According to statistics from VietstockFinance, out of 47 power companies that published their financial statements for Q3/2024, 32 businesses witnessed profit growth, including 6 that turned losses into profits. Only 8 companies reported lower profits, and 7 firms were in the red.

Thermal power surprises

|

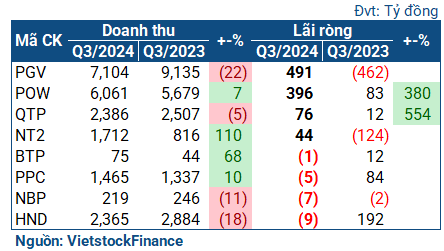

Business results of the thermal power group in Q3/2024

|

The thermal power group in Q3 surprised with several units significantly increasing their profits, even by folds. For instance, POW earned a net profit of VND 396 billion, nearly 5 times higher than the same period last year. However, POW’s gross profit actually declined due to surging fuel prices. The main reason for the company’s massive profit was over VND 411 billion in financial revenue, triple that of the previous year, mainly from exchange rate gains and profits from bank deposits.

| POW’s good profit in Q3/2024 thanks to exchange rate gains |

QTP (Quang Ninh Thermal Power) also recorded a significant profit increase with a net profit of VND 76 billion, 6.5 times higher than the same period. This was partly due to better control of heat loss, which led to higher gross profit. Moreover, similar to POW, QTP also reduced its foreign exchange losses, resulting in negative financial expenses.

PGV (EVNGENCO3) was among the companies that benefited the most from exchange rates, turning from a loss of VND 462 billion in the same period last year to a profit of VND 491 billion, also the highest profit in the thermal power group. In fact, the company’s revenue in this period decreased quite significantly – by 22%, leading to a gross profit of less than 50% compared to the previous year. However, financial expenses turned negative (VND -146 billion) thanks to reduced exchange rate losses, helping the company reverse its profit.

| PGV cleared cumulative losses thanks to exchange rate differences |

Meanwhile, NT2 also turned from a loss of VND 124 billion to a profit of VND 44 billion, mainly due to increased gross profit. There were no significant fluctuations in other expenses.

On the contrary, BTP, PPC, NBP, and HND all reported losses. Among them, PPC (Phả Lại Thermal Power) suffered a decline due to the loss of dividends from its member unit, causing a 75% drop in financial revenue. The remaining units mainly incurred losses due to lower electricity output, resulting from low mobilization.

Hydropower turns green after a difficult period

|

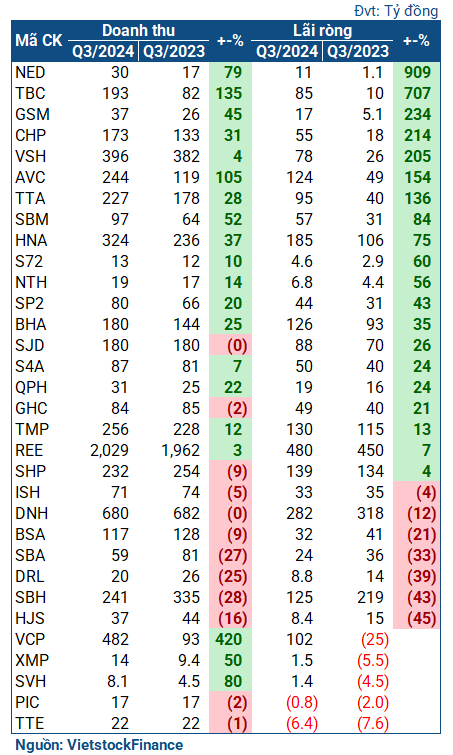

Business results of hydropower enterprises in Q3/2024

|

With the El Nino phenomenon ending at the beginning of Q3 and transitioning to La Nina, the hydropower group was expected to benefit. Indeed, the Q3 results showed that most businesses achieved profit growth, turning the hydropower group’s performance green. The common explanation in the explanatory notes was “favorable hydrological conditions.”

AVC (A Vuong Hydropower) had the highest profit in more than a year, reaching VND 124 billion in net profit, 2.5 times higher than the same period. Hydropower is given priority in mobilization due to its low cost. Favorable weather conditions increased the water flow, boosting the electricity output of AVC and leading to this remarkable achievement.

| AVC had the best profit in more than a year thanks to favorable hydrological conditions |

HNA (Hua Na Hydropower) also recorded substantial profits due to similar reasons. In Q3/2024, the hydropower company earned a net profit of VND 185 billion, a 75% increase compared to the same period last year, also the highest profit since Q2/2022.

