**GELEX Ranks Among the Top 30 Companies with the Highest Revenue on the Stock Exchange**

|

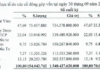

GELEX has ranked among the top 30 listed companies with the highest revenue on the stock exchange over the past five years.

|

GELEX has demonstrated impressive business performance in the first ten months of the year, with consolidated net revenue reaching VND 26,668 billion, equivalent to achieving 83% of the full-year revenue target. Consolidated pre-tax profit reached VND 2,558 billion, corresponding to 130% of the plan.

According to GELEX’s Q3/2024 financial report, the Group’s total assets as of September 30 were VND 53,617 billion, a decrease of 2.7% from the beginning of the year. This decrease was mainly due to a 13% reduction in long-term assets as a result of divesting from several energy projects.

In terms of capital structure, GELEX’s payables decreased by 8.4% compared to the beginning of the year, mainly due to the restructuring of long-term loans related to divested energy projects and a reduction in short-term debt from the divested capital. The proportion of short-term assets and short-term debt was 43.5% and 32.6%, respectively, ensuring working capital for production and business activities.

GELEX’s financial position remains robust, with debt ratios and solvency ratios well within safe limits as of September 30. The gross profit margin improved to 19.1%, higher than the average for 2023, thanks to enhanced margins in the electrical equipment, building materials, industrial park, and real estate sectors.

Recently, VIS Rating assigned a long-term issuer rating of ‘A’ with a stable outlook to GELEX. With support from Moody’s, VIS Rating applied international standards, adjusted for the Vietnamese market, resulting in objective and transparent credit ratings.

The VIS Rating report indicated that the Group’s competitive position and business diversification were rated ‘Strong,’ largely due to the ‘Strong’ performance of its industrial park real estate and electrical equipment manufacturing segments. Most of the Group’s subsidiaries are leading market players in terms of market share and business coverage.

VIS Rating highlighted the Group’s strong market presence, diverse product portfolio, and solid relationships with suppliers and financial institutions. They also commended GELEX’s successful execution of business plans and consistent achievement of annual profit targets.

Looking ahead, VIS Rating expects GELEX to maintain its ‘Very Strong’ annual revenue in the long term, backed by its solid market share in the electrical equipment manufacturing sector and its investment portfolio in the industrial park real estate sector. GELEX also has long-term expansion plans, including projects to increase clean water capacity, export electrical equipment, and develop the Tran Nguyen Han Complex.

VietCap’s latest report from August 2024 forecasts a significant increase in GELEX’s core net profit in 2025 due to a 13% rise in revenue from the electrical equipment segment and a 21% increase in revenue from the industrial park segment, coupled with lower interest expenses.

VietCap also projected a compound annual growth rate (CAGR) of 43% for GELEX’s net profit after tax for the period 2023-2028.

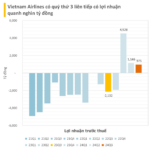

Vietnam Airlines Posts Near-Thousand Billion Profit for Third Consecutive Quarter, Yet Remains in a 35,000 Billion Cumulative Loss, With Stock Rising for Four Straight Sessions

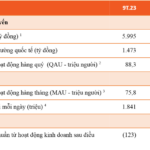

For the nine-month period ending September 2024, Vietnam Airlines reported a revenue of VND 79,161 billion, a remarkable 17% increase compared to the same period last year. The airline also achieved a impressive net profit of nearly VND 6,000 billion during this time frame.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.