I. MARKET ANALYSIS OF STOCKS ON 11/13/2024

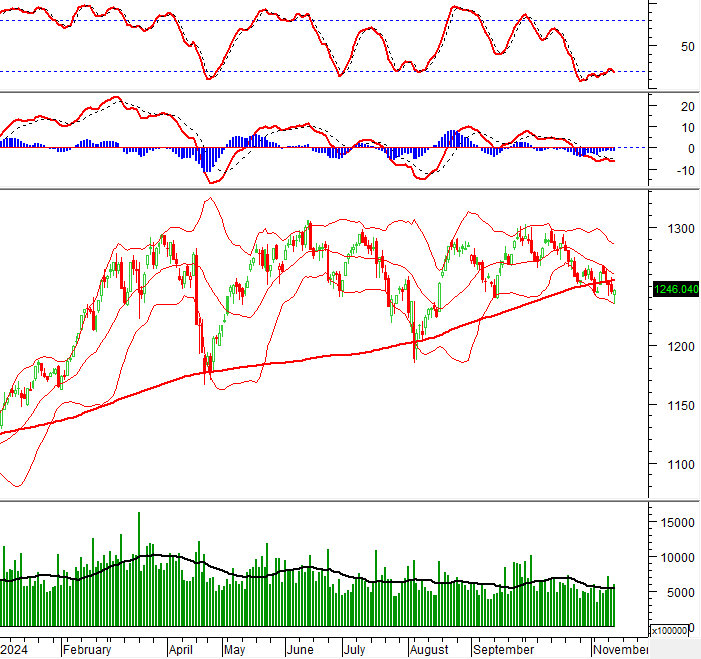

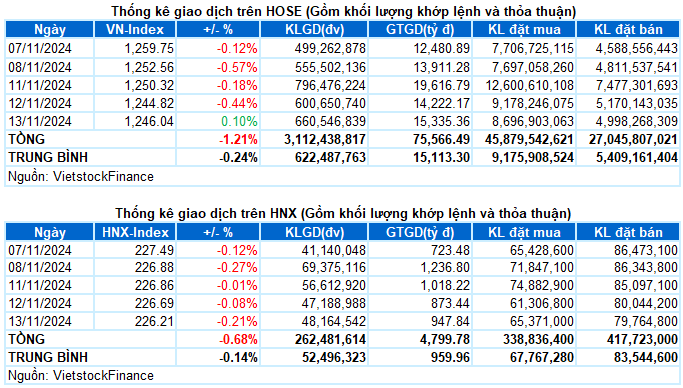

– On the trading day of November 13, the VN-Index slightly increased by 0.1%, reaching 1,246.04 points. Meanwhile, the HNX-Index decreased by 0.21% compared to the previous session, closing at 226.21 points.

– The matching volume on the HOSE reached nearly 588 million units, a 13.8% increase compared to the previous session. On the HNX, the matching volume rose by 7.4%, surpassing 41 million units.

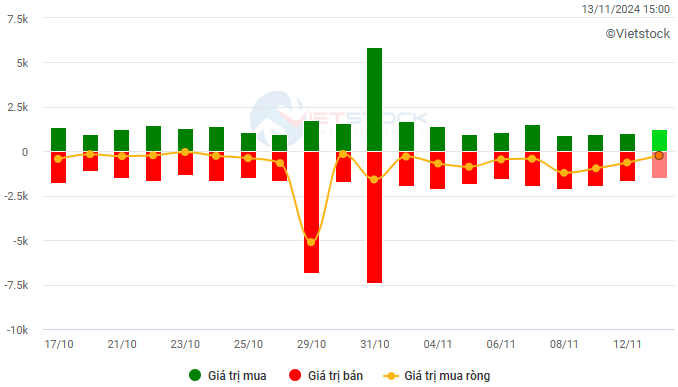

– Foreign investors continued to net sell on the HOSE with a value of more than VND 224 billion and net sold more than VND 30 billion on the HNX.

Trading value of foreign investors on the HOSE, HNX, and UPCOM by day. Unit: VND billion

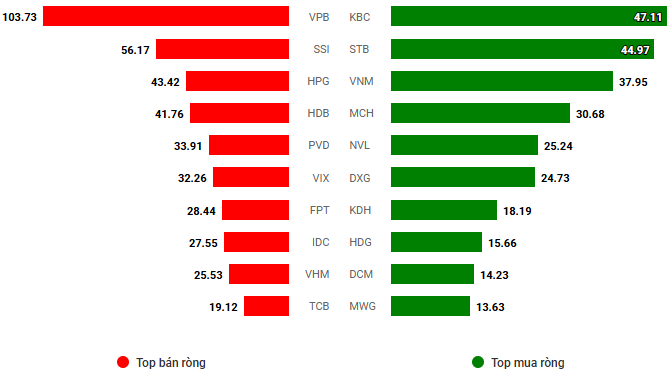

Net trading value by stock ticker. Unit: VND billion

– After four consecutive losing sessions, sellers continued to dominate the early trading hours today. Weak buying power, coupled with strong pressure from large-cap stocks, quickly pushed the indices down, with the VN-Index breaking below the support level of 1,240 points and losing more than 8 points by the end of the morning session. In the afternoon session, bottom-fishing forces started to emerge, easing the pessimistic sentiment among investors. Large-cap stocks in the banking and real estate sectors made a significant recovery, helping the VN-Index reverse and turn green by the end of the day. The VN-Index closed at 1,246.04 points, up slightly by 0.1% compared to the previous session.

