At the Shopping and Cost Council, Nghiêm Phương Nhi, Chairwoman of the Board of Members of VFS, was elected as the Council’s Chairwoman. Following her, other members of the Board of Members of VFS, including Mr. Hoàng Thế Hưng and Mrs. Nguyễn Thị Lan, were appointed as Council members.

Ms. Nghiêm Phương Nhi was also elected as the Chairwoman of the Investment and Capital Council. The remaining members of this council include Trần Anh Thắng, Vice Chairman of the Board of Members of VFS, and Mr. Nguyễn Xuân Điệp, a member of the Board of Members of VFS.

The newly established councils will each have a Secretary designated by the respective Chairpersons.

Source: VFS

|

Among the key members of these newly established councils, all except Mr. Trần Anh Thắng are new members of the Board of Members, appointed at the Annual General Meeting of Shareholders in April 2024.

Chairwoman Nghiêm Phương Nhi also holds the position of Chairwoman of the Board of Members at Amber Fund Management JSC and Hòa An Financial Investment JSC – the latter recently becoming the largest shareholder in VFS after acquiring 20.5 million shares (17.08%) in September 2024.

An upcoming “handover” of VFS shares worth hundreds of billions is about to take place?

According to VFS‘s website, the Chairwoman graduated with a Bachelor’s degree from the National Economics University, Saxion University of Applied Sciences (Deventer, the Netherlands), and completed a Master’s program at Radboud University Nijmegen (the Netherlands) in Business Administration. She has held several senior positions at Viettel Group, Vietnam Export-Import and Construction Corporation (VCG), and Viettel Construction Joint Stock Company (CTR).

Additionally, according to the Semi-annual Report for the first half of 2024, another member, Nguyễn Thị Lan, is also the Deputy General Director of Amber Capital JSC, which is part of the Amber Holdings ecosystem.

In the case of Mr. Trần Anh Thắng, VFS introduced him as a graduate of La Trobe University (Australia) with a Master’s degree in Finance and Banking. He became a member of the Board of Members of VFS in February 2017 and was then appointed as Chairman of the Board of Members in March of the same year. In May 2018, he took on the additional role of General Director. In April 2021, his role at VFS changed as he became the Vice Chairman of the Board of Members while continuing as the General Director until the present.

Apart from his key roles at VFS, Mr. Thắng is also an Independent Member of the Board of Members at Vietnam Export Import Commercial Joint Stock Bank (HOSE: EIB).

The Semi-annual Report for the first half of 2024 mentioned that Mr. Thắng used to be the Chairman of the Board of Members of Amber Capital Holdings JSC and Hanoi Non Nuoc Tourism Investment JSC. However, since April 2024, neither of these organizations is considered a related party to him. Amber Capital Holdings JSC remains a major shareholder of VFS, holding 8.8 million shares, equivalent to a 10.97% stake.

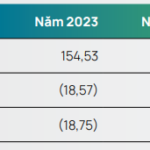

Regarding VFS‘s performance, the company recorded operating revenue of over 184 billion VND and a net profit of nearly 87 billion VND in the first nine months of 2024, an increase of more than 1% and 34%, respectively, compared to the same period last year.

For the year 2024, the company set a net profit target of over 124 billion VND. With the results achieved in the first nine months, the company has achieved 70% of its plan.

Profits Plummet: Bảo Minh Insurance Projects a 29% Drop in 2024 Profit Plans

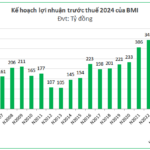

The Board of Directors of Baominh Insurance Joint Stock Corporation (HOSE: BMI) has proposed to adjust and reduce the profit plan for 2024, following a significant drop in interest rates in the third quarter due to Storm Yagi.

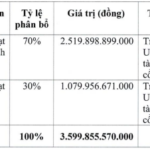

The Race to Surpass: HSC Aims High with a Proposed Capital Increase to Over VND 10 Trillion

The Ho Chi Minh City Securities Corporation (HSC) is planning to offer its existing shareholders a treat. According to the company’s recent extraordinary general meeting documents, the board of directors is seeking approval for a share sale proposal. The offer price? A tempting 10,000 VND per share, equivalent to the par value. And the timing? Well, HSC is eyeing 2025 for this enticing opportunity.