I. MARKET ANALYSIS OF STOCKS ON 06/11/2024

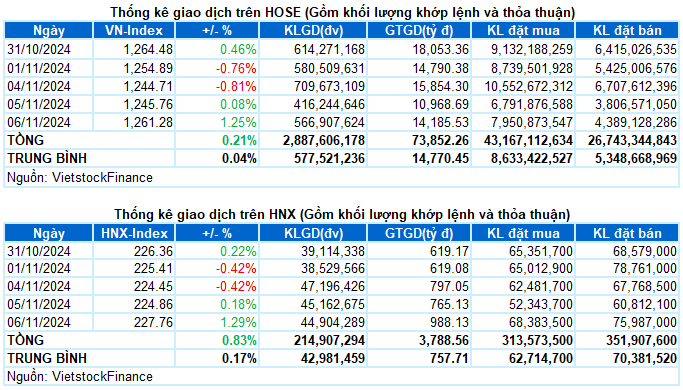

– The main indices turned green during the trading session on November 6th. The VN-Index closed 1.25% higher at 1,261.28 points, while the HNX-Index reached 227.76 points, a 1.29% increase compared to the previous session.

– The matching volume on the HOSE reached nearly 503 million units, a 51.1% increase from the previous session. The matching volume on the HNX also increased by 54.5%, surpassing 41 million units.

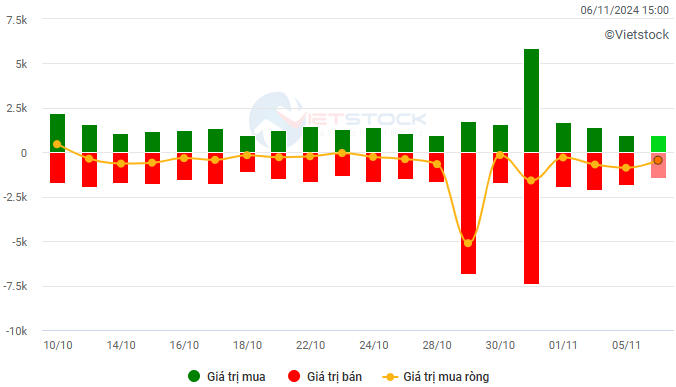

– Foreign investors continued to net sell on the HOSE with a net value of nearly VND 375 billion and net sold more than VND 74 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

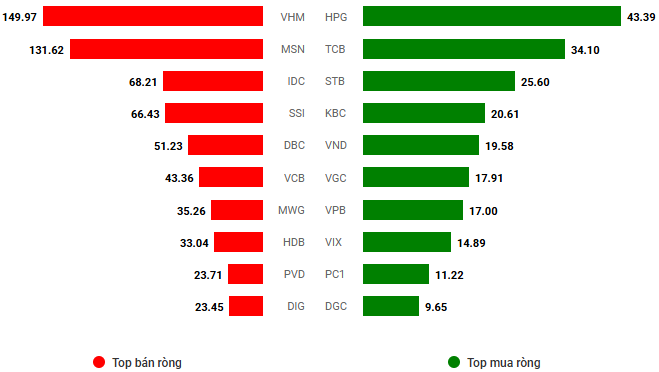

Net trading value by stock code. Unit: VND billion

– Investor sentiment turned more optimistic as the results of the US presidential election became clearer. Active buying demand appeared from the beginning of the session, with green spreading across the market, and this positive momentum was maintained until the end of the trading day. Liquidity also improved significantly compared to the previous session’s low volume, although it was still below the 20-session average. The VN-Index closed on November 6th at 1,261.28 points, a 15.52-point gain.

– In terms of impact, the top 10 stocks contributed more than 7.6 points to the VN-Index’s gain, led by GVR (1.66 points), CTG (1.22 points), and BID (0.9 points). In contrast, the top 10 stocks with the most negative influence took away less than half a point from the index, indicating a dominant buying sentiment.

– The VN30-Index closed 16.21 points or 1.23% higher at 1,329.56 points. The market breadth was overwhelmingly positive, with 29 gainers and only 1 stock standing at the reference price. GVR continued to shine, leading the gainers with a notable 5.1% increase. It was followed by BCM, CTG, TPB, and POW, which rose over 2%. The only stock that failed to advance was MWG, which closed at its opening price.

Most sectors were painted green, with the materials sector leading the pack, up 2.44%. Standout stocks in this sector included GVR (+5.14%), HPG (+1.7%), HSG (+1.75%), DCM (+2.48%), DPM (+1.49%), DGC (+1.18%), BMP (+1.38%), VCS (+2.95%), PHR (+3.67%), and VGC, which hit the upper limit.

Today’s highlight was the industrial real estate sector, which attracted strong cash flow from the beginning of the session. Many stocks in this sector witnessed strong breakouts, such as KBC, SIP, and SZC, which hit their ceiling prices, while BCM (+2.43%), IDC (+4.5%), LHG (+5.2%), NTC (+1.81%), and TIP (+5.77%) also posted significant gains. Additionally, several other real estate stocks rose over 1%, including VRE, VIC, KDH, NLG, TCH, CEO, IJC, and HDC, among others.