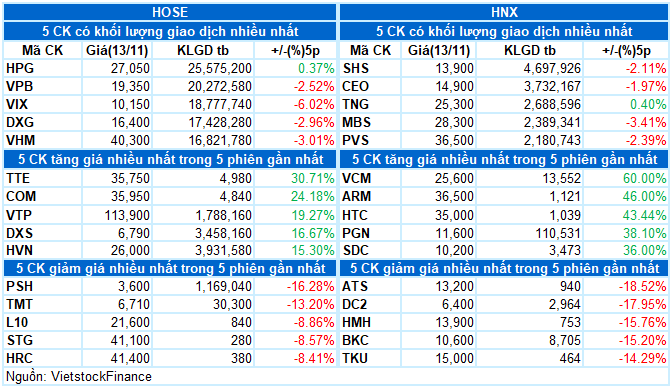

– In terms of contribution, VCB, VPB, and HVN had the most positive impact on the market today, adding 1.5 points to the VN-Index. On the other hand, HPG, GVR, and BID exerted considerable pressure, taking away 1.2 points from the index.

– The VN30-Index rose by 0.16%, reaching 1,304.04 points. The breadth of the basket improved in the afternoon session, recording 15 gainers, 11 losers, and 4 unchanged stocks. Among them, MWG and VPB witnessed the best recovery, increasing by 1.8% and 1.5%, respectively. In contrast, HPG, PLX, and GVR were at the bottom with losses of more than 1%. The remaining stocks in the basket only fluctuated slightly around the reference level.

More sectors were in the green today. Notably, telecommunications continued to shine with the outstanding performance of CTR (+5.34%), VGI (+0.82%), FOX (+1.47%), and ELC (+2.48%). Following were the industrial and information technology sectors, which climbed by 0.7%. The prominent names in these two sectors included ACV (+1.08%), MVN (+4.65%), HVN (+2.97%), PHP (+5.36%), FPT (+0.73%), and CMG (+0.68%).

The real estate and financial sectors significantly contributed to today’s rebound. Many stocks ended the session with strong gains, such as KBC (+2.96%), NVL (+2.37%), DXG (+2.18%), HDG (+2.86%), SZC (+1.32%), HDC (+2.76%), VPB (+1.31%), VCB (+0.65%), TCB (+0.42%), and EIB (+0.54%) … However, the market still witnessed clear differentiation as many stocks failed to escape the selling pressure, including IDC (-0.87%), TCH (-0.99%), QCG (-5.54%), IDJ (-1.61%), CTG (-0.43%), BID (-0.32%), STB (-0.45%), HDB (-0.58%), SSI (-0.97%), and HCM (-1.75%) …

On the losing side, energy stocks continued to underperform the market, falling by more than 2%. This was mainly due to the poor performance of BSR (-2.9%), PVS (-1.35%), PVD (-1.65%), PVC (-2.61%), POS (-1.46%), and PVB (-1.09%). Additionally, steel stocks also had a considerable impact on the overall decline in the materials sector, including HPG (-1.64%), HSG (-0.99%), NKG (-2.35%), and TVN (-2.6%).

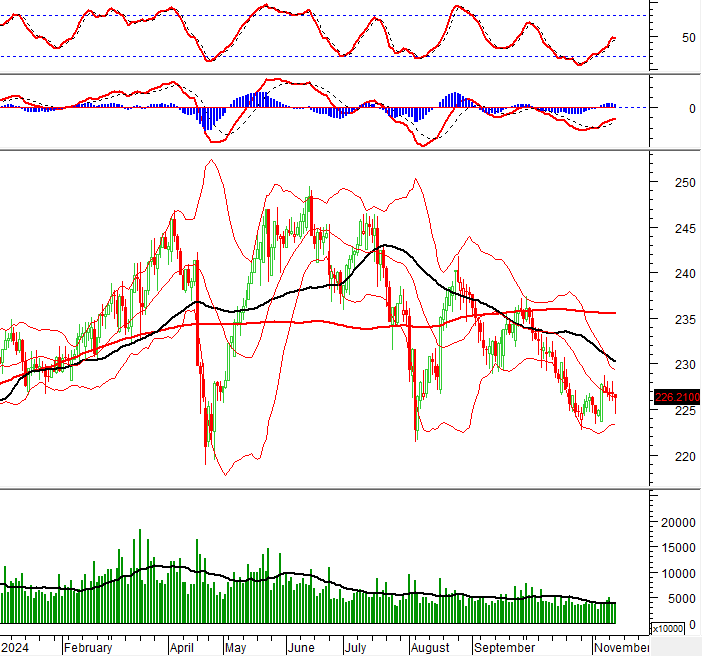

The VN-Index posted a slight gain and recovered from its recent losing streak. Moreover, the trading volume exceeded the 20-day average, indicating a relatively optimistic investor sentiment. However, the Stochastic Oscillator has given a sell signal, and the MACD is also indicating a similar signal, suggesting that the short-term outlook remains uncertain.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator gives a sell signal

