Agribank’s Latest Online Savings Interest Rates

Agribank has officially adjusted its online savings interest rates starting November 15, with the highest increase being 0.3%/year.

Accordingly, Agribank increased the interest rate by 0.2-0.3 percentage points for terms below 12 months.

Specifically, the interest rate for the 1-month term increased by 0.2 percentage points to 2.4%/year.

The interest rate for the 3-month term increased by 0.3 percentage points to 3.0%/year.

The interest rate for the 6-month term increased by 0.2 percentage points to 3.7%/year.

The bank maintained the same interest rate for terms of 12 months and above. Specifically, the 12-month and 24-month savings rates are currently at 4.8%/year and 4.9%/year, respectively.

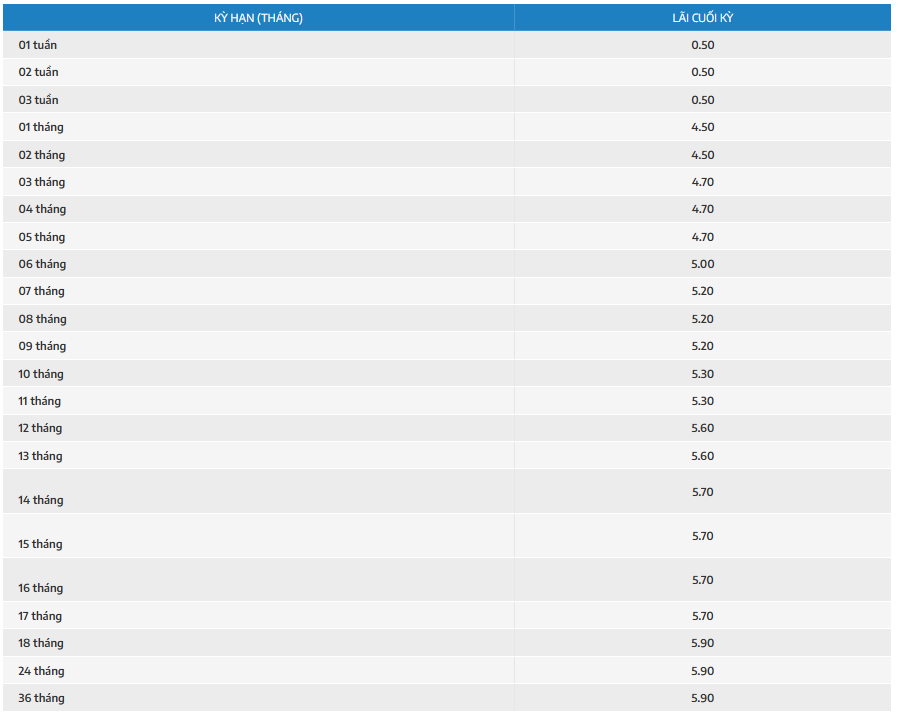

Nam A Bank’s Latest Online Savings Interest Rates

On the same day, the Southern Asia Commercial Joint Stock Bank (Nam A Bank) significantly increased online savings interest rates for some terms.

Accordingly, Nam A Bank increased the interest rate for 1-2 month terms by 0.7 percentage points to 4.5%/year.

The 3-month interest rate increased by 0.6 percentage points to 4.7%/year.

The 4-5 month interest rate increased by 0.5 percentage points to 4.7%/year.

The 10-11 month interest rate increased by 0.1 percentage points to 5.3%/year.

The 36-month interest rate increased by 0.2 percentage points to 5.9%/year.

Nam A Bank’s Latest Online Savings Interest Rates.

Since the beginning of November, nine banks have increased their savings interest rates, including: Nam A Bank, IVB, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank, and VietBank.

The Cash Flows Strongly into the Banks

According to the latest data released by the State Bank of Vietnam, resident deposits reached over VND 6,920 trillion by the end of August 2024, a 6% increase compared to the end of 2023. This significant growth showcases the thriving economy and the confidence of residents in the country’s financial system.

The Power of Compounding: Maximizing Your BIDV Savings Account Interest in November 2024

In November, BIDV offered an impressive 4.9% annual interest rate on online deposits for personal customers with a tenure of 24 to 36 months. This highly competitive rate showcases BIDV’s commitment to rewarding its customers with attractive returns on their savings. With this offer, customers can rest assured that their money is not only secure but also growing at a remarkable rate during this period.

Latest Savings and Loan Interest Rates at TPBank: How High Can They Go?

With an impressive 5.7% annual interest rate, TPBank offers an attractive deal for those looking to save over a 36-month period. This rate applies to standard deposits and shines as an appealing option for those seeking steady, long-term financial growth. Additionally, TPBank has announced a base lending rate of 8.4% for personal loans with a 12-month tenure, providing customers with a competitive and accessible opportunity to borrow funds for their short-term financial needs.

The Special Controlled Bank Continues to Increase Savings Interest Rates for the Second Time in September

Dong A Bank has once again raised its savings interest rates. This is the second time in September that the bank has increased its savings rates, marking a positive shift for customers.