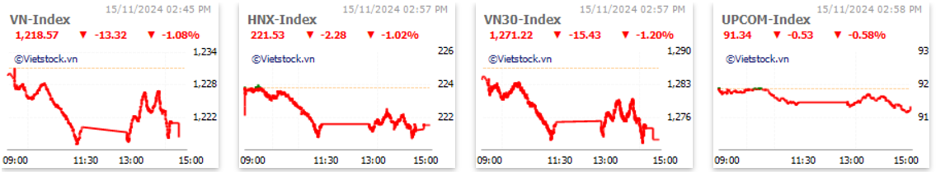

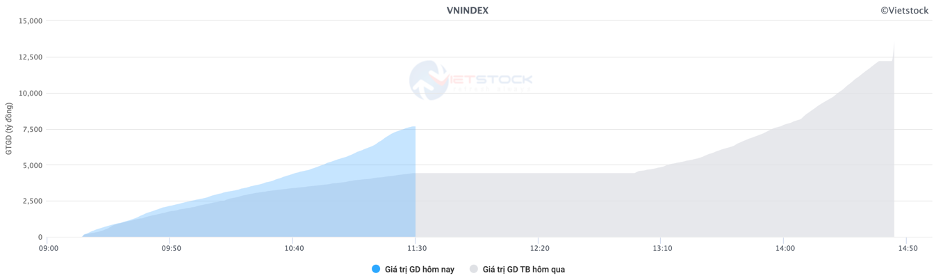

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 668 million shares, equivalent to a value of more than 16.2 trillion VND; HNX-Index reached over 61 million shares, equivalent to a value of more than 1.1 trillion VND.

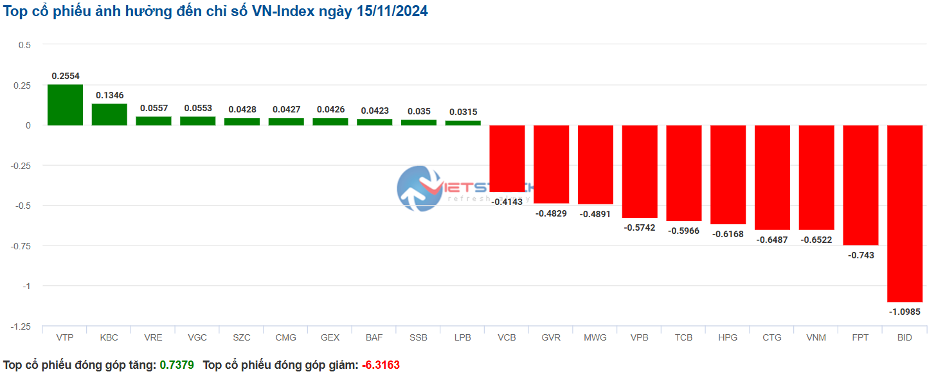

VN-Index opened the afternoon session quite negatively as selling pressure reappeared, pulling the index back into the red despite buying efforts. In terms of impact, VTP (6.99%), KBC (2.44%), and VRE (0.55%) were the stocks with the most positive impact on the VN-Index, with an increase of nearly 0.5 points. On the other hand, BID, FPT, and VNM were the stocks with the most negative impact on the index.

Source: Vietstock Finance

|

HNX-Index followed a similar trajectory, with the index negatively impacted by PVS (-2.86%), MBS (-2.93%), SHS (-2.94%), CEO (-2.76%),…

Source: Vietstock Finance

|

At the close, the market decreased by 1.08%. The energy sector was the most negatively impacted industry, falling by 2.78%, led by BSR (-4.06%), PVC (-4.63%), PVB (-2.58%), and PVS (-2.86%). This was followed by the materials and information technology sectors, which declined by 1.48% and 1.40%, respectively.

