flows into Vietnam Slow Down in 2024:

However, FDI inflows into Vietnam have decelerated in 2024. Total registered FDI reached $27.26 billion in the first ten months of 2024, reflecting a modest 1.9% year-on-year increase.

SSI Research attributes this slowdown to a significant decline in MOUs and new signings by listed industrial parks, ranging from 30% to 65% year-on-year in the first nine months of 2024. Several key factors contribute to this phenomenon:

First, foreign investors exhibit heightened sensitivity to exchange rate fluctuations, which can impact project profitability and trigger hesitation in new investments.

Second, there is a perceived lack of policy reforms to attract FDI into targeted sectors, making Vietnam less competitive compared to neighboring countries with more proactive policies, such as Indonesia’s Omnibus Law and Thailand’s competitiveness enhancement fund and reduced corporate income tax rate.

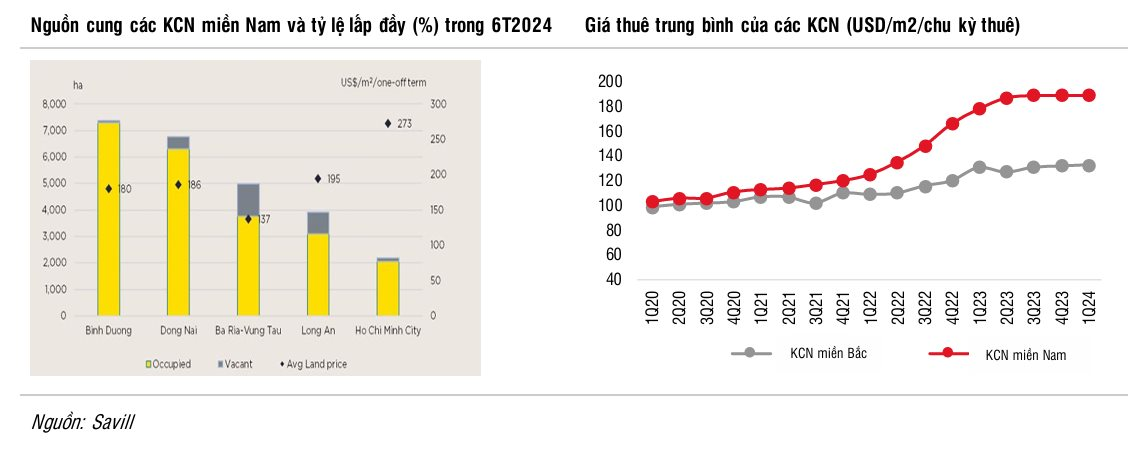

Third, infrastructure limitations, particularly in the southern region, pose challenges. The slow progress in infrastructure development results in higher logistics costs, making investment destinations less appealing.

