On November 13, gold expert Tran Duy Phuong shared his insights with Tien Phong Newspaper regarding the recent volatile gold prices.

– Gold prices have been unpredictable and continuously dropping deeply in recent days. What are the reasons behind this, in your opinion?

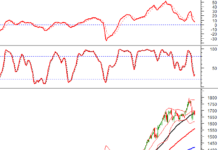

Mr. Tran Duy Phuong: The price of gold has been declining steadily over the past week, falling by about 200 USD per ounce. From a high of over 2,780 USD per ounce last week, it now stands at 2,609 USD per ounce.

Gold expert Tran Duy Phuong.

The direct cause of the drop in gold prices is the strengthening US dollar, along with optimistic sentiments about the US economy under a potential second term of the Trump administration. The market sentiment has also shifted following the US presidential election on November 5.

There are multiple reasons why investors are selling gold at this time. One factor is the US presidential election. Historically, gold prices tend to rise during election years, only to retreat after the election results are known.

Investors believe that a return of Donald Trump to the White House would ease tensions in the Middle East, reducing the appeal of gold as a hedge against risk.

I believe that gold prices could drop further by another 70-80 USD, reaching around 2,550 USD per ounce before this correction ends. By 2025, gold is likely to shine again. Prices may climb back to the 2,800 USD or even 2,900 USD per ounce mark this year, but reaching 3,000 USD per ounce seems unlikely.

– Gold prices have been on a rollercoaster, with people rushing to buy one day and then flocking to sell the next. Stores report being sold out one day and then announce they are fully stocked the next… What is happening, in your opinion? Should investors buy or sell gold at this point?

The domestic gold market is undoubtedly influenced by the downward trend in global gold prices. Specifically, gold prices in Vietnam have dropped significantly within a few days, with two prominent brands, SJC gold bullion and 9999 gold rings, experiencing a decline of 7-10 million VND per tael (selling – buying price).

People flock to buy and sell gold as prices fluctuate.

Whether domestic gold prices will continue to fall depends on the global market. However, I anticipate a further decline in international gold prices in November, which will likely affect local prices as well.

With the significant drop in domestic gold prices, the conversion rate between local and international gold prices is now equal. This presents a good opportunity for those looking to buy gold for storage or investment purposes. It is advisable to spread out purchases rather than buying a large quantity at once.

For those considering selling gold, it is essential to weigh the options carefully. In the past two days, I have observed a significant number of people selling their gold. Buyers are hesitant to invest at this time due to expectations of further price drops. Investors should carefully consider their needs. If you require funds and previously purchased gold at around 60-70 million VND per tael, it may be wise to sell and take profits. However, if it is not urgent, it is better to wait for a more favorable time when gold prices recover.

– Some argue that the local gold market is distorted due to inconsistent management and ineffective intervention measures. Do you have any suggestions for improving the management of this market?

It is true that when people buy gold and store it in their safes, it does not contribute to economic development. However, the traditional mindset and habits of Vietnamese people often lead them to favor gold as a store of value, believing that its price will appreciate over time. Gold also offers high liquidity, allowing people to sell it for cash whenever needed. If the State Bank of Vietnam (SBV) can implement specific mechanisms and policies that demonstrate to the public that investing in other products is more advantageous than holding gold, it may help reduce the tendency to hoard gold.

Gold bars and rings are back in stock at many gold shops in Ho Chi Minh City.

The SBV has successfully managed the gold market, especially SJC gold bullion. Without their timely intervention in April 2024, the price of SJC gold could have soared to 120 million VND per tael. Following the SBV’s intervention, at the request of the government, the price gap between Vietnamese and international gold has narrowed significantly. The previous peak difference of 18-20 million VND per tael has now decreased to a more reasonable range of 3-5 million, which I find appropriate.

Gold businesses are hoping that the SBV will not only stabilize SJC gold bullion but also provide a clear mechanism for gold materials used by gold shops to produce jewelry and rings. Currently, gold shops rely on buying and selling from customers to obtain these gold materials. It is desirable for the SBV to establish a roadmap that enables gold businesses to purchase gold materials directly from the SBV or designated enterprises, allowing them to operate with confidence in producing jewelry and ornaments to meet domestic demand.

– Thank you for your insights, Mr. Phuong!

The Golden Opportunity: Unveiling the Daily Treasure

As of the 15th of November, the price of gold rings has unexpectedly surged, with an increase of approximately 500 to 900 thousand VND per tael.

The Central Bank Governor Unveils a Special Relief Package: A VND 405 Trillion Loan Facility with Subsidized Interest Rates to Support Businesses and Individuals Affected by Natural Disasters

The Governor of the State Bank of Vietnam (SBV) has instructed credit institutions to focus on implementing solutions to support businesses and individuals affected by the recent typhoon. This includes debt restructuring and maintaining the current debt group classification as per existing regulations. The SBV has also directed credit institutions to consider reducing interest rates for those impacted by the storm, demonstrating a commitment to providing relief during challenging times.

Gold Prices Plummet Following Trump’s Election Victory

The global gold price plunge has dragged the price of 99.99% gold rings below the 88 million VND per tael mark.

“Gold’s Gloomy Outlook as ‘Risk-On’ Assets Reign Supreme Post-Trump Victory”

Last week’s markets were dominated by the US Presidential election, and the precious metals sector was no exception, as expected. What was surprising, however, was the pace of the volatility and the ensuing gold sell-off, which has left market participants wondering about the future direction of this metal.