|

Mr. Dau Minh Thanh receiving his appointment decision.

Source: Ministry of Construction |

Speaking at the conference to announce the decision to appoint the Chairman of the HUD Members’ Council, Minister Nguyen Thanh Nghi appreciated Mr. Dau Minh Thanh’s extensive experience in enterprise leadership and in leading functional units under the Ministry of Construction. Therefore, being appointed as the Chairman of the HUD Members’ Council is both an honor and a great responsibility for Mr. Dau Minh Thanh.

The Minister requested that Mr. Dau Minh Thanh continue to promote his experience and strengths to contribute to the development of HUD, making it even stronger and more influential within the Ministry of Construction, as well as in the construction industry and the country as a whole.

Thus, Mr. Dau Minh Thanh will replace Mr. Nguyen Viet Hung, who has been the Chairman of the HUD Members’ Council since 2018 and was recently appointed as the Vice Minister of Construction on September 11th.

HUD is a state-owned enterprise under the Ministry of Construction, mainly focusing on investing in the development of new urban areas and housing, as well as real estate business. According to the semi-annual audited financial statements for 2024, HUD is in the process of preparing for equitization, with one of the prerequisites being the rearrangement and handling of houses and land in accordance with the government’s decrees issued in 2017 and 2021.

Also related to divestment, in mid-October, HUD leaders agreed to choose Vietnam Industrial and Commercial Bank Securities Joint Stock Company (HOSE: CTS) as the consulting unit to formulate a plan for the transfer of capital from several member companies, including Investment and Development of Housing and Urban Areas HUD8 (UPCoM: HD8), Investment and Development of Housing and Urban Areas HUD Saigon (HUD9), Urban Development and Construction Joint Stock Company (VINAUIC), and Saigon – Rach Gia Joint Stock Company. HUD currently holds 51%, 54.8%, 52.8%, and 20.89% of these companies, respectively.

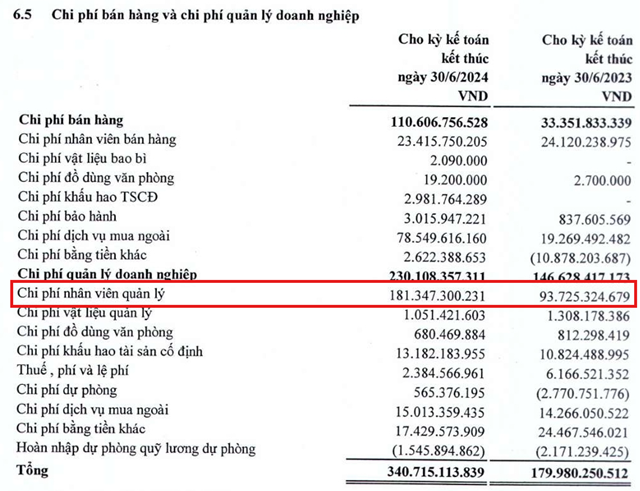

Management staff costs doubled over the same period last year

The consolidated financial statements for the first six months of 2024 of HUD continue to receive a qualified opinion from the independent auditing firm CPA Vietnam, mainly due to some subsidiary companies not assessing the recoverability of certain items on their financial statements.

Nevertheless, the results for the first half of this year are very positive for the enterprise under the Ministry of Construction, with revenue from sales of goods and services reaching nearly VND 1,800 billion, double that of the same period in 2023. Of this, revenue from real estate sales reached nearly VND 1,500 billion, 2.7 times higher than the previous year.

Despite the increase in costs, HUD‘s net profit still increased by 166%, reaching VND 130 billion. Notably, management staff costs exceeded VND 181 billion, double that of the first half of last year.

In 2024, the Ministry of Construction set a target for HUD‘s revenue and other income to reach approximately VND 1,850 billion, with a pre-tax profit of VND 260 billion. Of this, VND 350 billion is expected to be contributed to the state budget. The key projects with large investment plans for this year include the Eco-Urban Area project in Chanh My, Binh Duong province (VND 228 billion); the Thanh Lam – Dai Thinh 2 new urban area project in Hanoi (VND 200 billion); and the HUD – Son Tay new urban area project in Hanoi (VND 128 billion).

|

Source: HUD

|

By the end of the second quarter, HUD accounted for more than VND 15,100 billion in assets, with 80% being short-term assets. Inventories at the end of the period reached VND 9,500 billion, an increase of nearly VND 1,500 billion compared to the beginning of the year. The long-term unfinished asset portfolio is mainly comprised of the HUDTOWER office building project at 37 Le Van Luong, with a value of VND 595 billion. HUD is also in possession of VND 190 billion in advance payments from Tasco Joint Stock Company (HNX: HUT).

Payables stood at VND 11,400 billion, with a significant increase in taxes and other payables to the State, amounting to more than VND 1,500 billion. This is mainly due to land use taxes and land rent. Provisional profit for the period to be submitted to the state budget in 2023 increased by more than VND 52 billion.

At the end of June, HUD still held the bond lot HUDH2025001 with a value of VND 700 billion (par value). This bond was issued by the Company in December 2020 to raise VND 1,000 billion, with an initial interest rate of 10.5%/year and is expected to mature at the end of 2025. The report on the use of capital in the first six months shows that HUD has disbursed VND 500 billion for projects and programs, and of the remaining half of the planned amount for business capital supplementation, VND 400 billion has been spent.

HUD’s revenue and profit decreased in 2023, continuing the process of equitization

“Techcombank Offers 15% Equity Stake: Seeking Strategic Partnership in Tech”

Vietnam Technological and Commercial Joint Stock Bank (Techcombank, HOSE: TCB) is gearing up to welcome a new strategic partner on board by considering the sale of a 15% stake, as per an update from CEO Jens Lottner.