I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 07/11/2024

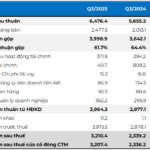

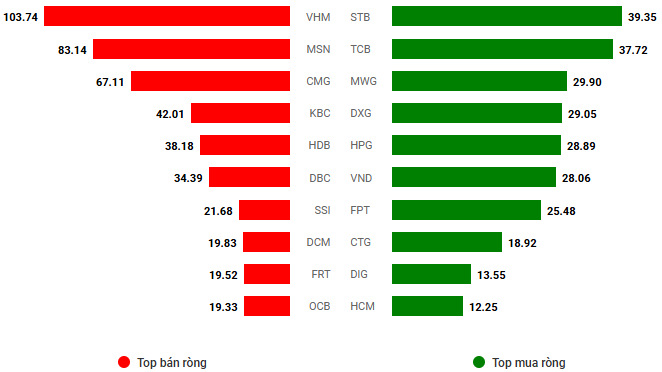

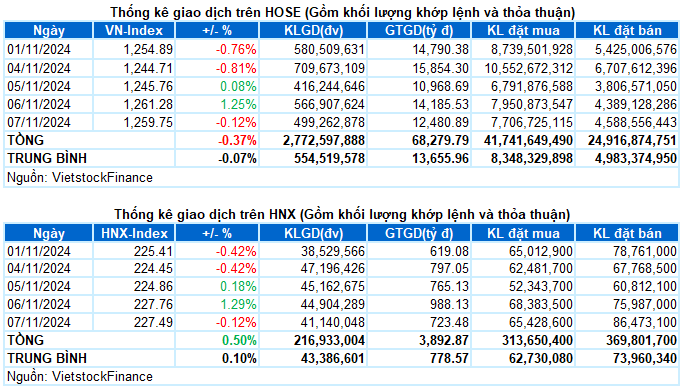

– The main indices adjusted slightly in the trading session on 07/11. VN-Index closed the session down 0.12%, to 1,259.75 points; HNX-Index at 227.49 points, down 0.12% from the previous session.

– Matching volume on HOSE reached more than 470 million units, down 6.4% from the previous session. Matching volume on HNX decreased by 1.5%, reaching nearly 41 million units.

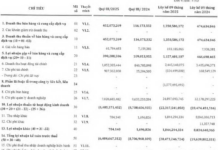

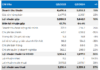

– Foreigners continued to sell on the HOSE with a value of more than 385 billion VND and net sold more than 26 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

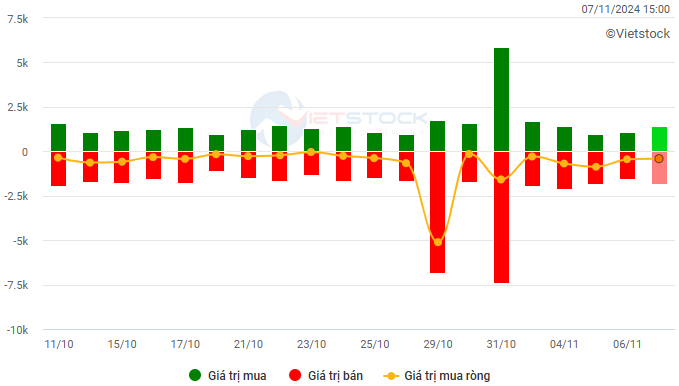

Net trading value by stock code. Unit: Billion VND

– After the positive developments of the international stock market last night, VN-Index entered the session on 07/11 enthusiastically. VN-Index surged more than 5 points after opening with improved liquidity. However, this upward momentum did not last long, and fluctuations continued to appear for the rest of the trading session. Buyers became weaker towards the end of the session, and the market returned to divergence within a narrow range. VN-Index closed at 1,259.75 points, down 0.12% from the previous session.

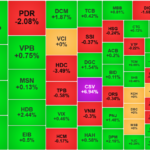

– In terms of impact, BID, CTG and GVR were the stocks that put the most pressure on the index today, taking away nearly 1.5 points from the VN-Index. On the opposite side, VCB, HVN and VTP traded positively, helping VN-Index gain about 1 point.

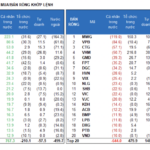

– VN30-Index closed down 0.22%, to 1,326.65 points. Sellers regained the upper hand across the board, recording 20 losing stocks, 5 gaining stocks, and 5 unchanged stocks. However, the volatility of stocks today was not too large. Specifically, MSN and GVR were the last two stocks with a decrease of 1.2%, while the rest increased or decreased slightly by less than 1%.

Industry groups were mixed. The telecommunications group was the most notable highlight, surging nearly 6%. Contributing significantly to this increase were stocks such as VGI (+7.1%), FOX (+4.03%), CTR (+2.4%), ELC (+1.75%), and FOC (+2.74%).

Transportation stocks in the industrial group also attracted positive investment demand, with many stocks rising more than 3%, such as ACV (+3.68%), HVN (+3.1%), MVN (+4.4%), HAH (+3.26%), and SCS (+3.17%).

