Rubber is one of the top export commodities for Vietnam, bringing significant value to the country. The Vietnamese rubber industry ranks 5th in terms of area and 3rd in natural rubber production worldwide.

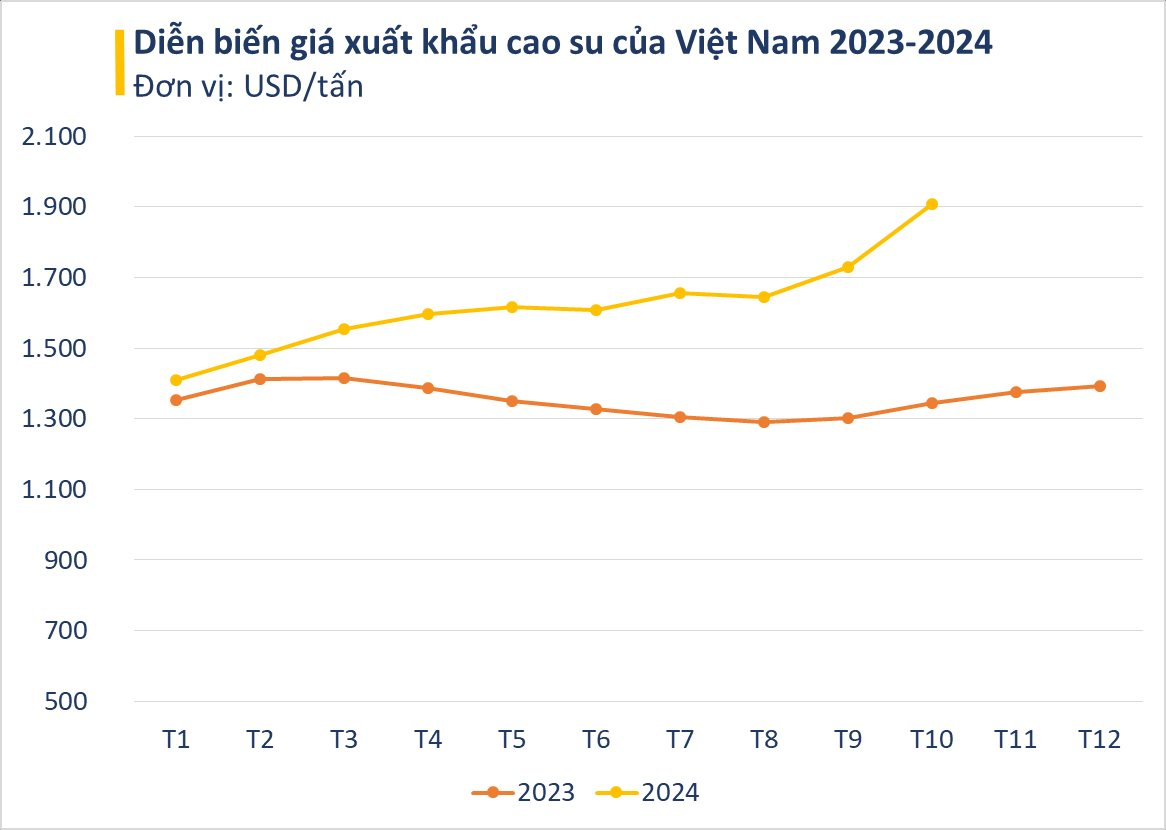

According to statistics from the General Department of Vietnam Customs, in October 2024, Vietnam’s rubber exports reached 224,950 tons, valued at $429.01 million. Compared to October 2023, this marked a 3% increase in volume and a significant 46% surge in value. This was the second consecutive month of growth in rubber exports compared to the same period in 2023. The average export price of rubber reached $1,907 per ton, a 41.7% increase from the previous year.

In the first ten months of 2024, rubber exports reached 1.54 million tons, valued at over $2.52 billion. While there was a slight decrease of 4.9% in volume, the export value increased by 16.4% compared to the same period in 2023. The average export price of rubber was $1,638 per ton, a notable 22.4% increase from the previous year.

In the first ten months of 2024, China remained Vietnam’s largest rubber export market, accounting for 78.7% of the country’s total rubber exports. This amounted to 1.06 million tons of rubber, valued at $1.7 billion. While there was a 16.8% decrease in volume, the export value increased by 1.5% compared to the same period in 2023.

