The government has just issued a resolution from the regular monthly meeting in October. The resolution requires ministries, sectors, and localities to implement more comprehensively and effectively the resolutions and conclusions of the Central Committee, the Politburo, and the National Assembly. We must persist in our set goals, strive for a GDP growth rate of about 7.4%-7.6% in the fourth quarter, and achieve a growth rate of over 7% for the whole year, along with completing all 15 key socio-economic development targets for 2024.

The government demands strengthening financial and state budget discipline. We will resolutely implement measures to collect state budget revenues for 2024, striving to exceed the National Assembly’s estimate by at least 15%.

According to the resolution, the government assigns the Steering Committee on Inspection and Problem Solving related to projects and investment programs to promptly survey, synthesize, and identify clusters of problems. They will then report and propose solutions to the government to issue directives to the ministries, sectors, and localities for implementation or submit to competent authorities for consideration and decision-making on issues beyond their authority.

The Ministry of Health is assigned to coordinate with concerned agencies to urgently resolve bottlenecks in the investment projects for constructing the second facilities of Bach Mai Hospital and Vietnam-Germany Friendship Hospital in Ha Nam province. Deputy Prime Minister Le Thanh Long will direct and ensure the progress as required.

The State Bank of Vietnam is requested to urgently complete and submit to competent authorities a plan for the mandatory transfer of the remaining specially controlled banks and a plan to handle the Saigon Commercial Joint Stock Bank (SCB) in December. Deputy Prime Minister Ho Duc Phoc will direct and ensure the progress as required.

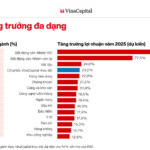

Profiting from the Economic Recovery

The banking sector is poised to reach new heights in 2024, with expectations of soaring profits. This optimistic outlook is underpinned by the sustained growth in credit and a notable easing of bad debt pressures, thanks to the economy’s robust recovery trajectory.

“Techcombank Expands its Financial Ecosystem with a Strategic Investment in Non-Life Insurance”

On October 24, 2024, Hanoi played host to the launch ceremony of Techcom Non-life Insurance Company. The event was graced by the presence of representatives from the Ministry of Finance, the Board of Directors of Techcombank, and strategic partners.

The New Interest: “The Coming Year’s Slashed Interest Rates”

With the Fed and many central banks entering a cycle of cutting interest rates, Vietnam will continue to maintain its accommodative stance to support economic growth. Interest rates are expected to drop by 0.7% in the coming year, providing a boost to the economy and potentially spurring investment and consumption.