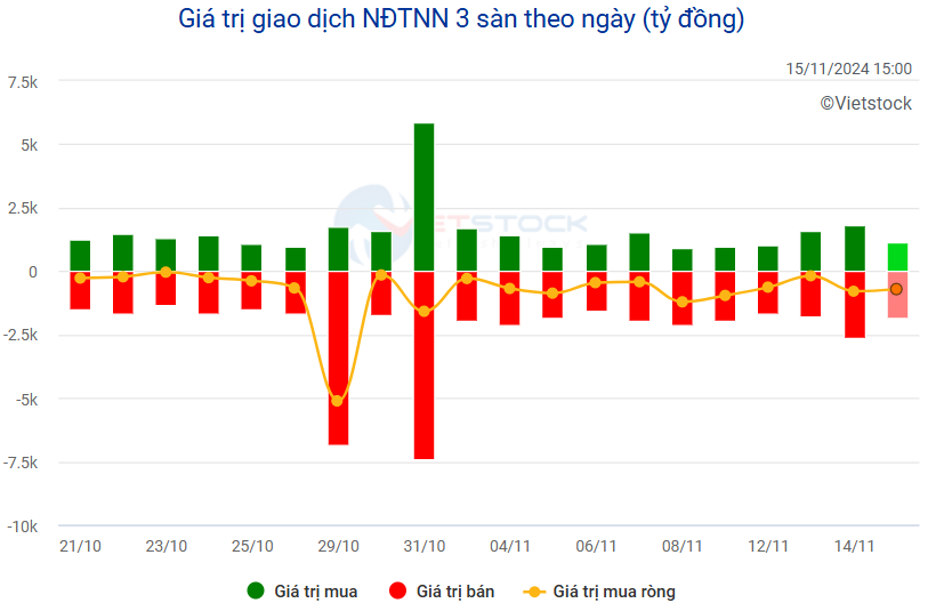

In terms of foreign trading, they net sold over 1,400 billion VND on the HOSE exchange, focusing on VHM (698.13 billion), FPT (342.92 billion), SSI (208.74 billion), and VNM (104.24 billion). On the HNX exchange, foreign investors net sold more than 19 billion VND, mainly offloading SHS (19.33 billion), PVS (15.52 billion), and IDC (9.22 billion).

Source: Vietstock Finance

|

11:40 a.m.: Is the historical milestone of 1,200 points approaching again?

The sellers showed no signs of stopping, and the pessimistic sentiment caused the indices to continue their downward spiral. At the end of the morning session, the VN-Index fell by 11.47 points, or 0.93%, to 1,220.42 points; HNX-Index decreased by 0.99% to 221.61 points. The market breadth inclined towards decliners, with 533 stocks falling and 138 stocks rising.

Liquidity was significantly higher compared to the previous morning, with the VN-Index trading volume surpassing 359 million shares, equivalent to a value of nearly 8.8 trillion VND. The HNX-Index recorded a trading volume of nearly 35 million shares, with a value of nearly 609 billion VND.

Source: VietstockFinance

|

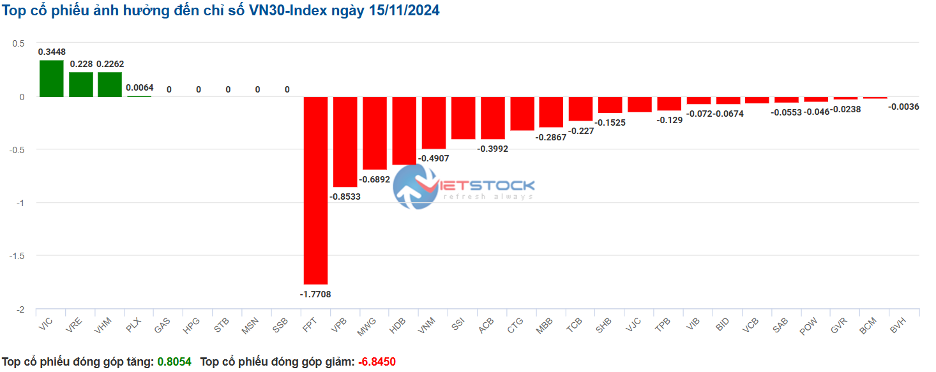

The lack of support from large-cap stocks made the market situation even more challenging. The VN30-Index ended the morning session down 11.43 points, or 0.89%, at 1,275.22 points. FPT (-1.8%), CTG (-1.6%), and BID (-1.2%) were the biggest drags on the VN-Index, causing the index to lose nearly 2.5 points. There were no significant gainers on the upside.

The red dominated across all sectors. The telecommunications and energy sectors ranked last with declines of 3.9% and 2.59%, respectively, mainly due to large-cap stocks such as VGI (-3.8%), FOX (-4.17%), CTR (-3.24%), and VNZ (-2.17%); BSR (-3.05%), PVS (-2%), and PVC (-1.85%).

The key sectors of banking and real estate were unable to recover as selling pressure prevailed, with notable losers including HDB (-2.18%), MSB (-2.16%), EIB (-2.16%), BVS (-3.87%), CTS (-3.5%), MBS (-2.93%), SSI (-2.83%); TDH (-4.1%), SNZ (-4.03%), KDH (-3.75%), NLG (-2.98%),… Only a few stocks managed to stay in the green, including VHM, VRE, VIC, KBC, SZC, NTL, and SSB.

Foreign investors offloaded FPT heavily in the morning session, with a net sell value of over 195 billion VND, while the total net sell value on the HOSE exceeded 424 billion VND. On the HNX exchange, foreign investors also net sold more than 25 billion VND, with PVS being the most notable stock (13.28 billion VND).

10:40 a.m.: Negative sentiment starts to emerge

As of 10:30 a.m., the VN-Index fell more than 6 points, trading around 1,225 points. The HNX-Index also declined slightly, trading around 223 points.

The breadth of the VN30 basket was mostly covered in red. Among them, VIC, VRE, and VHM contributed 0.34 points, 0.29 points, and 0.23 points to the VN30-Index, respectively. On the other hand, FPT, MWG, and VPB were under selling pressure, dragging down the index by nearly 3.5 points.