The VN-Index slightly increased and recovered from its recent losing streak. Additionally, the trading volume exceeded the 20-day average, reflecting a relatively optimistic investor sentiment.

However, the Stochastic Oscillator has given a sell signal, and the MACD is also indicating a similar signal. This suggests that the short-term outlook remains uncertain.

HNX-Index – Hammer candlestick pattern appears

The HNX-Index narrowed its decline with the emergence of a Hammer candlestick pattern, accompanied by volume surpassing the 20-day average. However, the index remains above the Middle line of the Bollinger Bands, indicating that the situation is not overly pessimistic.

Currently, both the Stochastic Oscillator and the MACD are giving buy signals. If this signal persists in the next sessions, the risk of further declines will not be significant.

Analysis of Money Flow

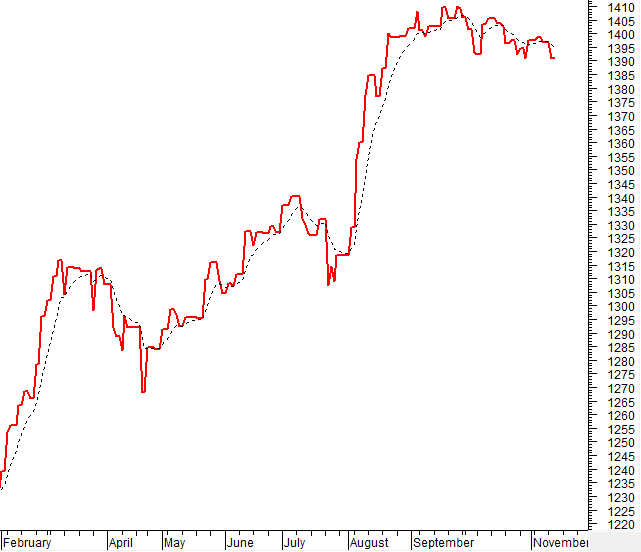

Changes in smart money flow: The Negative Volume Index of the VN-Index fell below the 20-day EMA. If this state continues in the next session, the risk of a sudden downturn (thrust down) will increase.

Changes in foreign capital flow: Foreign investors continued to net sell in the trading session of November 13, 2024. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS ON 11/13/2024

Economics & Market Strategy Analysis Department, Vietstock Consulting

The Beat of the Market: Investors Sell-Off with a Wave of Pessimism

The market closed with the VN-Index down 13.32 points (1.08%), settling at 1,218.57; the HNX-Index also ended below the reference level at 221.53 points. The market breadth tilted towards sellers, with 546 declining stocks against 193 advancing ones. The VN30-Index basket was mostly red, recording 26 losses, 3 gains, and 1 stock referencing.

The Market Beat: Green Wave Extends, VN-Index Recovers Over 15 Points

The market closed with strong gains, seeing the VN-Index surge by 1.25% to 1,261.28; a substantial increase of 15.52 points. Meanwhile, the HNX-Index also witnessed a healthy boost, rising by 1.29% to 227.76, an increase of 2.9 points. The market breadth tilted heavily in favor of bulls, with 536 tickers advancing against 147 declining names. The large-cap basket, VN30, painted a similar picture, with 29 constituents climbing and only 1 remaining unchanged.

The Market Beat: Foreigners Continue Their Selling Spree

At the end of the trading session, the VN-Index climbed 1.22 points (0.1%) to reach 1,246.04, while the HNX-Index dipped 0.48 points (0.21%), settling at 226.21. The market breadth tilted towards decliners, with 358 stocks falling versus 311 gainers. The VN30 basket, however, painted a greener picture, as 15 constituents rose, 11 fell, and 4 remained unchanged, tipping the scale in favor of the bulls.

The Ultimate Headline:

“Vietstock Weekly: Navigating the Short-Term Risks”

The VN-Index witnessed a significant drop, plunging by over 33 points, accompanied by the emergence of a bearish Black Marubozu candlestick pattern. Adding to the gloom, the index sliced below the SMA 200-week support, indicating a decidedly negative investor sentiment. Furthermore, the MACD and Stochastic Oscillator indicators continue their southward journey, reinforcing the sell signal and painting a picture of a short-term outlook that remains devoid of optimism.