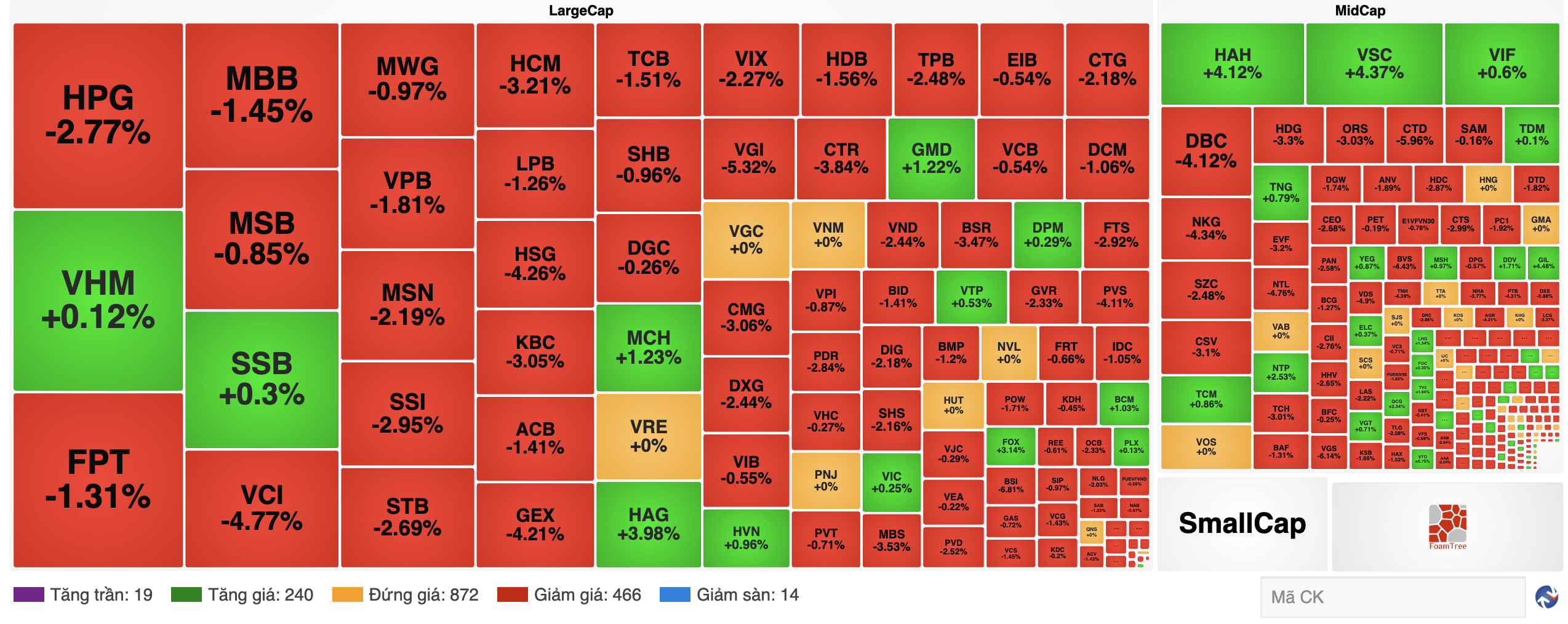

The VN-Index ended the trading session 14.15 points lower (equivalent to a 1.14% decrease) at 1,231.89 points – the lowest since August 16, 2024. A similar trend was observed on the Hanoi Stock Exchange as the HNX index fell by over 1% to 223.82 points.

