On the evening of November 14, the international gold price was traded at $2,555 per ounce, a further decrease of $18 per ounce compared to the morning session. Within a day, the price of gold dropped by nearly $60 per ounce after falling below the $2,600 mark.

If calculated from the highest peak at $2,790 per ounce, the precious metal has now decreased by $235 per ounce (equivalent to a drop of about VND 7.2 million per tael).

The global gold price has been continuously declining as the US Dollar Index (DXY) on the international market has not stopped its strong upward trend. Currently, the DXY is at 106.7 points, surpassing the peak in October 2023.

According to analysts, the gold price is affected by a decrease after a series of shock increases right after Donald Trump won the US presidential election. With the expectation that the US economy will recover, the US dollar strengthened. Gold is no longer an attractive safe-haven asset for investors at the moment.

Gold price continues to drop tonight

The downward trend in global gold prices has also caused domestic gold prices to fall. This evening, SJC gold bars were bought and sold by SJC Company at VND 80 million per tael and VND 83.5 million per tael, respectively, stable compared to the morning session. However, some other companies adjusted the buying and selling prices of SJC gold bars down to VND 80 million per tael and VND 82.9 million per tael, respectively, which is VND 600,000 lower than the price offered by SJC Company.

The plain gold ring was traded at around VND 79 million per tael for buying and VND 81.7 million per tael for selling, unchanged from the morning session.

Compared to the all-time high, the SJC gold bar price has decreased by about VND 7 million per tael, while the plain gold ring price has dropped more sharply by approximately VND 8 million per tael.

Currently, the global gold price converted according to the listed exchange rate is about VND 78.6 million per tael.

The Central Bank Governor Unveils a Special Relief Package: A VND 405 Trillion Loan Facility with Subsidized Interest Rates to Support Businesses and Individuals Affected by Natural Disasters

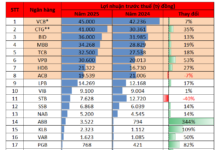

The Governor of the State Bank of Vietnam (SBV) has instructed credit institutions to focus on implementing solutions to support businesses and individuals affected by the recent typhoon. This includes debt restructuring and maintaining the current debt group classification as per existing regulations. The SBV has also directed credit institutions to consider reducing interest rates for those impacted by the storm, demonstrating a commitment to providing relief during challenging times.