Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 587 million shares, equivalent to a value of more than 13.7 trillion VND; HNX-Index reached over 41.3 million shares, equivalent to a value of more than 860 billion VND.

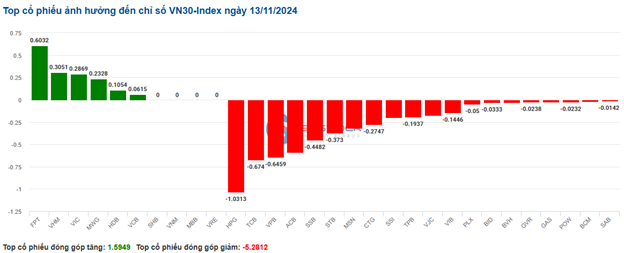

At the beginning of the afternoon session, the VN-Index quickly recovered with the return of buyers, successfully maintaining a positive green color at the end of the session. In terms of impact, VCB, VPB, HVN, and MWG were the codes with the most positive impact on the VN-Index, with an increase of more than 2.1 points. On the contrary, HPG, GVR, BID, and CTG were the codes with the most negative impact, taking away 1.4 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on November 13, 2024 |

On the other hand, the HNX-Index had a rather negative performance, with the index being negatively impacted by PVS (-1.35%), IDC (-0.87%), MBS (-1.05%), and CDN (-5.03%)…

|

Source: VietstockFinance

|

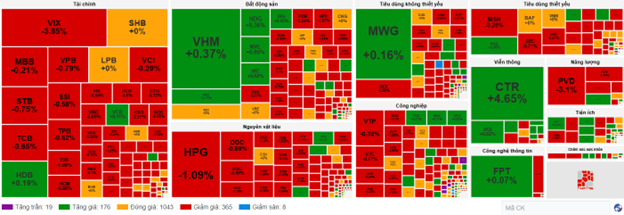

The telecommunications industry was the group with the strongest increase, up 0.96%, mainly contributed by VGI (+0.82%), FOX (+1.47%), CTR (+5.34%), and ELC (+2.48%). This was followed by the information technology industry and the real estate industry, with increases of 0.72% and 0.32%, respectively. On the contrary, the energy industry had the largest decrease in the market, down 1.97%, mainly due to BSR (-2.9%), PVS (-1.35%), PVD (-1.65%), and PVC (-2.61%).

In terms of foreign trading, they continued to net sell more than 193 billion VND on the HOSE exchange, focusing on SSI (56.7 billion), HPG (45.81 billion), MWG (42.75 billion), and HDB (41.62 billion). On the HNX exchange, foreigners net sold more than 30 billion VND, focusing on IDC (27.55 billion), PVS (7.56 billion), SHS (2.4 billion), and CEO (2.27 billion).

| Foreign trading buying and selling dynamics |

Morning session: Failing to hold the support level of 1,240 points, the VN-Index continued to sink

No notable recovery efforts were observed towards the end of the morning session, as the market fell below the 1,240-point support level and continued to decline. At the midday break, the VN-Index decreased by 0.68%, settling at 1,236.33 points; the HNX-Index dropped by 0.79%, falling to 224.89 points. Selling pressure intensified, resulting in 429 declining stocks and only 188 advancing stocks at the end of the morning session.

The VN-Index‘s matched volume reached over 282 million units in the morning session, equivalent to a value of more than 6.4 trillion VND. The HNX-Index recorded a trading volume of over 17 million units, with a value of over 387 billion VND.

A series of pillar stocks weighed heavily on the overall index, led by HPG, CTG, VPB, and BID, which took away more than 2.5 points from the VN-Index. Meanwhile, on the rising side, VCB, VIC, VHM, and CTR attempted to curb the decline, but their contribution was not significant.

Most industry groups were engulfed in red. Notably, the energy group plunged more than 3%, becoming the worst-performing sector in the morning session. The three largest stocks in the industry by market capitalization, BSR (-2.9%), PVS (-4.05%), and PVD (-4.13%), all experienced heavy selling pressure. Following closely was the materials sector, with numerous stocks declining by over 1%, particularly steel companies, which witnessed negative performance after the Ministry of Industry and Trade decided to terminate and not extend anti-dumping measures on certain cold-rolled stainless steel products. The affected stocks included HPG (-2%), HSG (-1.49%), NKG (-2.59%), TVN (-1.3%), and VGS (-2.05%)…

The financial industry, which accounts for the largest proportion of market capitalization, continued its lackluster performance, making a market recovery challenging. Red dominated the sector, with notable decliners including CTG (-1.3%), TCB (-1.3%), STB (-2.98%), MSB (-1.71%), VPB (-1.57%), TPB (-1.55%), EIB (-1.62%), SSI (-1.56%), HCM (-2.28%), MBS (-2.1%), and FTS (-1.98%)…

On the bright side, the telecommunications and healthcare sectors went against the broader market trend, with standout performances from CTR (+3.89%), VGI (+0.47%), FOX (+0.63%), DHG (+1.17%), PMC (+9.09%), and DAN (+3.74%)…

Foreigners maintained their net selling stance, although the selling intensity eased compared to recent sessions. Net selling value on the HOSE exchange in the morning amounted to over 154 billion VND. No stock experienced excessive selling pressure, and the two codes that witnessed notable net selling were SSI and VIX, with values of nearly 30 billion VND each. On the HNX exchange, foreigners net sold nearly 22 billion VND, focusing their sales on the PVS stock.