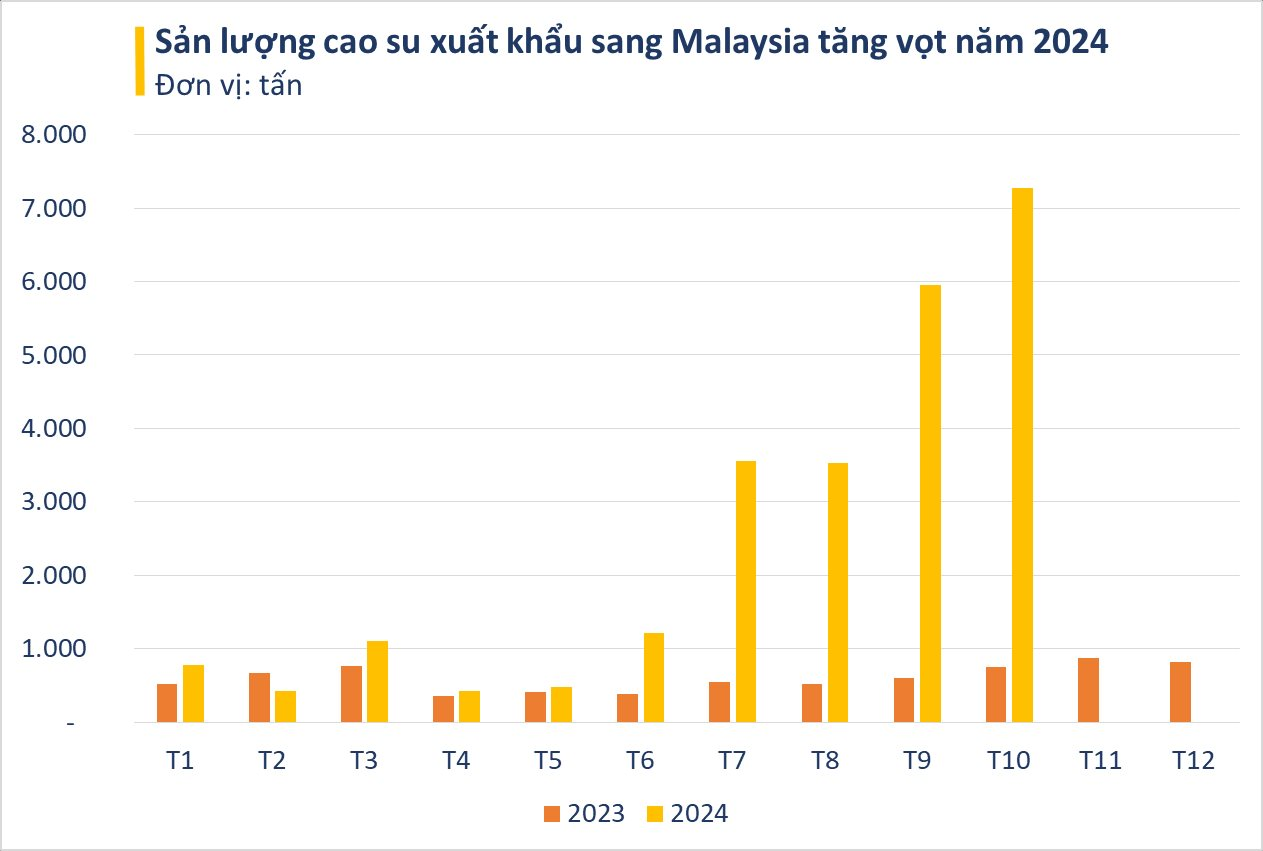

The statistics reveal a significant shift in rubber export markets during this period. While exports to China, South Korea, the Netherlands, and Argentina decreased compared to 2023, significant increases were recorded in markets such as India, the United States, Germany, and Taiwan. Notably, Malaysia has emerged as a key player in this shift.

Specifically, in October, Vietnam exported 7,260 tons of rubber to Malaysia, valued at $11.47 million. This marked a substantial increase of 22.2% in volume and 47.8% in value compared to September 2024. Even more impressively, when compared to October 2023, the volume increased by 861%, and the value surged by 1,240%. This was the month with the highest production volume and revenue since the beginning of the year.

From the beginning of the year until now, Malaysia has spent $35.17 million on importing 24,800 tons of rubber from Vietnam, reflecting a remarkable 349% increase in volume and a 405% surge in value compared to the same period in 2023. As a result, Malaysia has become the second-largest importer of Vietnamese rubber in terms of volume and the third-largest in terms of value.

According to the Vietnam Rubber Association (VRA), Vietnam has approximately 930,000 hectares of rubber plantations, producing 1.3 million tons of rubber per year. Despite a significant decrease in Vietnam’s rubber export volume this year, the export value has increased due to high export prices. With these results, the rubber export turnover for Vietnam in 2024 is expected to reach $3-3.5 billion, an increase of $200-400 million compared to 2023.

Since the beginning of November 2024, rubber prices on Asian exchanges have slightly increased compared to the previous month’s end. The market is supported by optimistic economic prospects in China and anticipated tariff policies from the newly elected US administration, which have boosted the upward trend.

However, the rise in rubber prices is somewhat limited due to the EU’s decision to impose tariffs on Chinese electric vehicles. This move follows similar actions by the US and Canada, which imposed a 100% tax on certain Chinese electric vehicle models. Consequently, this may impact China’s automotive sales and production, including the use of rubber in tire manufacturing.

As China is currently Vietnam’s largest rubber export partner, any fluctuations in this market significantly impact Vietnam’s rubber industry.

“Gold’s Turbulent Week: Market Update for November 16th”

Oil prices fell more than 2% on November 15 as weak Chinese data stoked demand concerns, while gold posted its biggest weekly fall in three years and aluminum surged after China scrapped export rebates.

The Billion-Dollar Product from Vietnam: A Global Frenzy with Prices Soaring to a 2-Year High, China as its Top Patron

The export price of this commodity hit a 2-year high as of June 2022. This marks a significant peak, with prices soaring to levels not seen since 2020. This news is sure to capture the attention of investors and economists alike, as it indicates a potential shift in the market and could have far-reaching implications for the global economy. With such a dramatic rise, the question now is whether this upward trend will continue or if a correction is on the horizon.