Market liquidity increased from the previous trading session, with the VN-Index matching volume reaching over 502 million shares, equivalent to a value of more than 12.1 trillion VND. The HNX-Index also saw a volume of over 41.2 million shares, with a value of more than 947 billion VND.

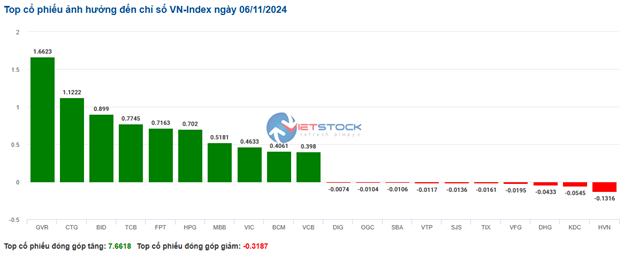

The VN-Index started the afternoon session on a positive note, with buying momentum picking up towards the end of the session, pushing the index into the green. In terms of impact, GVR, CTG, BID, and TCB were the most influential codes on the VN-Index, contributing over 4.4 points to the increase. On the other hand, HVN, KDC, DHG, and VFG had a negative impact but did not significantly affect the index.

Similarly, the HNX-Index also performed quite positively, with the index being positively impacted by IDC (+4.5%), MBS (+3.9%), VCS (+2.95%), and NTP (+3.7%).

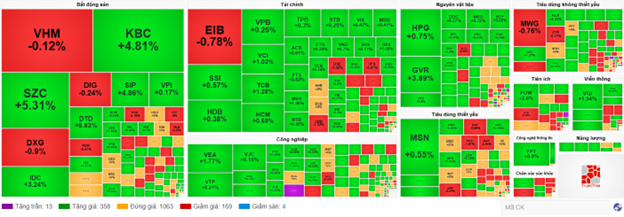

At the close, the market was up 1.25%. The materials sector led the gains with a 2.44% increase, mainly driven by HPG (+1.7%), GVR (+5.14%), VGC (+7%), and DGC (+1.18%). This was followed by the energy and information technology sectors, which rose 1.84% and 1.48%, respectively. In contrast, the healthcare sector saw the biggest decline in the market, falling -0.02%, mainly due to IMP (-0.11%), DHG (-1.35%), VDP (-4.12%), and BBT (-10.34%).

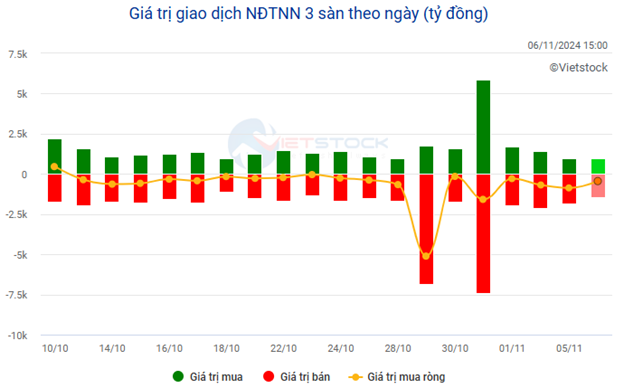

In terms of foreign trading, they continued to sell a net amount of more than 374 billion VND on the HOSE exchange, focusing on VHM (144.45 billion), MSN (131.17 billion), SSI (66.23 billion), and DBC (44.51 billion). On the HNX exchange, foreigners sold a net amount of more than 74 billion VND, mainly in IDC (68.21 billion), PVS (13.36 billion), and MBS (2.23 billion).

Source: VietstockFinance

|

12:00 PM: Money flows into financial stocks, VN-Index maintains its upward momentum

As investor sentiment gradually turns optimistic, the main indices recover positively. Financial and real estate stocks are leading the market’s upward trend.

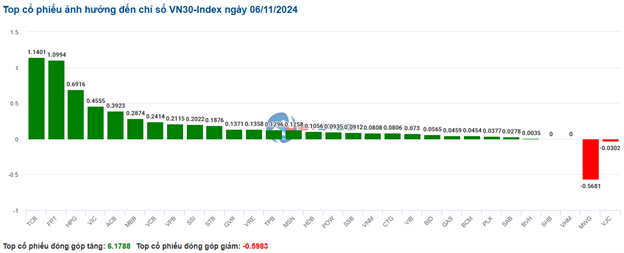

The breadth of the VN30 basket is mostly covered in green, with financial and real estate stocks driving the recovery. Four banking codes, TCB, ACB, MBB, and VCB, contributed 1.14 points, 0.39 points, 0.29 points, and 0.24 points to the index, respectively. On the other hand, MWG and VJC were the only two codes that faced selling pressure, but their impact was not significant.