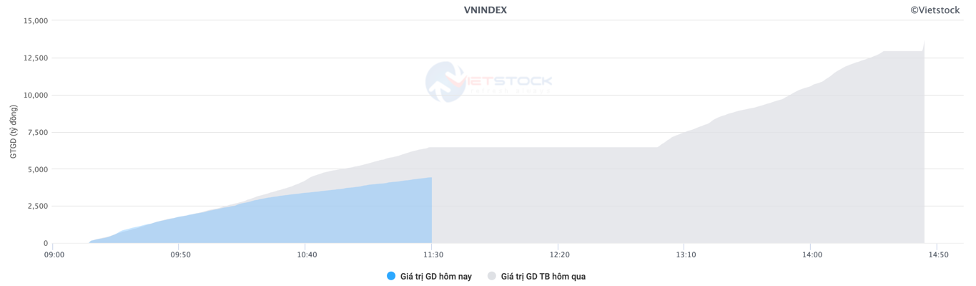

Notably, market liquidity remained low, with a total trading value of nearly VND 18,400 billion on all three exchanges, indicating that investors were not rushing to “bottom fish” despite the market’s deep decline.

The pressure on the market came mainly from the exchange rate movements as the State Bank adjusted the central exchange rate to 24,288 VND/USD – the highest in history as of the latest update.

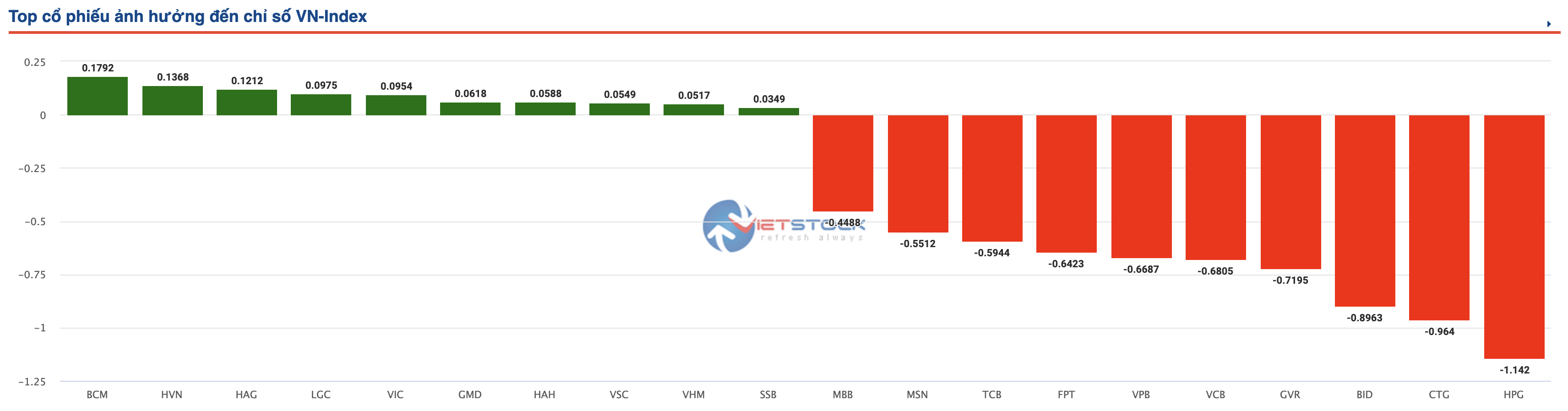

In this session, bank stocks had the most significant impact on the index, with six representatives in the top 10 stocks negatively affecting the VN-Index, including CTG, BID, VCB, VPB, TCB, and MBB.

The “steel king,” HPG, also contributed to the downward trend, plunging nearly 3% and causing the VN-Index to lose more than one point. Securities stocks also tumbled, with SSI falling nearly 3%, VCI down by almost 5%, while MBS and HCM both lost over 3%.

On a positive note, BCM, HVN, and HAG were the three stocks that had the most positive impact on the VN-Index.

Source: VietstockFinance

|

A concerning development was the net selling trend maintained by foreign investors for over 12 consecutive sessions, with a net sell value of more than VND 760 billion in this session. Looking further ahead, foreign investors have been “aggressively” selling Vietnamese stocks since the beginning of October 2024.

| Trading Value of Foreign Investors on the 3 Exchanges |

11:40 AM: Bank stocks continue to weigh down the VN-Index

The market witnessed a tug-of-war between buyers and sellers amid low liquidity. The “king” stocks continued to exert pressure, making it challenging for the overall index to break through. The VN-Index paused at 1,242.74 points (-0.26%) at midday, while the HNX-Index lost 0.37% to reach 225.39 points. The market breadth was negative, with 327 declining stocks versus 253 advancing ones.

