The Ho Chi Minh City Tax Department revealed that COMECO committed errors in declaring value-added tax for July 2022, but this did not result in an underpayment of tax liabilities.

Additionally, the company made mistakes in calculating the tax base or the amount of deductible tax, leading to a shortfall in value-added tax and corporate income tax for the fiscal year 2022-2023. However, their economic transactions were accurately reflected in their accounting books, invoices, and documents.

As a consequence of these violations, COMECO was fined over 140 million VND and was ordered to pay back taxes of more than 700 million VND, along with late payment fees amounting to 83 million VND.

In total, the amount of tax retrieval, penalties, and late payment fees for COMECO amounted to nearly 924 million VND.

COMECO is a well-known brand in the field of petroleum business. Starting with 19 gas stations in 2000, COMECO has now expanded to 38 branches in Ho Chi Minh City and neighboring provinces such as Long An, Ben Tre, and Binh Duong…

A COMECO gas station. Illustration

|

The company’s chartered capital currently stands at over 141 billion VND, almost nine times its initial value. The largest shareholder is the Vietnam Oil Corporation – Joint Stock Company (UPCoM: OIL), holding 44.79% of the capital, followed by Saigon Petroleum Company Limited (Saigon Petro) with 39.65% ownership.

In terms of business performance, in the third quarter of 2024, COMECO recorded net revenue of nearly 981 billion VND and a net profit of 7 billion VND, a decrease of 13% and 52%, respectively, compared to the same period last year.

| COM’s net profit for the quarters of 2022-2024 |

For the first nine months of 2024, COMECO’s net revenue exceeded 3,147 billion VND, a 2% decrease compared to the same period, achieving 79% of the annual plan. Pre-tax profit increased by 2% to over 19 billion VND, surpassing the annual profit target by nearly 19%. Net profit amounted to over 15 billion VND.

As of September 30, 2024, COMECO had bank deposits of over 143 billion VND, a 22% increase from the beginning of the year. They also held a securities portfolio valued at over 19 billion VND based on purchase price, currently incurring a temporary loss of over 30% (for which loss provisions have been made).

The largest components of their securities portfolio included shares of Thu Duc Import-Export Commercial Joint Stock Company (HNX: TMC) with an original value of nearly 6 billion VND but currently showing a temporary loss of 55%; Ca Mau Trading Joint Stock Company (HOSE: CMV) with an original value of nearly 5 billion VND (temporary loss of 22%), and Petroleum Machinery Joint Stock Company (HNX: PMS) with an original value of nearly 4 billion VND…

In the stock market, COM’s share price rose in 3 out of the last 4 trading sessions, including 1 ceiling-hitting session. In the morning session on November 11, COM’s market price continued to climb by 2.89% to 33,850 VND/share, marking a gain of over 20% within a week, but still 8% lower than at the beginning of the year.

| Movement of COM share price since the beginning of 2024 |

“Lucrative Seafood Enterprise: A Tasty Dividend Treat”

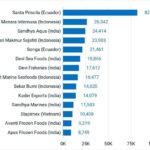

As the largest and most profitable shrimp company in the industry, it is also the only Vietnamese representative in the Top 15 shrimp suppliers in the US for 2023.

“Affordable Housing for All: A Japanese Corporation’s Vision for Vietnam”

In 2020, Ho Chi Minh City witnessed the launch of nearly 17,000 affordable housing units, a welcome addition to the market. However, the following three years saw a shift, with a predominant focus on luxury apartments.