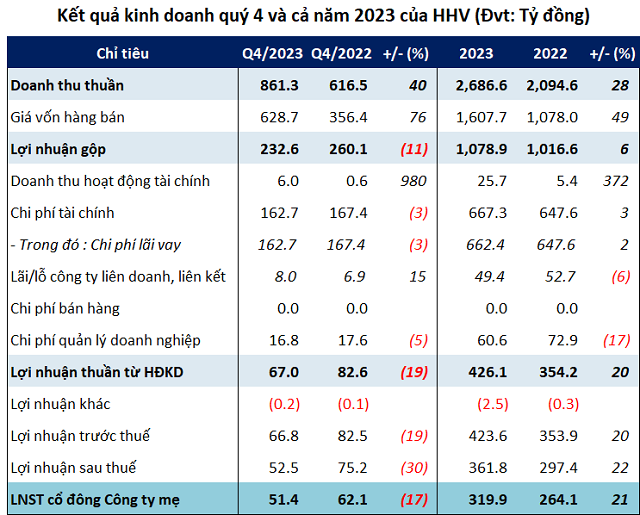

The Transportation Infrastructure Investment Corporation – Deo Ca (HOSE: HHV) announced its consolidated financial statements for the fourth quarter of 2023, with revenue of over VND 861 billion, a 40% increase compared to the same period last year. However, higher costs led to a decrease in gross profit to VND 233 billion.

Source: VietstockFinance

|

Most expenses of HHV for the quarter decreased, but not enough for HHV to show growth compared to the same period last year. As a result, Deo Ca reported a net profit of over VND 51 billion for the fourth quarter, a decrease of 17%.

For the full year of 2023, HHV recorded net revenue of nearly VND 2,687 billion, a 28% increase, and net profit of nearly VND 320 billion, a 21% increase compared to the same period last year. With these results, the company exceeded its full-year after-tax profit target by 7%.

Net revenue and net profit of HHV from 2019 – 2023

Explaining the above results, HHV stated that in 2023, the company’s main activities, toll collection for BOT projects and construction activities, both recorded revenue growth compared to the same period last year. Among them, toll revenue reached over VND 1,572 billion, an increase of 6%, thanks to the increase in traffic volume after the period affected by the Covid-19 pandemic.

In addition, HHV also benefited greatly from infrastructure investment in 2023 by winning bids for several projects with large construction values. Specifically, the Quang Ngai – Hoai Nhon expressway project with a construction value of over VND 14,400 billion; the Cam Lam – Vinh Hao expressway project is preparing to operate in the second quarter of 2024, and the coastal road projects through various localities also contributed to strong growth in construction revenue.

Last December, HHV also approved the participation in investment, construction, and operation management of the Dong Dang Expressway project (Lang Son province) – Tra Linh (Cao Bang province) Phase 1 under the public-private partnership (PPP) format. In which, phase 1 covers about 93.35 km with a total investment of over VND 14,000 billion (the investor will raise nearly VND 7,000 billion, and the rest will be state capital). The project implementation period for phase 1 is from 2020 – 2025, and phase 2 will be after 2025.

In the 2024-2025 period, HHV aims for net revenue of VND 2,915 billion and VND 3,326 billion, respectively. The after-tax profit during this period is expected to be VND 448 billion and VND 532 billion.

HHV to participate in the over VND 14,000 billion Dong Dang – Tra Linh expressway project

Debt exceeds 1.1 billion USD

As of December 31, 2023, the total assets of HHV reached over VND 36,775 billion, a 3% increase compared to the beginning of the year. The majority of assets are long-term assets, accounting for 97% of total assets, with VND 35,603 billion. Among them, the total cash and bank deposits of Deo Ca is about VND 390 billion, accounting for just over 1% of total assets.

Meanwhile, Deo Ca’s total liabilities amount to over VND 28,045 billion (equivalent to over 1.1 billion USD), an increase of 3% compared to the beginning of the year. Among them, the total amount of short-term and long-term financial borrowings is over VND 20,284 billion, a decrease of 2% compared to the beginning of the year, accounting for 72% of total borrowings and 55% of the company’s capital sources.

| Capital sources of HHV from 2019 – 2023 |

As of the end of 2023, Vietnam Joint Stock Commercial Bank for Industry and Trade (HOSE: CTG) is the largest creditor of Deo Ca with a total short-term loan of VND 927 billion and a total long-term loan of VND 18,305 billion.

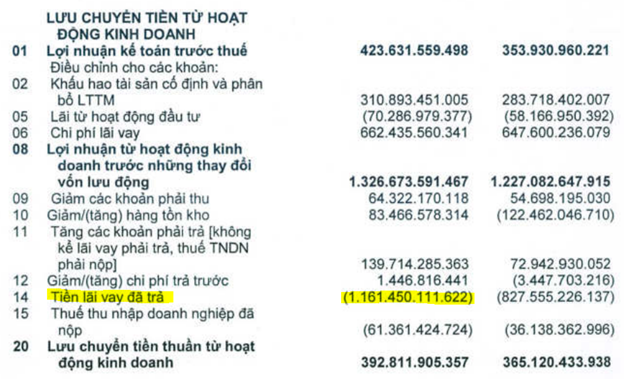

According to Deo Ca’s cash flow report, the company had to spend over VND 1,161 billion on interest expenses in 2023, a 40% increase compared to 2022. If evenly distributed over 365 days, Deo Ca is losing over VND 3 billion per day to cover these interest expenses.

Source: HHV

|

Adjusted capital usage plan from the additional share offering

Recently, on February 5th, HHV announced the information regarding the approval of the plan to use the entire surplus (over VND 6.5 billion) from the net offering of shares by the company.

Accordingly, the entire surplus amount will be used by HHV to contribute capital to Deo Ca Investment Joint Stock Company; nearly VND 34 billion will be contributed to BOT Bac Giang – Lang Son Joint Stock Company; VND 150 billion will be used to repay short-term loans at credit institutions; nearly VND 166 billion for purchasing machinery, equipment, and transportation vehicles to serve the company’s regular business activities; VND 110 billion for additional working capital to support production and business activities, and nearly VND 256 billion for business cooperation with Cam Lam – Vinh Hao Expressway Joint Stock Company (a component project of the investment in the construction of some sections of the North – South East Highway from 2017 to 2020).

Thanh Tu