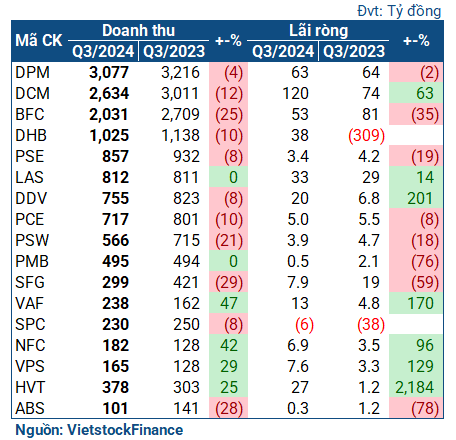

According to statistics from VietstockFinance, out of 17 enterprises in the chemical and fertilizer industry that published their Q3 financial statements, 8 enterprises achieved profit growth compared to the same period (including 1 unit that turned losses into profits). The remaining enterprises witnessed a decline in profits.

|

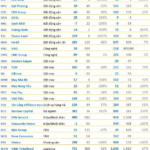

Q3 business results of the fertilizer and chemical group in 2024

|

The giants took a step back

3 out of 4 giants in the fertilizer and chemical industry experienced a decline in results in Q3/2024, although the decrease was not significant.

DPM (Phu My Fertilizer) recorded a slight decrease in both revenue and profit. Specifically, revenue decreased by 4% over the same period last year, reaching nearly VND 3.1 trillion; net profit was VND 63 billion, down 2%.

| Phu My Fertilizer has not yet recovered after the booming year of 2022 |

BFC (Binh Dien Fertilizer) recorded a more significant decrease, with a 25% drop in revenue (reaching over VND 2 trillion) and a 35% drop in net profit (VND 53 billion).

| Business situation of BFC |

In fact, Q3 is usually the time when the fertilizer group sees a decline in revenue as it is past the peak of the Summer-Autumn crop. Even DCM (Ca Mau Fertilizer) recorded a 12% decrease in revenue. However, thanks to their effective control of production costs, DCM still achieved a net profit of VND 120 billion, up 63% over the same period.

| Business performance of DCM |

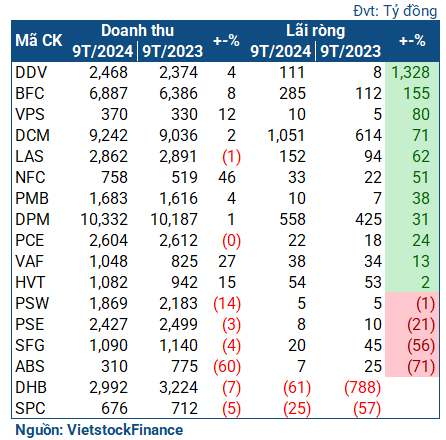

Thanks to the good performance in the previous quarters, the cumulative picture of the 3 giants is positive. After 9 months, DCM achieved nearly VND 1.1 trillion in net profit, up 71%; BFC reached VND 285 billion, 2.6 times higher than the same period last year; DPM earned VND 558 billion, a 31% growth. All 3 enterprises have either met or are close to completing the plans set by the 2024 General Meeting of Shareholders.

Meanwhile, Duc Giang Chemical Corporation (DGC) experienced its 8th consecutive quarter of profit decline, but the decrease was only 7%. Despite the drop, the Q3 net profit still exceeded VND 706 billion, which is a commendable result as it far surpasses the figures before Q4/2021 – when profits soared due to the global commodity boom, and is comparable to the results of the recent quarters. In addition, the enterprise also exceeded the plan set for Q3 (VND 2.4 trillion in revenue and VND 720 billion in post-tax profit).

| Duc Giang Chemical Corporation took a step back, but the result was not too bad |

Chemicals bring in high profits

Unlike the giants, the performance of the remaining enterprises was quite consistent. Many chemical units shone, with several names belonging to Vinachem (Vietnam Chemical Group), while fertilizer units did not perform badly thanks to their effective cost control.

