On November 11th, over 170.6 AIG shares of Asia Group Joint Stock Company (AIG) began trading on the UPCoM exchange, with a reference price of 63,000 VND per share on the first trading day.

However, the AIG stock price declined continuously during the first three trading sessions. Specifically, on the first day, AIG shares dropped by 8.1%, followed by a further decline of over 3% in each of the next two days.

By the end of the trading session on November 13th, the AIG share price closed at 52,900 VND per share, representing a 16% decrease from the reference price on the first day. Consequently, the company’s market capitalization decreased by more than 1,723 billion VND.

As the owner of more than 51.72 million AIG shares, Chairman Nguyen Thien Truc’s stock holdings were valued at over 2,736 billion VND, reflecting a loss of over 522 billion VND.

The matched trading volume on the first day was 72,500 shares, followed by a significant decrease in the next two sessions, with 15,700 and 13,600 shares traded, respectively.

The Asia Group Corporation has evolved since the early 2000s, initially known as CTL Company Ltd., which later changed its name to ATL and then to ACC – Hoá Chất Á Châu. In 2009, ACC – Hoá Chất Á Châu invested in constructing the AFI – Asia Saigon Food Ingredients non-dairy creamer production facility.

In subsequent years, the company attracted investments from several professional funds, including PENM Partner Capital (2014) and NewQuest Capital Partners (2018). Mekong Enterprise Fund II also invested in Hoá Chất Á Châu in 2011 before divesting in 2018.

In July 2017, AIG took shape by consolidating the financial results of seven subsidiary companies under the core legal entity, Asia Group Joint Stock Company (AIG).

Today, AIG offers a diverse range of products, including non-dairy creamers, tapioca starch, coconut water, coconut milk, essential oils, and vegetable juices, among others.

As of September 30, 2024, the company had ten direct subsidiaries, two indirect subsidiaries, one indirect joint venture, one direct associate, and two indirect associates. Notable clients of the company include prominent brands such as Vinamilk, TH True Milk, Vitadairy, Nutricare, IDP, Nutifood, Friesland Campina, Nestle, Masan, Đức Việt, Dabaco, Acecook, Vifon, and others.

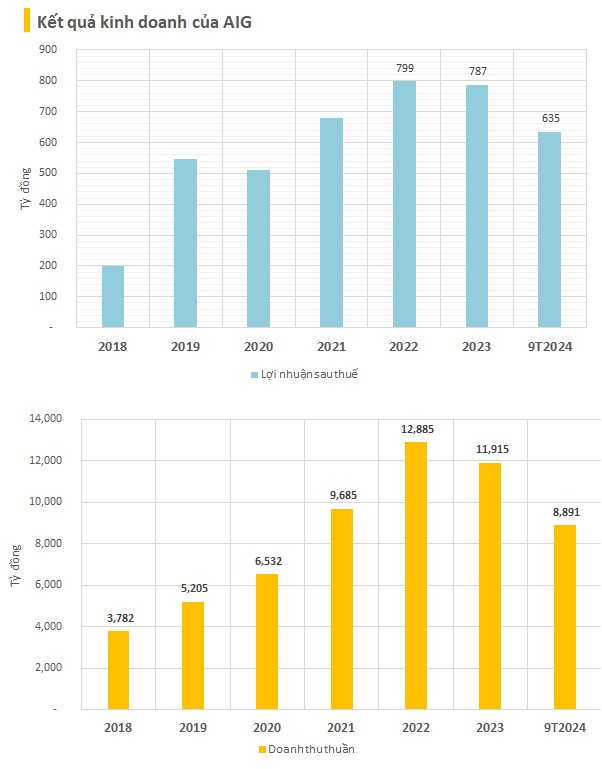

In terms of financial performance, during the third quarter of 2024, AIG recorded net revenue of 3,112 billion VND, a 7% increase compared to the same period last year, while net profit reached 203 billion VND, a nearly 10% rise.

For the first nine months of the year, AIG’s net revenue amounted to 8,891 billion VND, a 3% improvement, and net profit stood at 634 billion VND, a 10% increase compared to the same period in the previous year. For 2024, the company set a target of nearly 12,950 billion VND in net revenue and nearly 890 billion VND in net profit.

In the previous year, 2023, the company reported net revenue of over 11,915 billion VND, a decrease of nearly 8% year-over-year, while net profit declined slightly by 1% to 787 billion VND.

PLX – A Fair Valuation Stock for Long-Term Investors

As the leading retailer in the Vietnamese petroleum industry, Petrolimex (HOSE: PLX) is an attractive prospect for investors seeking long-term opportunities. The stock is currently trading at a reasonable price, as indicated by our valuation metrics, making it a compelling option for those looking to diversify their portfolios.

“A Stunning Turnaround: Novaland’s Q3 Profits Soar to Over 3,000 Billion VND”

Despite an exceptional surge in profits during the third quarter of 2024, Novaland Group (Novaland), listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol ‘NVL’, faces the grim prospect of historical annual losses. With a staggering cumulative loss of over VND 4,000 billion in the first nine months of the year, the real estate giant is struggling to stay afloat.

“Q3 2024: NVL Records Impressive Profits, Requests HOSE to Lift Warning”

Previously, HOSE placed NVL stock in alert status from September 23 onwards due to the listed entity’s delay in submitting its semi-annual 2024 financial statements, which exceeded the regulated deadline by over 15 days. Concurrently, HOSE also included this stock in the list of those subjected to margin cuts.

The Mobile World’s Captain Nguyen Duc Tai Reports a 21-Fold Increase in Q3 Profits: Unveiling the Secrets to Their Success

In just the first nine months, this retail business surpassed its annual profit goal by 20% – an impressive feat.