Source: VietstockFinance

|

Telecommunications stocks are leading the gains, up 1.43%. Specifically, buying momentum is concentrated in VGI, up 1.8%, CTR, up 0.4%, MFS, up 2.68%, and TTN, up 0.65%…

Following closely are financial stocks, with most codes in the sector trading in the green. In the banking group, HDB rose 0.38%, VPB increased 0.25%, TCB gained 1.07%, and STB climbed 0.29%. In the securities group, SSI advanced 0.57%, VCI rose 1.03%, and HCM moved up 0.69%…

Additionally, the real estate sector also witnessed a decent recovery, although some level of differentiation persisted. On the upside, most of the gainers were industrial real estate stocks, such as KBC, up 5%, SZC, up 5.18%, SIP, up 5%, and BCM, up 2.74%… Conversely, residential real estate stocks like VHM, DXG, PDR, and KDH remained in the red, but their declines were not significant.

On the flip side, the healthcare sector exhibited differentiation, with red codes dominating. Specifically, pharmaceutical stocks like DCL, DHG, IMP, and DP3 all posted slight declines of less than 1%. The remaining codes remained unchanged, while four codes managed to stay in the green: DBD, up 1.22%, TNH, up 0.46%, VNY, up 5.66%, and DTG, up 1.68%.

The breadth of the market favored the bulls, with over 350 gainers compared to around 160 losers. At this point, the VN-Index had climbed more than 7.6 points to 1,253 points, while the HNX-Index rose 0.49% to around 225 points, and the UPCOM-Index gained 0.29%.

Total trading volume on the three exchanges surpassed 152 million units, equivalent to over 3.6 trillion VND. However, foreign investors continued to be net sellers, offloading more than 79 billion VND, mainly in VHM, MSN, and HDB.

Source: VietstockFinance

|

Opening: Green from the start

As of 9:30 AM on November 6, the VN-Index opened in positive territory, gaining nearly 7 points to reach 1,252.58 points. Meanwhile, the HNX-Index also edged slightly higher, staying above 225.8 points.

According to APNews, Trump continued his winning streak in Arkansas, Florida, Nebraska, North Dakota, South Dakota, Louisiana, Wyoming, Ohio, and Texas, while Harris secured victories in Delaware, New Jersey, Illinois, and New York. The race tightened, with Trump leading by 78 electoral votes to Harris’s 99.

The VN30 basket witnessed a predominance of green codes, with 4 declining, 25 advancing, and 1 unchanged. Among the decliners, BVH, MWG, VHM, and VJC experienced the sharpest drops. Conversely, GVR, POW, BCM, and TCB were the top gainers.

Telecommunications services stocks stood out at the beginning of the morning session, with several codes trading in the green from the start, including VGI, up 2.08%, CTR, up 0.88%, and YEG, up 0.97%…

Additionally, materials stocks significantly contributed to the market’s performance this morning. Notable gainers in the sector included HPG, up 0.57%, GVR, up 1.4%, NKG, up 0.48%, BMP, up 1.38%, and VGC, climbing 1%…

The Market Beat: Foreigners Continue Their Selling Spree

At the end of the trading session, the VN-Index climbed 1.22 points (0.1%) to reach 1,246.04, while the HNX-Index dipped 0.48 points (0.21%), settling at 226.21. The market breadth tilted towards decliners, with 358 stocks falling versus 311 gainers. The VN30 basket, however, painted a greener picture, as 15 constituents rose, 11 fell, and 4 remained unchanged, tipping the scale in favor of the bulls.

The Ultimate Headline:

“Vietstock Weekly: Navigating the Short-Term Risks”

The VN-Index witnessed a significant drop, plunging by over 33 points, accompanied by the emergence of a bearish Black Marubozu candlestick pattern. Adding to the gloom, the index sliced below the SMA 200-week support, indicating a decidedly negative investor sentiment. Furthermore, the MACD and Stochastic Oscillator indicators continue their southward journey, reinforcing the sell signal and painting a picture of a short-term outlook that remains devoid of optimism.

The Market Beat: VN-Index’s Unique Path

As global stock markets rally, Vietnam’s story takes a different turn as it finds itself among the few to witness a decline.

The Cautious Sentiment: Will It Persist?

The VN-Index retreated amid subdued trading volumes, which remained below the 20-day average. This pullback underscores investors’ cautious sentiment following the previous rally. However, the index remains firmly above the 200-day SMA, indicating that the outlook is not overly pessimistic. As of now, the Stochastic Oscillator has dipped into oversold territory, generating a buy signal. Should the MACD indicator follow suit in upcoming sessions, it would further alleviate near-term risks.

The Upcoming US Election: What’s in Store for the Vietnamese Stock Market?

The Vietnamese stock market has historically shown a positive correlation with the US stock market. With a correlation of 27% in the last month and 76% in the last quarter between the S&P 500 and the VN-Index, the movements in the US stock market are expected to significantly influence the short-term trends of the VN-Index.