Sài Gòn Commercial Joint Stock Bank (SCB) announces an adjustment to the transaction limit for Napas 247 Instant Money Transfer for individual customers, effective from 1 pm on November 11, 2024.

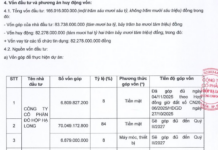

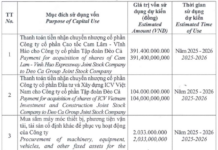

Accordingly, the maximum transaction limit for Napas 247 Instant Money Transfer for each individual customer is VND 50 million/time/day/customer, applicable to over-the-counter transactions and SCB eBanking channel.

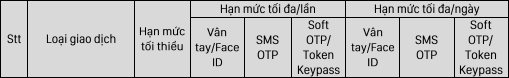

Napas 247 Instant Money Transfer limit at SCB from 11/11/2024

Specifically, for money transfer transactions using fingerprint/Face ID authentication, the maximum amount per transaction is VND 2 million, and the daily limit is VND 50 million.

For money transfer transactions authenticated via SMS OTP, Soft OTP/Token Keypass, the maximum limit is VND 50 million per transaction and VND 50 million per day.

Besides adjusting the transaction limit for Napas 247 Instant Money Transfer, other transaction limits remain applicable as per SCB’s regulations from time to time.

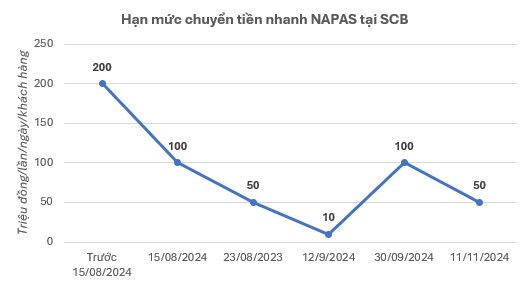

Previously, SCB had made several adjustments to the transaction limit for Napas 247 Instant Money Transfer, from a maximum of VND 200 million/time/day/customer to VND 100 million/time/day/customer on August 15, 2024; to VND 50 million/time/customer on August 23, 2024; and to VND 10 million/day/customer on September 12, 2024. The limit was then increased to VND 100 million/time/day/customer on September 30, 2024.

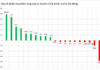

In parallel with the adjustment of the money transfer limit, SCB has also been closing several transaction offices recently. Most recently, on November 1, 2024, SCB announced the closure of four transaction offices in four different provinces and cities, including Ba Dinh Transaction Office – Thang Long Branch; Tan Quy Transaction Office – Tan Dinh Branch; Go Cong Transaction Office – Tien Giang Branch, and Thuan An Transaction Office – Binh Duong Branch.

Additionally, SCB has also announced the temporary suspension of the implementation of the SCB Premier Member ranking policy, effective from November 10, 2024, and the special privileges for the high-end banking service – SCB Premier, from December 10, 2024. The fee collection policy for product/service usage of customers from December 2024 will be applied according to SCB’s current regulations.

Transfer Money Faster with the New Feature on PVConnect

To enhance user experience, Vietnam Public Joint Stock Commercial Bank (PVcomBank) has successfully introduced a new feature on its digital banking platform, PVConnect: account information suggestions for fund transfers. This innovative feature, currently available in only a handful of banking apps, allows customers to effortlessly paste the beneficiary’s account information, with PVConnect automatically recognizing the account number, bank, and recipient’s name, thus streamlining the fund transfer process.

“A Billionaire’s Benevolent Gesture: Forgoing 30 Years of Salary to Right Wrongs”

“The defendant, Ngo Thanh Nha, the CEO of Van Thinh Phat Group, intends to use their salary earned over nearly 30 years of dedication to the corporation to rectify the situation and address any consequences that may arise.”

The Elderly Woman in Binh Duong Borrowed Money to Send to Strangers Out of Fear of ‘Going to Jail’

“Despite her family’s desperate attempts to stop her, an elderly woman from Binh Duong fell prey to a cunning scam. The fraudster, posing as a police officer, demanded a transfer of 50 million VND, threatening to incarcerate her in Bo La detention camp if she failed to comply. Sadly, the woman, convinced by the imposter’s deceitful words, borrowed money from her children to fulfill the scammer’s demands.”

“Recovering Almost VND 1 Billion Transferred to Scammers: Timely Action by Hai Duong Resident Leads to Account Freeze”

On September 20, the Hai Duong Provincial Police, in collaboration with the Agribank branch, thwarted an attempted fraud amounting to nearly VND 1 billion. This successful collaboration highlights the proactive measures taken by authorities and financial institutions to protect citizens from falling prey to such scams.