TBC (Thac Ba Hydropower) made a profit of VND 85 billion, 8 times higher than the same period. CHP (Central Hydropower) tripled its profit from the previous year, reaching VND 55 billion. Both attributed the positive results to “favorable hydrological conditions,” which increased electricity output.

Hydropower was also the reason for the profit increase of REE, which reached VND 480 billion in net profit, a 7% increase compared to the same period last year. REE’s total electricity sales volume reached 2.7 billion kWh in Q3, a 4% growth. REE stated that the profit improvement was thanks to the contribution of hydropower members such as TBC and VSH (Vinh Son – Song Hinh).

| REE’s profit increase in Q3 thanks to hydropower |

However, in the case of VSH, despite a threefold increase in profit compared to the same period last year (reaching VND 78 billion), the improvement did not come from electricity sales. In fact, the company’s revenue in this period only increased slightly, indicating that this hydropower giant has not fully recovered. The reduction in financial expenses after debt restructuring and additional revenue from deposit agreements compensated for the lack of growth.

Not all companies benefited from favorable hydrological conditions. DNH (Da Nhim – Ham Thuan – Da Mi Hydropower) experienced a 12% decrease in profit, amounting to VND 282 billion in Q3, due to lower water flow compared to the previous year, resulting in reduced electricity output. SBH (Song Ba Ha Hydropower) faced a similar situation, with a 43% drop in profit, totaling VND 125 billion.

Renewable energy shows strong differentiation

The renewable energy group exhibited a significant differentiation. Businesses with a strong presence in solar and hydropower saw profit increases, while wind power entered a low period.

For example, TTA achieved a net profit of VND 95 billion, 2.3 times higher than the same period. TTA’s portfolio includes 2 hydropower plants (with a total capacity of over 56MW) and a solar power plant (with a capacity of up to 62MW).

HDG (Ha Do Group) also increased its profit by 63%, reaching VND 138 billion. Although HDG is a real estate company, its revenue is mainly from electricity sales. In Q3, the electricity segment brought in VND 445 billion in revenue, a 24% increase, and a gross profit of VND 310 billion, a 46% jump. However, HDG’s portfolio includes hydropower, wind power, and solar power.

PC1 also had a successful quarter, with an 18% increase in revenue from the electricity segment, totaling VND 448 billion, and a 21% rise in gross profit from electricity sales, amounting to VND 233 billion. Similar to HDG, PC1 invests in both hydropower and wind power, and the profit increase was mainly due to hydropower.

BGE (BCG Energy) turned from a loss of VND 51 billion to a profit of VND 158 billion. This improvement was partly due to additional revenue from new customers in the rooftop solar power segment and partly because the company had fully repaid its bond debt by the end of last year and reduced exchange rate losses, leading to lower financial expenses.

In contrast, GEG (Gia Lai Electricity) reported a net loss of VND 27 billion (compared to a profit of VND 14 billion in the same period). The company explained that wind power entered a low period, resulting in lower revenue. Moreover, the electricity selling price is still based on the temporary price set by the Ministry of Industry and Trade (equal to 50% of the ceiling price of the wind power generation price framework), which does not accurately reflect the actual situation. In addition, GEG’s three wind power projects (TPĐ1, TPĐ2, VPL) account for a considerable proportion of its debt structure, keeping financial expenses high and resulting in losses.

The Rising Tide of Bad Debt: A Major Challenge for the Banking Sector

The sharp rise in non-performing loans in Q3 2024, coupled with a decline in lending, presents a significant challenge for the banking industry. This worrying trend is a red flag, indicating that without swift and effective action, the banking system could be facing substantial financial risks in the near future.

What Are Proprietary Trading Firms Holding in Their Portfolios?

The proprietary trading segment has brought in a substantial profit of over 3.53 thousand billion VND for securities companies, despite a modest increase. What are the secret weapons in the portfolios of these securities firms, and how have they achieved this success? It’s time to delve into the strategies and uncover the key drivers behind these impressive results.

Clean Energy Revolution: How Hydropower is Propelling Lai Chau Province to the Top of the Economic Growth Charts

In the first nine months of the year, Lai Chau province’s gross regional domestic product (GRDP) grew by an impressive 11.63%, ranking third in the country and a significant climb of 41 places compared to the first six months. This remarkable growth is attributed to the province’s increased electricity production, which has accelerated its economic development.

“VinaCapital Fund Sells Over 1 Million KDH Shares”

Vietnam Ventures Limited, a member of the VinaCapital group, has announced the sale of over 1 million shares of Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH). This move continues the downward trend in ownership witnessed over the past period.