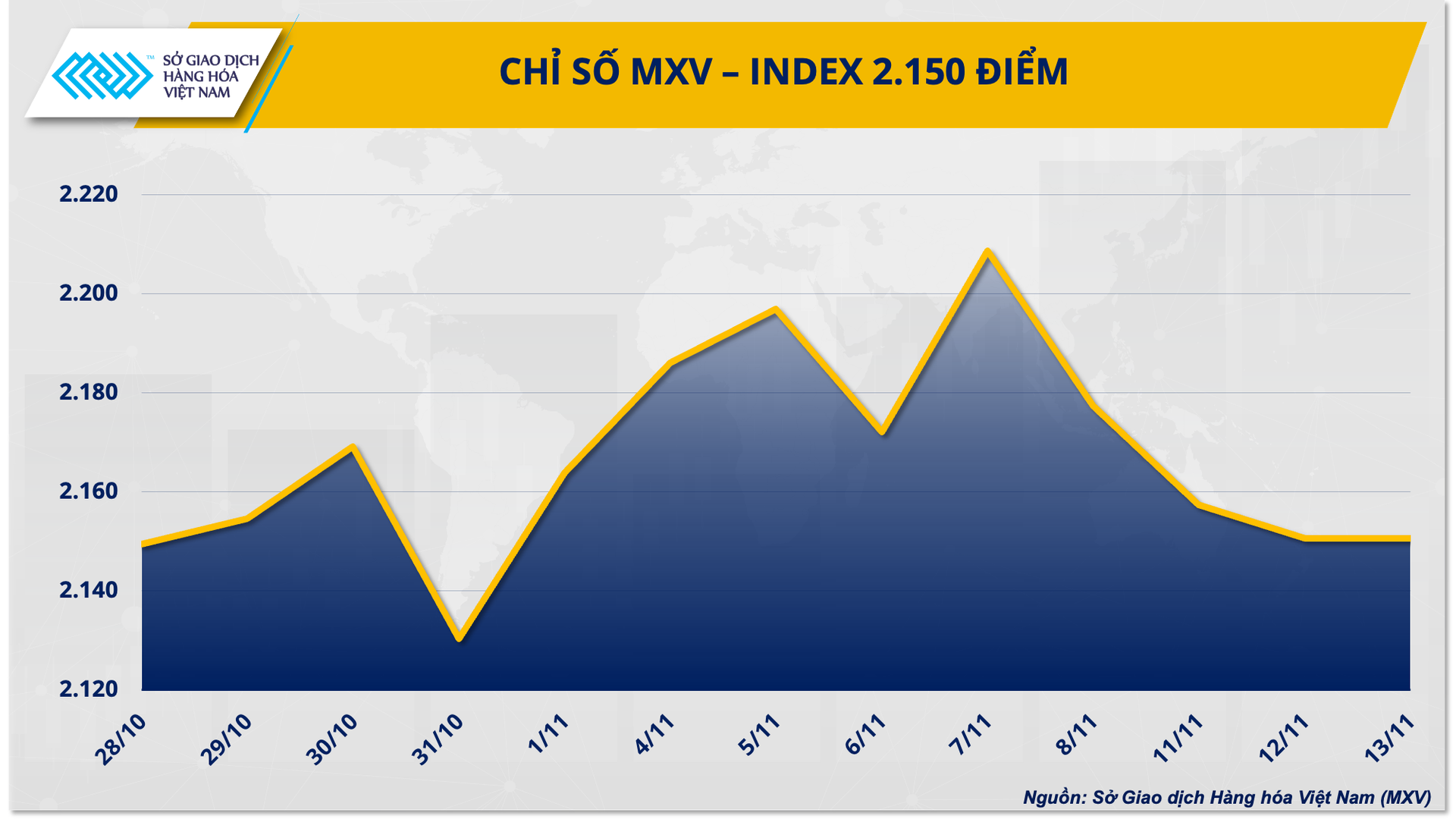

According to the Vietnam Commodity Exchange (MXV), the global commodity market witnessed mixed performances during the trading session on November 13. At the close, the MXV-Index remained unchanged at 2,150 points.

