The trading session on November 7th concluded with significant fluctuations, as Vietnam’s major stock indices witnessed a decline. The VN-Index dropped by 1.53 points to 1,259.75, despite maintaining a green hue for most of the session; the HNX-Index fell by 0.27 points to 227.49, and the UPCoM-Index lost 0.42 points, ending at 92.29. Market liquidity, which started off quite vigorously, gradually weakened in the afternoon session, finishing with over 13,811 billion VND, a lower result compared to the previous day.

It is evident that the core sectors, including banking, securities, and real estate, experienced a downturn in the afternoon session after an encouraging morning session.

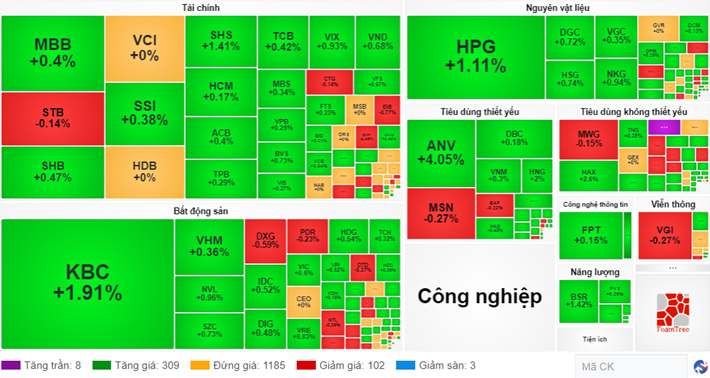

Examining the market map based on transaction value, the red hue dominated the large areas of the banking sector, with MBB, VPB, HDB, TCB, and CTG being notable examples. In the securities sector, stocks such as VCI, SSI, VIX, and HCM witnessed similar trends, while many real estate stocks returned to the reference level or even turned red, including VHM and KBC.

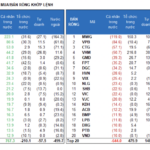

Foreign investors marked their 20th consecutive net selling session, with today’s scale reaching nearly 422 billion VND. The strong net selling focused on VHM, with more than 103 billion VND, followed by MSN with nearly 90 billion VND, and CMG with over 66 billion VND. On the buying side, the purchasing power was distributed relatively evenly across various stocks but was generally insufficient to create a balance.

| Foreign investors have had 20 net selling sessions |

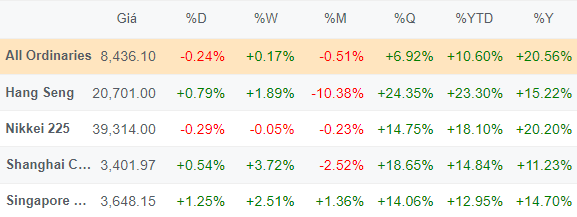

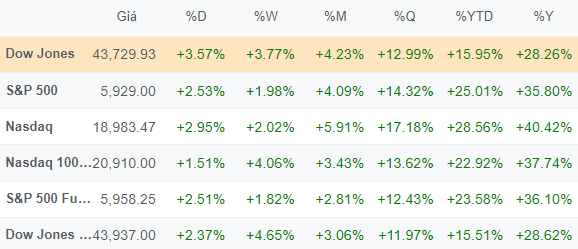

Vietnam’s stock market was among the few declining markets today. Looking at Asia, it is easy to spot numerous indices in the green, such as the Hang Seng, which rose by 2.08%, the Shanghai Composite by 2.55%, and the Singapore Straits Times by 1.8%. The Nikkei 225 was among the few indices that declined. Overall, Asian stock markets gained 0.3%. Additionally, on the other side of the globe, the major US stock indices, including the Dow Jones, S&P 500, and Nasdaq, all reached new historical highs.

|

|

|

Source: VietstockFinance

|

14:10: Continuing fluctuations

Following the fluctuations of the morning session, the afternoon session began with a pull-up to the region of 1,265 points but quickly reversed to a decline around 1,262 points. The market breadth became more balanced, with 343 stocks rising, 338 falling, and 935 remaining unchanged.

Amidst the lack of significant fluctuations in the sectors, considering the stocks that positively impacted the VN-Index, VCB took the lead, contributing almost 1.1 points, followed by HVN with nearly 0.4 points and GAS with over 0.3 points. On the opposite side, GVR was the stock that took away the most points, with more than 0.5 points.

Contrary to the improved liquidity compared to the previous session, foreign investors were trading less, with a purchasing value of nearly 917 billion VND and a selling value of over 1,318 billion VND, resulting in a net sell of over 400 billion VND, likely leading to another net selling session.

Morning session: Green hues weaken, “Viettel” family leaves an impression

Concluding the morning session, Vietnam’s main stock indices mostly gained points despite facing significant pressure in the latter half, with the VN-Index rising by 1.62 points to 1,262.9 and the HNX-Index climbing by 0.25 points to 228.01. Meanwhile, the UPCoM-Index decreased by 0.28 points to 92.42.

|

Market performance of the main stock indices

Source: VietstockFinance

|

Overall, the market started the morning session on a positive note, with many banking, real estate, and securities stocks surging, only to weaken later as these stocks narrowed their gains or even turned red.

The most noticeable shift occurred in the banking and securities sectors. From being predominantly green in the first half of the morning session, many stocks quickly returned to the reference level, such as MBB, SHB, VIB, LPB, OCB, MSB, SSI, and MBS, or turned red, including HDB, VPB, CTG, TPB, EIB, BID, VCI, and FTS. The remaining green hues were not very prominent, and only slight increases were observed.