The cautious sentiment from the previous session’s sell-off persisted, resulting in even lower liquidity compared to the previous morning. The matched volume on the VN-Index reached over 161 million units, equivalent to a value of approximately VND 4.3 trillion in the morning session. On the HNX-Index, the matched volume was over 15 million units, with a value of more than VND 310 billion.

Source: VietstockFinance

|

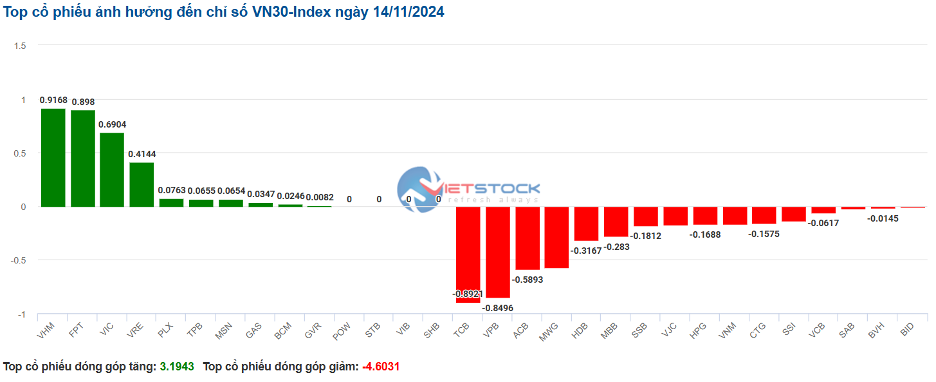

Among the top 10 stocks with the most negative influence, eight were from the banking sector, led by VPB, VCB, and TCB, which collectively dragged down the VN-Index by around 1.5 points. In contrast, VHM, VIC, and GAS acted as pillars, contributing over one point to the index’s gains.

When analyzing sector performance, energy continued to lag, with large-cap stocks in the industry facing substantial selling pressure, including BSR (-1.98%), PVS (-2.47%), and PVD (-0.84%). Following closely was the financial sector, which saw red across most stocks, although the declines were mostly below 1%. However, due to their high market capitalization, these stocks significantly impacted the market indices. Notable losers included VCB (-0.43%), CTG (-0.44%), BID (-0.43%), TCB (-0.86%), VPB (-1.55%), MBB (-0.62%), and others…

On the flip side, the real estate sector shone, led by the Vingroup trio: VHM (+1.24%), VIC (+0.99%), and VRE (+1.93%). The consumer staples sector also witnessed positive momentum, with several stocks attracting strong buying interest, such as MCH (+2.09%), VHC (+1.08%), FMC (+1.43%), MPC (+0.64%), and others…

Foreign investors maintained their net selling stance, with a net sell value of over VND 344 billion on the HOSE in the morning session. Notably, FPT was net sold for more than VND 92 billion. On the buying side, no particular standout emerged, with VRE and HAH leading the net purchases, but the values were not significant. On the HNX exchange, foreign investors net sold over VND 27 billion, with PVS being the most heavily sold stock.

10:30 AM: Investors exhibit a cautious stance

Market participants displayed a cautious attitude, resulting in a tug-of-war between bulls and bears around the reference levels. As of 10:30 AM, the VN-Index edged down 0.16 points to hover around 1,246 points, while the HNX-Index climbed slightly by 0.46 points to trade around 226.5 points.

The breadth of the VN30-Index basket indicated a slight dominance of declining stocks. Specifically, on the positive side, VHM added 0.92 points, FPT contributed 0.90 points, VIC gained 0.69 points, and VRE rose by 0.41 points. Conversely, stocks like TCB, VPB, ACB, and MWG dragged down the index by nearly three points.