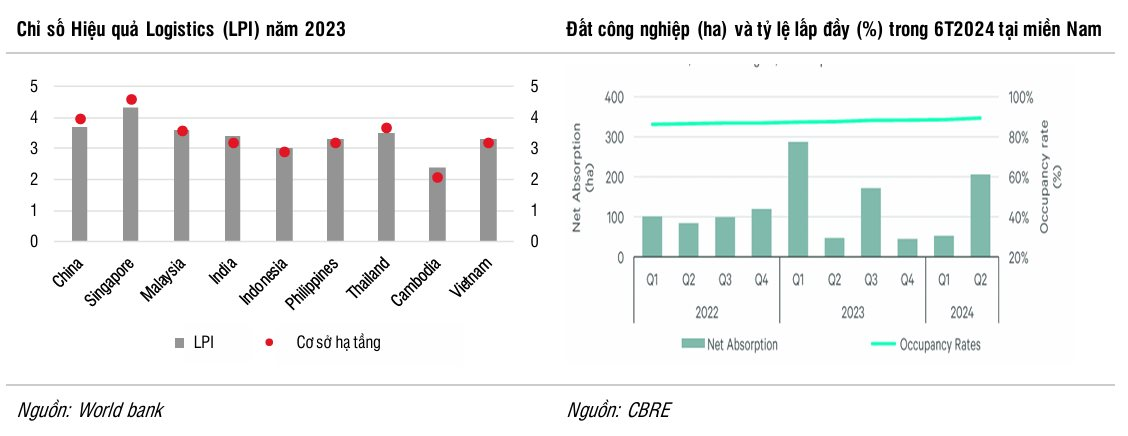

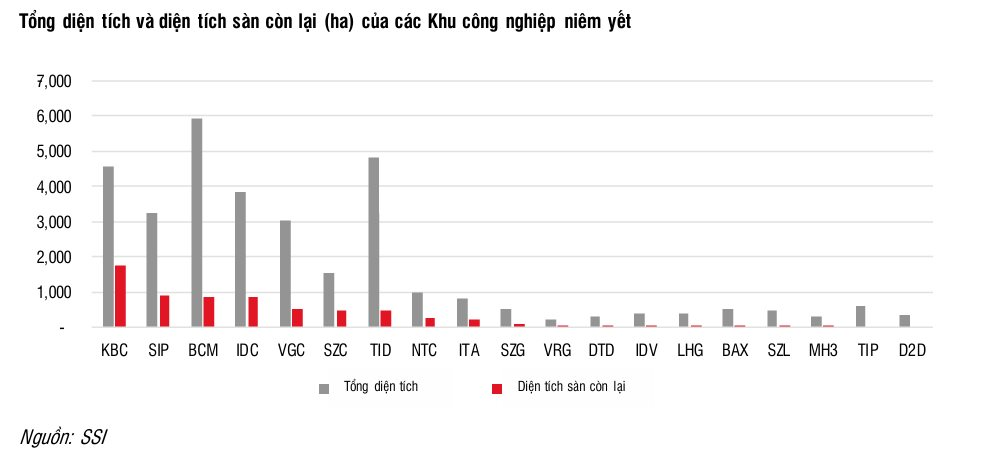

Fourth, the scarcity of readily available land in industrial zones constrains investors’ choices for investment locations. According to CBRE, the average occupancy rate stood at 81% in the North and a high 92% in the South as of June 2024.

FDI Growth Prospects and Benefits for Industrial Real Estate:

To address these challenges, the Vietnamese government is taking proactive steps to attract FDI. These include exploring support mechanisms for large enterprises affected by the global minimum tax and proposing incentives within the Law on Digital Technology Industry for investments in semiconductor manufacturing.

Additionally, authorities are considering amendments to the current Investment Law to enable provincial People’s Committees to grant investment registration certificates for new industrial parks. There is also a focus on enhancing infrastructure connectivity between industrial hubs, such as the North-South Expressway and the railway connecting China and Vietnam.

During his 2024 presidential campaign, Trump emphasized protective trade measures, including a proposed 60% tariff on Chinese goods to reduce the trade deficit and boost domestic production. He also suggested standard tariffs ranging from 10% to 20% for other countries to safeguard American industries from foreign competition.

These campaign statements signal a shift toward more protectionist policies, leaving the approach to imported goods unclear. In the short term, FDI enterprises may await further specifics on Trump’s new tariff policies, including any laws impacting imports from Vietnam.

Nevertheless, SSI Research anticipates continued FDI growth, even with the implementation of new US tax laws.

The introduction of new land price frameworks in various localities since late 2024 has resulted in significantly higher compensation costs for land clearance in new industrial parks. This increase in expenses is expected to compress profit margins for new industrial park projects to 30-35%, compared to over 50% for existing projects.

Given these factors, SSI Research anticipates that companies with substantial leaseable areas, such as SIP, IDC, VGC, SZC, KBC, and NTC, will continue to reap substantial benefits.

“VitaminMira: Leading the Way in Modern Healthcare in Vietnam”

In today’s fast-paced world, where stress and pressure are prevalent, health has become an invaluable asset and a top priority for many. As a result, there has been a growing preference for convenient vitamin drink products as a means to enhance one’s nutrition and maintain a healthy lifestyle.

The Fashion Brand Lep’ Shuts Down: A CEO’s Heartfelt Letter on the Reasons for Closing After 8 Years

The fashion brand, Lep’, has just announced via their Facebook fan page that they will be closing all their stores. This surprising news has left many fans of the brand shocked and saddened. As Lep’ has built a strong reputation for its unique and trendy designs, this abrupt announcement has certainly caught the attention of the fashion industry and its loyal customers.