Notably, while metals plunged, industrial raw materials led the market’s upward trend. Coffee prices, in particular, extended their gains for the third consecutive session, with Arabica coffee reaching a 2-month high.

Capital exodus from the metal market amid strong USD pressure

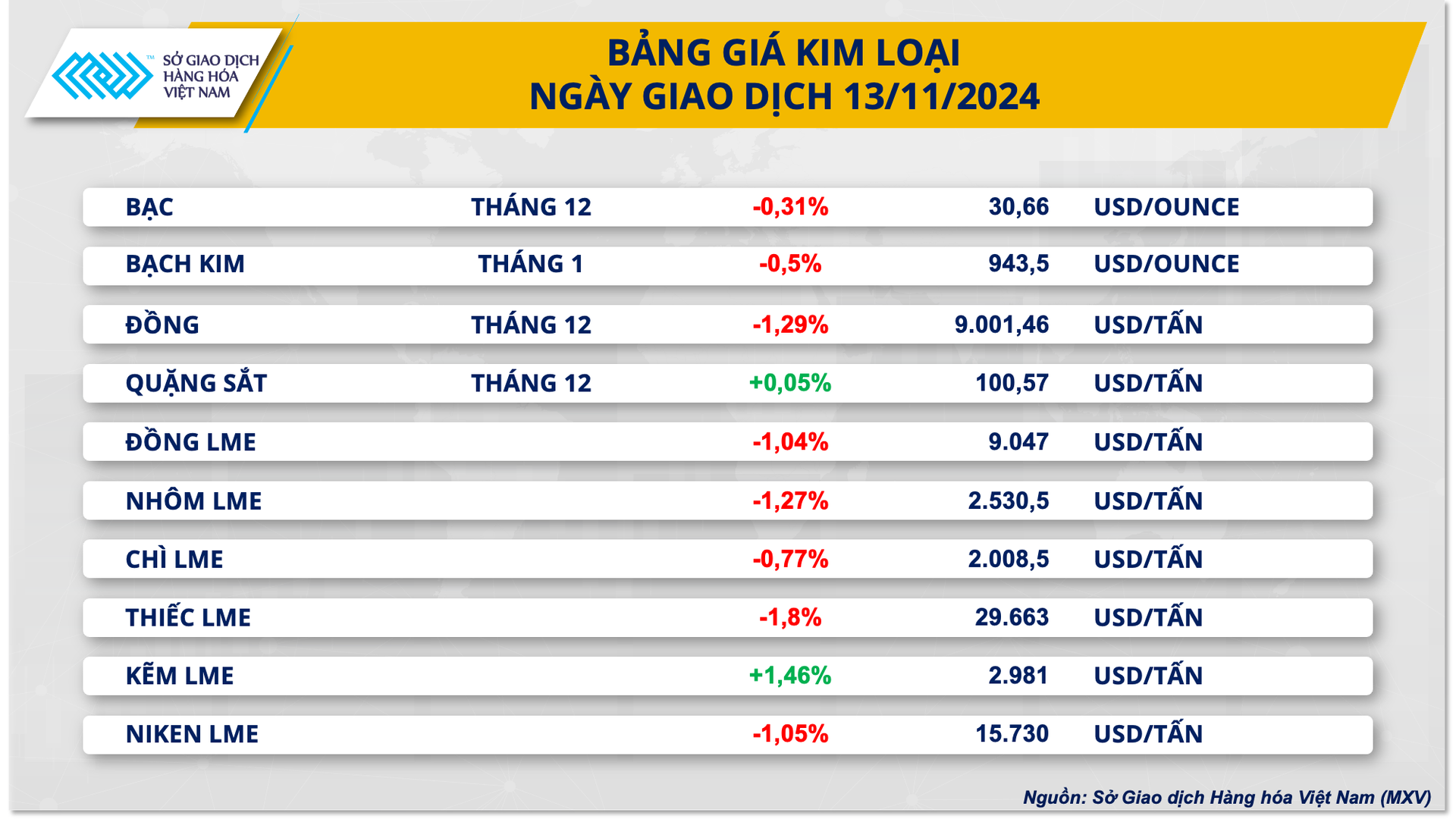

As per MXV, the macro headwinds continued to weigh on the metal market. For precious metals, silver prices dipped by 0.31% to trade near $31 per ounce. Platinum also extended its losing streak for the fourth straight session, falling by 0.5% to $943.5 per ounce and lingering at its 2-month low.