Source: VietstockFinance

|

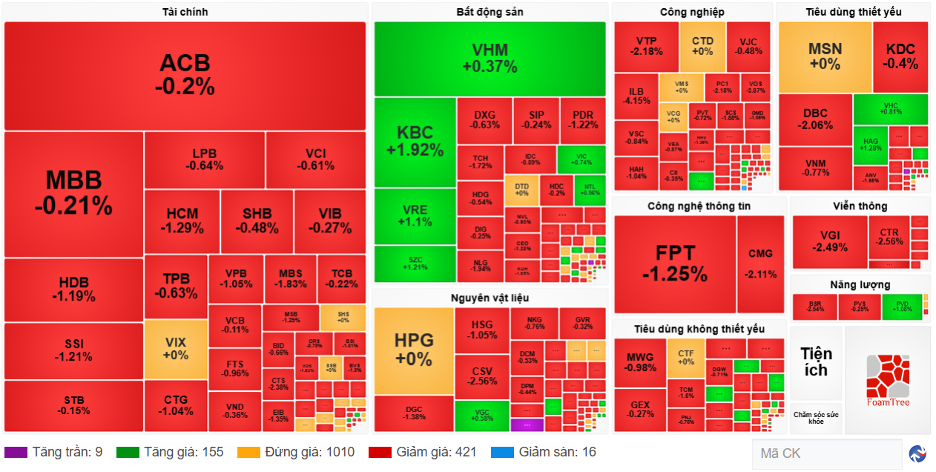

Leading the downward momentum was the telecommunications services sector, with notable stocks such as VGI falling by 2.49%, YEG by 3.02%, CTR by 2.56%, MFS by 4.2%, and ELC by 2.22%,… The remaining stocks were either unchanged or slightly in the green.

Additionally, the industrials sector also witnessed a significant decline as the breadth inclined towards sellers. Notable losers included VTP (-2.18%), CTD (-0.15%), PC1 (-2.18%), VJC (-0.48%), VOS (-3.87%), and HAH (-1.04%),…

In contrast, the real estate sector displayed a more positive performance, with investors focusing on stocks such as VHM (+0.37%), VRE (+1.1%), KBC (+1.92%), VIC (+0.74%), and SZC (+1.21%), resulting in a slight gain for the sector.

Compared to the opening, buyers and sellers were engaged in a tight battle, with 1,010 stocks unchanged and sellers slightly ahead, as 421 stocks declined (16 of which hit the floor) while 155 stocks advanced (9 of which hit the ceiling).

9:30 a.m.: Red dominates across most sectors

The market opened the morning session on a negative note, with red dominating across most sectors. The VN30 index was the most negatively impacted, as most of the stocks within this group declined.

As of 9:30 a.m., a slew of VN30 stocks fell, including FPT, BCM, POW, MBB, MWG, TPB, SSI, CTG,… Meanwhile, VRE, VHM, VIC, and STB were the only stocks within the group that managed to stay in the green, with slight gains.

The telecommunications services sector was the most negatively impacted group in the market today, as stocks continued to fall from previous sessions, such as VGI (-2.61%), CTR (-1.81%), FOX (-2.09%), and ELC (-1.3%),…

Financial stocks also painted a gloomy picture, with most stocks in the red from the start of the session, including MBB (-0.42%), ACB (-0.2%), CTG (-0.74%), TCB (-0.22%), VPB (-0.79%), SSI (-0.61%), HCM (-0.74%), and ORS (-1.17%),…

The Market Beat: Green Wave Extends, VN-Index Recovers Over 15 Points

The market closed with strong gains, seeing the VN-Index surge by 1.25% to 1,261.28; a substantial increase of 15.52 points. Meanwhile, the HNX-Index also witnessed a healthy boost, rising by 1.29% to 227.76, an increase of 2.9 points. The market breadth tilted heavily in favor of bulls, with 536 tickers advancing against 147 declining names. The large-cap basket, VN30, painted a similar picture, with 29 constituents climbing and only 1 remaining unchanged.

The Ultimate Headline:

“Vietstock Weekly: Navigating the Short-Term Risks”

The VN-Index witnessed a significant drop, plunging by over 33 points, accompanied by the emergence of a bearish Black Marubozu candlestick pattern. Adding to the gloom, the index sliced below the SMA 200-week support, indicating a decidedly negative investor sentiment. Furthermore, the MACD and Stochastic Oscillator indicators continue their southward journey, reinforcing the sell signal and painting a picture of a short-term outlook that remains devoid of optimism.

The Cautious Sentiment: Will It Persist?

The VN-Index retreated amid subdued trading volumes, which remained below the 20-day average. This pullback underscores investors’ cautious sentiment following the previous rally. However, the index remains firmly above the 200-day SMA, indicating that the outlook is not overly pessimistic. As of now, the Stochastic Oscillator has dipped into oversold territory, generating a buy signal. Should the MACD indicator follow suit in upcoming sessions, it would further alleviate near-term risks.

The Upcoming US Election: What’s in Store for the Vietnamese Stock Market?

The Vietnamese stock market has historically shown a positive correlation with the US stock market. With a correlation of 27% in the last month and 76% in the last quarter between the S&P 500 and the VN-Index, the movements in the US stock market are expected to significantly influence the short-term trends of the VN-Index.