In the real estate sector, although the gains narrowed, many stocks still posted impressive increases, notably NVL rising by 4.33%, PDR by 3.29%, CEO by 1.97%, DIG by 1.9%, and HDC by 1.74%…

The “Viettel” family of stocks attracted much attention in the morning session, with VGI surging by 7.79%, VTK by 5.28%, CTR by 2.48%, and VTP by 6.07%, even touching the ceiling price at one point. Amid the wave of cross-border trade, VTP recently drew interest by investing in a Logistics Park project at the gateway to China.

Market liquidity improved significantly compared to the previous session, with a trading volume of over 309.5 million shares, corresponding to a value of over 7,454.3 billion VND.

Foreign investors net sold over 265 billion VND in the morning session, with VHM standing out with nearly 55 billion VND, followed by DBC and CMG with more than 31 billion VND each. On the buying side, bank and real estate stocks shared the leading positions, including STB, DXG, and TCB, with values around 20 billion VND.

10:30: VN-Index maintains its green hue, many stocks hit the ceiling price

The positive momentum continued into the morning session, with the VN-Index temporarily climbing by 4.71 points to the 1,266 level, led by the real estate, banking, securities, steel, information technology, and construction sectors. FPT contributed nearly 1 point, and VCB added almost 0.7 points.

|

The green hue persists on the VN-Index

Source: VietstockFinance

|

The real estate group of stocks attracted the most attention in the market, with many commercial real estate stocks witnessing strong increases, such as NVL surging by 5.29%, PDR by 3.52%, CEO by 2.63%, DIG by 2.61%, and DXG by 2.07%… Industrial park stocks also continued their positive trends from the previous day, with KBC rising by 1.91%, SZC by 0.73%, and IDC by 0.52%…

The market witnessed a strong uptrend, with 14 stocks hitting the ceiling price, notably VTP, CIG, and TTF.

Regarding VTP, the stock hit the ceiling price with a current buying queue of over 450,000 shares, following the news of “Viettel”‘s investment in a Logistics Park project in Lang Son, a gateway to China.

Opening: Full of enthusiasm and green hues

Asian stock markets opened mostly in the green, and overnight, the major US stock indices simultaneously reached new historical highs after Donald Trump’s victory in the 2024 US Presidential election. With these developments, Vietnam’s stock market is opening with enthusiasm.

Vietnam’s stock market started with a widespread green hue. By 9:25 am, the VN-Index had climbed by 3.34 points to 1,264.62, the HNX-Index increased by 0.7 points to 228.46, and the UPCoM-Index rose slightly by 0.01 points to 92.72. Market liquidity improved compared to the same period yesterday, with a trading volume of over 53.8 million shares, corresponding to a value of over 1,125.4 billion VND.

Out of 24 sectors (according to VS-SECTOR), 18 sectors witnessed an increase, led by transportation, up by 1.2%, consumer services, up by 1.15%, and energy, up by 1%.

Although the real estate sector only rose by 0.32%, its impact on the market was significant. Stocks of industrial park real estate continued to attract attention, with KBC climbing by 1.91%, SZC by 0.73%, and IDC by 0.52%… Commercial real estate stocks also exhibited positive trends, with VHM rising by 0.36%, VIC by 0.6%, and NVL by 0.96%…

Additionally, many stocks from sectors with significant capitalization, such as banking, securities, steel, and chemicals, also witnessed increases.

|

Green hues spread early in Vietnam’s stock market

Source: VietstockFinance

|

Turning to Asian markets, the opening session also witnessed an uptrend in many indices, notably the Hang Seng, which rose by 0.79% to 20,701 points, Shanghai by 0.54% to 3,401.97 points, and Singapore Straits Times by 1.25% to 3,648.15 points, while the Nikkei 225 was among the few declining indices.

|

Asian markets mostly opened positively

Source: VietstockFinance

|

Overnight, US stocks surged, with major indices reaching new record highs, as Donald Trump emerged victorious in the 2024 US Presidential election.

At the close of the trading session on November 6th, the Dow Jones soared by 1,508.05 points, reaching a record high of 43,729.93 points. The S&P 500 also climbed and achieved an all-time high of 5,929.04 points, while the Nasdaq Composite mirrored this trend, scaling to a new peak of 18,983.47 points.

Tesla, a company with CEO Elon Musk, a prominent supporter of Trump, witnessed a more than 14% jump in its stock price. Bank stocks also received a boost, with JPMorgan Chase’s shares rising by 11.5% and Wells Fargo’s shares surging by 13%. Shares of Trump Media & Technology Group, a social media company closely associated with Trump, rose by 5.9% after a volatile trading session.

|

US stock indices simultaneously reached new highs

Source: VietstockFinance

|

The Cautious Sentiment: Will It Persist?

The VN-Index retreated amid subdued trading volumes, which remained below the 20-day average. This pullback underscores investors’ cautious sentiment following the previous rally. However, the index remains firmly above the 200-day SMA, indicating that the outlook is not overly pessimistic. As of now, the Stochastic Oscillator has dipped into oversold territory, generating a buy signal. Should the MACD indicator follow suit in upcoming sessions, it would further alleviate near-term risks.

The Upcoming US Election: What’s in Store for the Vietnamese Stock Market?

The Vietnamese stock market has historically shown a positive correlation with the US stock market. With a correlation of 27% in the last month and 76% in the last quarter between the S&P 500 and the VN-Index, the movements in the US stock market are expected to significantly influence the short-term trends of the VN-Index.

The Savvy Investor’s Bottom-fishing Expedition

The VN-Index pared losses, forming a Hammer candlestick pattern with above-average volume. This indicates a temporary reprieve from market risk as bottom-fishing funds entered the market, spurring a surge in trading volume. The Stochastic Oscillator, having exited oversold territory, continues to signal a buy. If this signal holds firm in the coming sessions, the short-term outlook may not be as pessimistic.