The strengthening US dollar exerted significant pressure on the prices of precious metals. After reaching a 4-month peak, the DXY index climbed further to mark a 1-year high in the previous session. At the close, the index rose by 0.43% to 106.48 points, logging its fourth consecutive daily gain.

Investors flocked to the US dollar, anticipating that the new policies of President-elect Donald Trump would favor the US economy, despite potentially causing significant federal budget deficits and leading to higher interest rates and inflation in the long run.

Moreover, as a safe-haven asset, precious metals lost their luster as investors diverted funds to riskier and more lucrative assets like stocks and cryptocurrencies. US stock market indices, including the Dow Jones and Nasdaq, have consistently reached new highs recently, while the price of bitcoin surged past the $93,000 mark to hit an all-time high.

Base metals also faced strong headwinds from the robust US dollar and weak demand prospects in China. COMEX copper prices plunged further, closing 1.29% lower at $9,001 per ton, the lowest level in nearly two months.

The latest data revealed that the import price gap for Yangshan copper in China, a closely watched indicator of the country’s copper import demand, has narrowed by 30% to around $46 per ton, down from nearly $70 at the beginning of October 2024. This indicates a softening demand for copper imports in the top consumer nation.

Additionally, selling pressure intensified after Citi Research lowered its copper price forecast to an average of $8,500–9,000 per ton by the end of this year. Specifically, for the fourth quarter, the average copper price is projected to drop to $9,000 per ton, down from the previous estimate of $9,500.