For instance, CSV (Southern Basic Chemicals) saw a significant increase in both revenue and profit, recording a net profit of VND 73 billion, 51% higher than the same period. The enterprise attributed this to the surge in gross profit during the period due to better product consumption compared to the same period last year, including main products such as NaOH (up 29%), HCL (49%), liquid chlorine (25%), H2SO4 (doubled), Javel (16%)… Similarly, the sales revenue of products at the subsidiary company, such as yellow phosphorus, increased by up to 80%, and the selling price also increased slightly.

| Sales revenue and selling prices of main products increased, helping CSV achieve favorable results |

With the significant contribution from Q3, CSV achieved a net profit of VND 186 billion in the first 9 months, up 16% over the same period last year, and has almost completed its pre-tax profit target for the whole year.

Another Vinachem member, HVT (Viet Tri Chemicals), also recorded high profits with a net profit of VND 27 billion, 23 times higher than the same period last year. The main reason for this was the stable consumption of main products and the increase in selling prices during Q3. Additionally, the low base from the same period last year also contributed to this growth.

In the fertilizer group, LAS (Lâm Thao Super Phosphate and Chemicals) performed well, with revenue remaining unchanged and a net profit of VND 33 billion, up 14%. This was mainly due to the significant decrease in production costs thanks to the purchase of reasonably priced raw material batches.

DDV (DAP – Vinachem) even tripled its profit from the same period last year, reaching over VND 20 billion. However, the gross profit remained unchanged, and the main reason for the increase in profit was the substantial decrease in selling expenses due to reduced sales volume.

| One of the main reasons for DDV‘s strong growth was the low base from the same period last year |

Another case is DHB (Ha Bac Nitrogen Fertilizer), which reported a profit of VND 38 billion (compared to a loss of VND 309 billion in the same period last year). This profit only accounts for 3.7% of the revenue, mainly due to the reduction in interest expenses thanks to the restructuring of the enormous debt at the Development Bank (VDB) at the end of 2023. However, due to an unexpected loss in Q2, DHB still recorded a loss of VND 61 billion in the first 9 months of the year.

|

Business results of fertilizer and chemical enterprises

in the first 9 months of 2024 |

Expectations for recovery

According to the Ministry of Industry and Trade, the consumption demand for fertilizer in Vietnam is currently around 11 million tons per year, including types such as urea, DAP, NPK, and potassium… Among these, urea accounts for the highest proportion, with an estimated capacity of 3 million tons per year.

Most of the raw materials are sourced from domestic gas fields such as Bach Ho and Nam Con Son… However, for potassium, Vietnam relies entirely on imports.

According to Mirae Asset Securities, fertilizer prices in Vietnam are expected to recover in the coming period. This is due to the global energy crisis, which has pushed up natural gas prices and, consequently, fertilizer production costs, leading to the closure of many European factories and disrupting the supply chain.

Additionally, the conflict between Russia and Ukraine has also had an impact. Being one of the world’s largest fertilizer producers, Russia’s involvement in the conflict has affected the global fertilizer supply and caused fluctuations in oil prices due to the sanctions imposed.

However, the demand for fertilizer may decrease as prices rise, and there is a trend towards sustainable agriculture with organic fertilizers, reducing the need for inorganic fertilizers. Furthermore, some countries have restricted exports and maintained production only to meet domestic demand, keeping global fertilizer prices low for almost a year.

Meanwhile, BIDV Securities (BSC) is optimistic about the amended Value-Added Tax (VAT) Law for the fertilizer industry, which allows for the imposition of VAT on input materials for fertilizers instead of the current exemption. Calculations show that the application of VAT could increase the profits of fertilizer enterprises such as DCM and Vinachem members by up to 20%.

The Cement Business: Stuck in a Rut of Losses

Amidst challenging circumstances, sluggish consumption, and rising costs, several cement businesses had to resort to reducing their product prices to offset operational expenses.

“The Fertilizer Industry’s Plea: Remove the 5% VAT or Risk Our Decline and Halt Production.”

The latest amendments to the Value-Added Tax Law fail to address the long-standing issue faced by the domestic fertilizer industry. As a result, this vital sector continues to be discriminated against, excluded from the scope of value-added tax applicability. This exclusion puts the industry at risk of reverting to the decline and stagnation witnessed during 2015-2020, threatening its very survival.

Profitable Third Quarter for Vietnamese Giants: Vietnam Airlines Soars with Impressive Profits, While Real Estate and Textile Companies, Including Quốc Cường Gia Lai, Report Exponential Gains

Coteccons (CTD) has announced a net profit of VND 93 billion for the first quarter of the 2024-2025 fiscal year, marking a significant 39% increase from the same period last year.