The real estate group was mixed, and after shining in the previous session, most industrial park stocks stabilized, rising or falling slightly around the reference price. The remaining real estate stocks performed similarly, with a few codes showing significant fluctuations, namely DXS hitting the ceiling price, NVL (+3.85%), PDR (+1.88%), HDG (+1.44%), and SNZ (-2.3%).

On the downside, materials, healthcare, and financial groups ranked at the bottom with a decrease of about 0.3%. Selling pressure was typical in stocks such as GVR (-1.19%), VGC (-1.05%), DCM (-1.21%); DVN (-3.11%), DTP (-7.64%), DBD (-1.01%); SGB (-1.61%), EIB (-1.29%), ORS (-1.41%),…

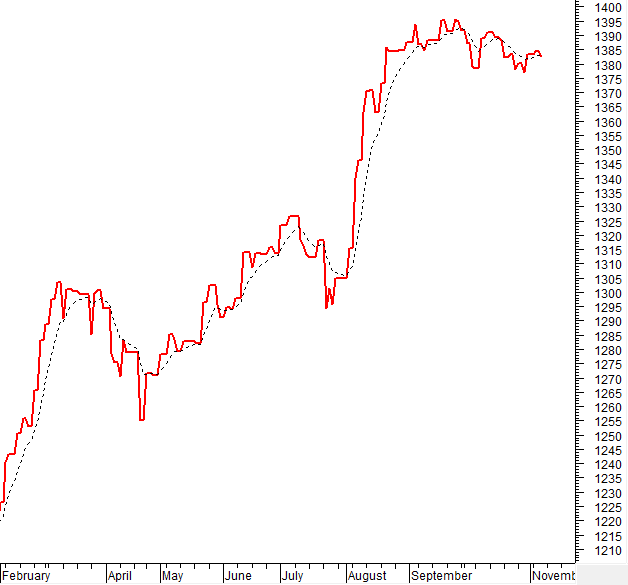

VN-Index fell again as trading volume continued to stay below the 20-day average. This suggests that investors remain cautious after the previous strong gains. However, the index is still holding above the SMA 200-day, indicating that the situation is not overly pessimistic. Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If, in the coming sessions, the MACD indicator also gives a similar signal, short-term risks will be reduced.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Maintaining above the SMA 200-day

VN-Index fell again as trading volume continued to stay below the 20-day average. This suggests that investors remain cautious after the previous strong gains. However, the index is still holding above the SMA 200-day, indicating that the situation is not overly pessimistic.

Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If, in the coming sessions, the MACD indicator also gives a similar signal, short-term risks will be reduced.

HNX-Index – Inverted Hammer Candlestick Pattern Appears

HNX-Index edged lower with the appearance of an Inverted Hammer candlestick pattern while staying above the Middle line of the Bollinger Bands. In addition, trading volume was above the 20-day average, indicating that money is still flowing into the market.

Currently, the Stochastic Oscillator and MACD indicators are both giving buy signals. If this signal is maintained in the coming sessions, the situation will not be too pessimistic.

Analysis of Money Flow

Fluctuations in Smart Money Flow: The Negative Volume Index indicator of VN-Index cut above the EMA 20-day. If this state continues in the next session, the risk of a sudden drop (thrust down) will be limited.

Fluctuations in Foreign Money Flow: Foreigners continued to sell in the trading session on 07/11/2024. If foreign investors maintain this action in the coming sessions, the situation will be more pessimistic.

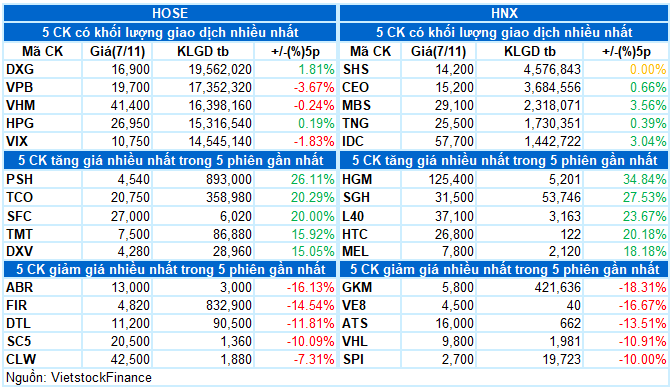

III. MARKET STATISTICS ON 07/11/2024

Economic and Market Strategy Analysis Department, Vietstock Consulting

The Upcoming US Election: What’s in Store for the Vietnamese Stock Market?

The Vietnamese stock market has historically shown a positive correlation with the US stock market. With a correlation of 27% in the last month and 76% in the last quarter between the S&P 500 and the VN-Index, the movements in the US stock market are expected to significantly influence the short-term trends of the VN-Index.

The Savvy Investor’s Bottom-fishing Expedition

The VN-Index pared losses, forming a Hammer candlestick pattern with above-average volume. This indicates a temporary reprieve from market risk as bottom-fishing funds entered the market, spurring a surge in trading volume. The Stochastic Oscillator, having exited oversold territory, continues to signal a buy. If this signal holds firm in the coming sessions, the short-term outlook may not be as pessimistic.

The Big Deal with MSN: Foreigners Net Sell nearly VND 1,600 billion

Foreign investors sold a net amount of 1,584.2 billion VND, and they sold a net of 497.0 billion VND in matched orders.

The Surprising Surge of Penny Stocks: A Market Phenomenon

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.