Arabica Coffee Prices Near 2-Month High

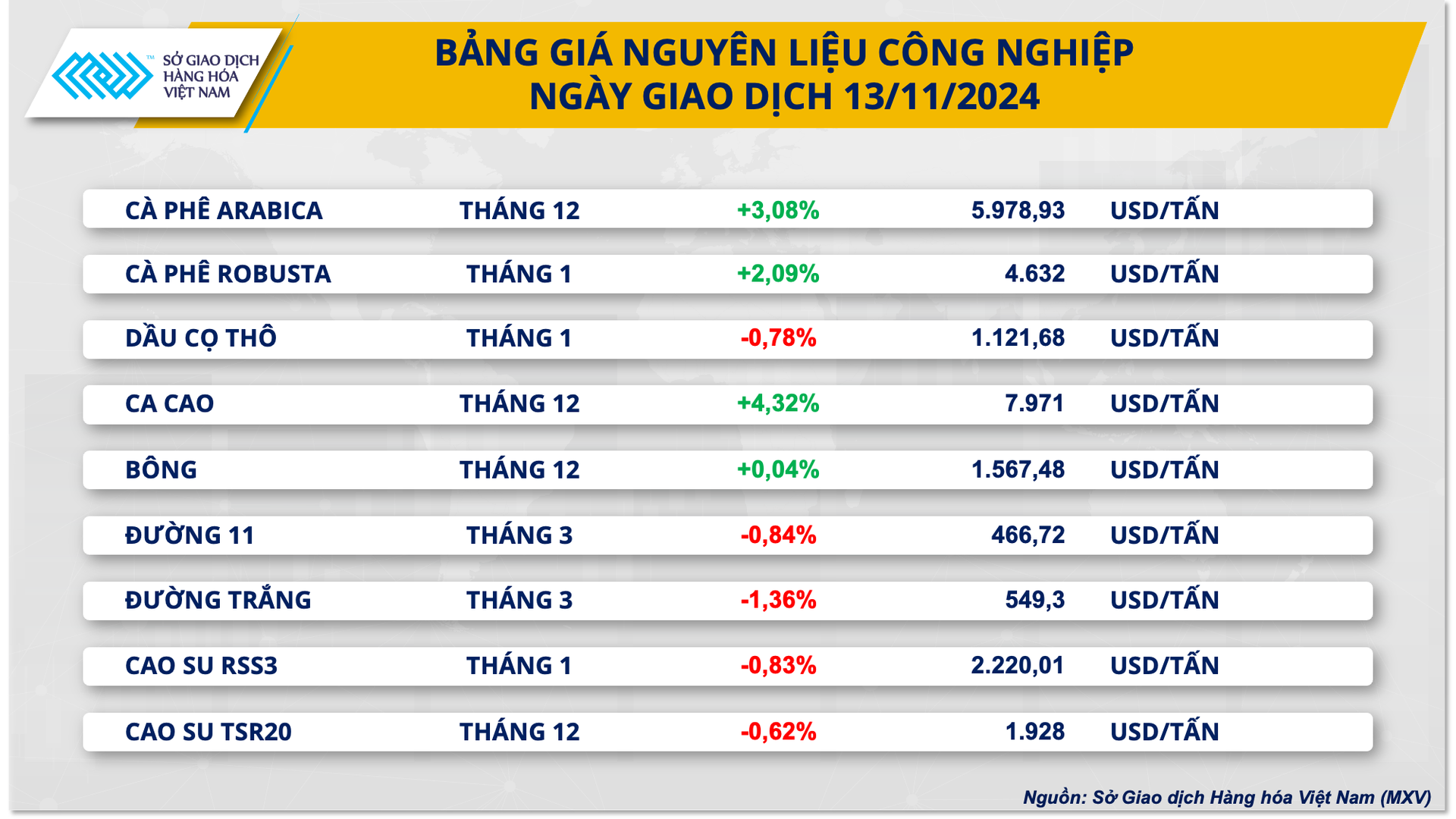

At the close of yesterday’s trading session, industrial raw materials were predominantly in the green, with coffee prices climbing for the third straight day. Arabica coffee prices rose by 3.1% to nearly $6,000 per ton, nearing a 3-month high, while Robusta coffee prices increased by 2.1% to $4,632 per ton, the highest level in four weeks. Concerns about weather conditions in Brazil and Vietnam overshadowed the pressure from the rising Dollar Index and USD/BRL exchange rate.

Vietnam is entering the main harvest season for the 2024-2025 crop year amid market worries about the impact of La Niña, with heavy rains potentially disrupting the harvest and reducing coffee yields. Meanwhile, Brazil also faces the risk of water scarcity for coffee tree growth and the 2025-2026 harvest. Weather forecaster Climatempo stated that after a brief period of rainfall in Minas Gerais—Brazil’s largest Arabica-producing state—in the middle of the week, the region is expected to experience hotter and drier conditions in the coming ten days.

Additionally, the Brazil Coffee Exporters Council (CECAFE) reported that the country exported 4.93 million bags of coffee in October 2024, marking an 11.5% increase compared to the same period in 2023. This surge in exports was supported by ample supply following the 2024 harvest and robust foreign demand.

Notably, today is the last day of the meeting to decide on the timing of implementing the EU’s EUDR regulations on the import of goods related to deforestation. Previously, the European Commission (EC) proposed postponing the enforcement of EUDR by 12 months, which was approved by the European Council. If the meeting adopts this proposal, coffee prices may come under pressure as European importing countries could pause their recent aggressive buying spree.

In the domestic market, this morning (November 14), coffee prices in the Central Highlands and the Southeast region ranged between 111,100 and 111,400 VND per kg, up by 300 to 500 VND per kg compared to yesterday. Thus, domestic coffee prices are currently almost double those of the same period last year.

The Great Gold Crash: Investors Panic, Sending Prices Plummeting.

On the evening of November 6, investors rushed to offload gold, furiously dumping the precious metal and canceling long-term transactions.

Gold Prices Plunge as Fed Rate Cut Hopes Fade

Investors cautiously awaited the Fed’s release of the minutes from its September meeting, along with the latest inflation data from the U.S. Labor Department.