Source: VietstockFinance

|

The consumer staples sector exhibited a mixed performance, but the number of stocks maintaining their upward momentum prevailed. On the buying side, MCH (+1.86%), HAG (+0.88%), VHC (+1.22%), and ANV (+0.54%) led the gains. Meanwhile, stocks like VNM, DBC, SAB, and PAN faced selling pressure but did not witness significant declines.

Next, the real estate sector maintained its solid performance from the start of the session, driven by stocks such as VHM (+1.36%), VRE (+2.21%), DXS (+1.33%), BCM (+0.88%), VIC (+1.35%), and others…

In contrast, the financial sector underperformed, with leading stocks in the industry facing selling pressure. These included VCB (-0.11%), CTG (-0.73%), TCB (-0.86%), BID (-0.11%), and others…

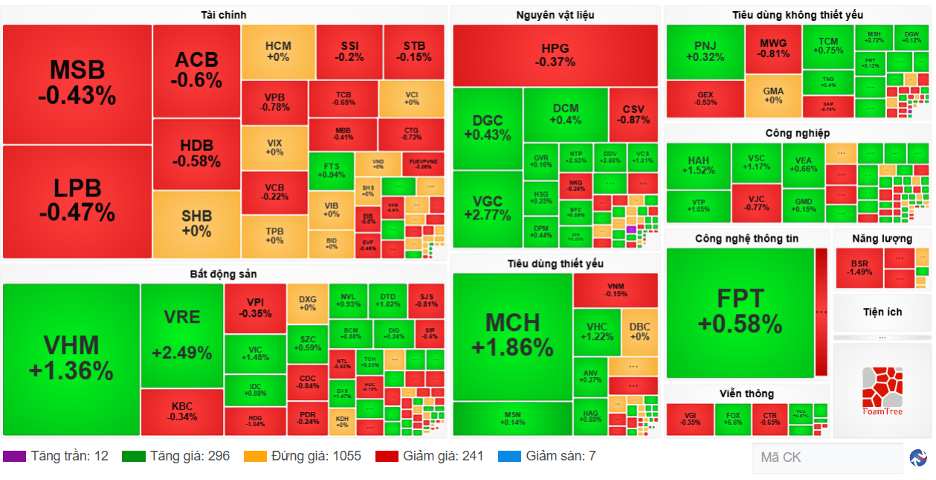

Compared to the opening, the buying side still held a slight advantage, although the breadth remained largely balanced, with many stocks trading flat. There were 296 advancing stocks (12 of which hit the ceiling price) and 241 declining stocks (7 of which hit the floor price).

Source: VietstockFinance

|

9:30 AM: Mild decline at the opening

At the start of the November 14 session, the VN-Index fell by over two points to 1,243.75 points. Meanwhile, the HNX-Index also witnessed a slight decline, settling at 226.16 points.

On November 13, the S&P 500 inched up 0.02% to 5,985.38 points. The Dow Jones gained 47.21 points (equivalent to 0.11%) to reach 43,958.19 points, having risen by as much as 230 points earlier in the day. The Nasdaq Composite advanced 0.26% to 19,230.74 points.

The Consumer Price Index (CPI) for October rose 2.6% year-over-year, matching the forecast of economists polled by Dow Jones and up 0.2 percentage points from September. The core CPI, excluding food and energy prices, increased by 3.3% in the previous month, in line with expectations. Following the inflation report, the market anticipated a high probability of another rate cut by the central bank in December 2024, according to the CME FedWatch tool.

Red dominated most industry groups, with several large-cap energy stocks witnessing negative performance from the opening bell, including BSR (-1.49%), PVS (-0.55%), PVD (-0.42%), POS (-0.99%), and others…

Large-cap stocks like VPB, VCB, and TCB weighed on the market, collectively pulling down the index by approximately one point. Conversely, FPT, VHM, and GAS led the gains, contributing over one point to the index’s advance.