10:40 am: Financial stocks continued to weigh on the VN-Index

As sellers gradually gained the upper hand, market sentiment turned pessimistic, causing the major indices to weaken. As of 10:30 am, the VN-Index had slipped by 0.63 points, hovering around 1,244 points. The HNX-Index declined by 0.91 points, trading around 225 points.

Within the VN30 basket, red stocks outnumbered green ones, with only a handful of codes maintaining positive momentum. Specifically, HPG, TCB, VPB, and ACB subtracted 1.03 points, 0.67 points, 0.65 points, and 0.59 points from the index, respectively. Conversely, FPT, VHM, VIC, and MWG witnessed strong buying interest, contributing more than 1.3 points to the VN30-Index.

Source: VietstockFinance

|

The energy group faced intense selling pressure, recording the steepest decline in the market at 1.95%. Within this group, sellers predominantly targeted the industry’s giants, such as BSR, which fell by 1.93%, PVS by 2.16%, PVD by 3.1%, PVC by 0.87%, and PVB by 1.09%.

Following closely, the financial sector encountered robust selling pressure, with red dominating most codes. Specifically, in the securities industry, VIX dropped by 3.37%, SSI by 0.39%, and VND by 0.35%… Meanwhile, in the banking industry, STB fell by 0.75%, TCB by 0.65%, VPB by 0.52%… Only a handful of stocks managed to stay in positive territory, including VCB, which climbed by 0.44%, while LPB, HDB, and SHB remained unchanged…

On the flip side, the telecommunications sector stood out with robust momentum, supported by the gains in VGI (+1.52%), YEG (+1.81%), and ELC (+0.76%).

From a technical perspective, CTR continued its upward trajectory in the morning session of November 13, 2024, forming a candle pattern resembling Marubozu, accompanied by a surge in volume that exceeded the 20-session average. This indicated heightened trading activity among investors. Currently, CTR‘s price is approaching the upper bound of the medium-term Bullish Price Channel, which coincides with the Fibonacci Projection 23.6% level. Moreover, the MACD indicator has generated a buy signal and is positioned above zero, further reinforcing the ongoing recovery trend.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, resulting in over 1,000 stocks trading flat, with sellers slightly gaining the upper hand. There were 365 declining stocks (including 8 at the lower limit) and 176 advancing stocks (including 19 at the upper limit).

Source: VietstockFinance

|

Opening: Cautious start to the session

At the start of the November 13 session, as of 9:30 am, the VN-Index hovered around the reference level, reaching 1,243.55 points. The HNX-Index also edged slightly lower, trading around 226.15 points.

On the afternoon of November 12, as part of the 8th session agenda of the 15th National Assembly, the National Assembly voted to approve the Resolution on the 2025 Socio-Economic Development Plan. The electronic voting results showed that 424 deputies participated in the voting, with 424 votes in favor (accounting for 88.52%).

With the majority of deputies voting in favor, the National Assembly officially passed the Resolution on the 2025 Socio-Economic Development Plan.

Red temporarily prevailed within the VN30 basket, with 20 declining stocks, 4 advancing stocks, and 6 unchanged stocks. Notably, HPG, VJC, and BCM were the worst-performing stocks. Conversely, VCB, BID, and FPT were the top gainers.

The energy sector had the most negative impact on the market in the morning session, as oil and gas stocks continued to sink into the red from the opening bell. Notable decliners included PVD (-1.45%), BSR (-0.48%), PVS (-0.54%), and PVC (-0.87%)…

On the contrary, the telecommunications services sector extended its growth trajectory, led by familiar names from recent sessions, such as VGI (+2%), CTR (+3.13%), YEG (+1.81%), and TVK (+3.09%)…

The Cautious Sentiment: Will It Persist?

The VN-Index retreated amid subdued trading volumes, which remained below the 20-day average. This pullback underscores investors’ cautious sentiment following the previous rally. However, the index remains firmly above the 200-day SMA, indicating that the outlook is not overly pessimistic. As of now, the Stochastic Oscillator has dipped into oversold territory, generating a buy signal. Should the MACD indicator follow suit in upcoming sessions, it would further alleviate near-term risks.

The Upcoming US Election: What’s in Store for the Vietnamese Stock Market?

The Vietnamese stock market has historically shown a positive correlation with the US stock market. With a correlation of 27% in the last month and 76% in the last quarter between the S&P 500 and the VN-Index, the movements in the US stock market are expected to significantly influence the short-term trends of the VN-Index.

The High Stakes of Stock Market Investing: When Businesses Gamble and Lose

Investing in the stock market is a popular alternative to idle cash sitting in banks for many businesses, as they seek to grow their wealth. However, when market conditions turn unfavorable, these same businesses often find themselves burdened with losses amounting to tens or even hundreds of billions of dong.

The Savvy Investor’s Bottom-fishing Expedition

The VN-Index pared losses, forming a Hammer candlestick pattern with above-average volume. This indicates a temporary reprieve from market risk as bottom-fishing funds entered the market, spurring a surge in trading volume. The Stochastic Oscillator, having exited oversold territory, continues to signal a buy. If this signal holds firm in the coming sessions, the short-term outlook may not be as pessimistic.