The financial sector also made a significant contribution to today’s strong performance. Notable performers in this sector included BID (+1.37%), CTG (+2.43%), TCB (+1.92%), MBB (+1.64%), STB (+1.87%), ACB (+1.41%), HDB (+1.34%), TPB (+2.42%), VCI (+2.49%), VND (+2.44%), and HCM (+1.73%), to name a few.

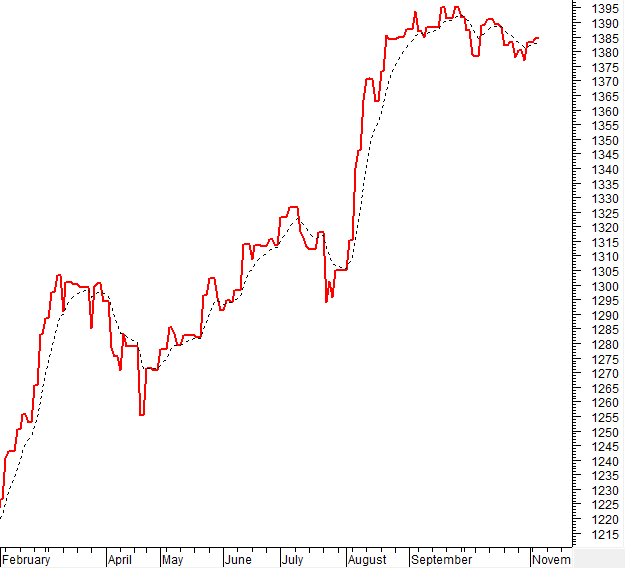

The VN-Index witnessed a strong rebound and broke above the SMA 200-day moving average. However, to reinforce the sustainability of this uptrend, the trading volume needs to surpass the 20-day average. At present, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If the MACD indicator also provides a similar signal in the upcoming sessions, the short-term outlook will become even more optimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator Indicates a Buy Signal in the Oversold Region

The VN-Index witnessed a strong rebound and broke above the SMA 200-day moving average. However, for this uptrend to be sustained, the trading volume needs to surpass the 20-day average.

Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If the MACD indicator also provides a similar signal in the upcoming sessions, the short-term outlook will turn even more optimistic.

HNX-Index – Formation of a White Marubozu Candlestick Pattern

The HNX-Index witnessed a strong surge, forming a White Marubozu candlestick pattern and breaking above the Middle line of the Bollinger Bands. Additionally, the trading volume surpassed the 20-day average, reflecting the optimism among investors.

At present, both the Stochastic Oscillator and MACD indicators are providing buy signals. If this momentum is maintained in the upcoming sessions, the outlook will become even more positive.

Money Flow Analysis

Movement of Smart Money: The Negative Volume Index indicator of the VN-Index has crossed above the EMA 20-day moving average. If this trend persists in the next session, the risk of a sudden downward thrust will be mitigated.

Foreign Capital Flow: Foreign investors continued to net sell during the trading session on November 6, 2024. If this sentiment persists in the upcoming sessions, the market sentiment may turn less optimistic.

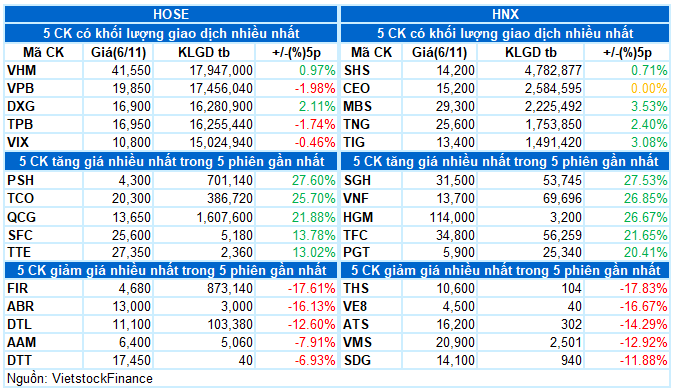

III. MARKET STATISTICS ON 06/11/2024

Economic and Market Strategy Division, Vietstock Consulting

The Cautious Sentiment Rises

The VN-Index staged a mild recovery, with a slight uptick in the session, but this was accompanied by a significant plunge in trading volume, falling below the 20-day average. This indicates that investor sentiment remains cautious following the recent downturn. The Stochastic Oscillator and MACD indicators continue to trend downward after issuing sell signals, suggesting that the short-term outlook remains bearish.

The Gloomy Sentiment Subsides

The VN-Index edged higher and rebounded after a recent streak of losses. Accompanying this rebound was a trading volume that surpassed the 20-day average, reflecting a relatively optimistic sentiment among investors. However, the Stochastic Oscillator has signaled a resumption of selling, and the MACD indicator is conveying a similar message. This suggests that the short-term outlook remains pessimistic.

The Beat of the Market: Investors Sell-Off with a Wave of Pessimism

The market closed with the VN-Index down 13.32 points (1.08%), settling at 1,218.57; the HNX-Index also ended below the reference level at 221.53 points. The market breadth tilted towards sellers, with 546 declining stocks against 193 advancing ones. The VN30-Index basket was mostly red, recording 26 losses, 3 gains, and 1 stock referencing.