Illustrative Image

As of May 10, 2024, Vietnam’s fruit and vegetable export turnover reached US$6.16 billion, up 27.8% over the same period last year. While the Chinese market reduced imports, the US boosted the purchase of Vietnam’s fruits and vegetables, with coconuts being the most prominent.

The US is a major consumer of coconut products, with a growing demand for processed coconut products such as coconut water, coconut oil, and coconut flour. The US imports a large volume of coconuts year-round to meet domestic consumption needs.

According to data from the International Trade Center (ITC), in the first eight months of 2024, the US imported 44,910 tons of fresh, peeled or unpeeled coconuts (excluding the inner shell) (HS code 080119), worth US$47.35 million, up 11.5% in volume and 18.8% in value compared to the same period last year.

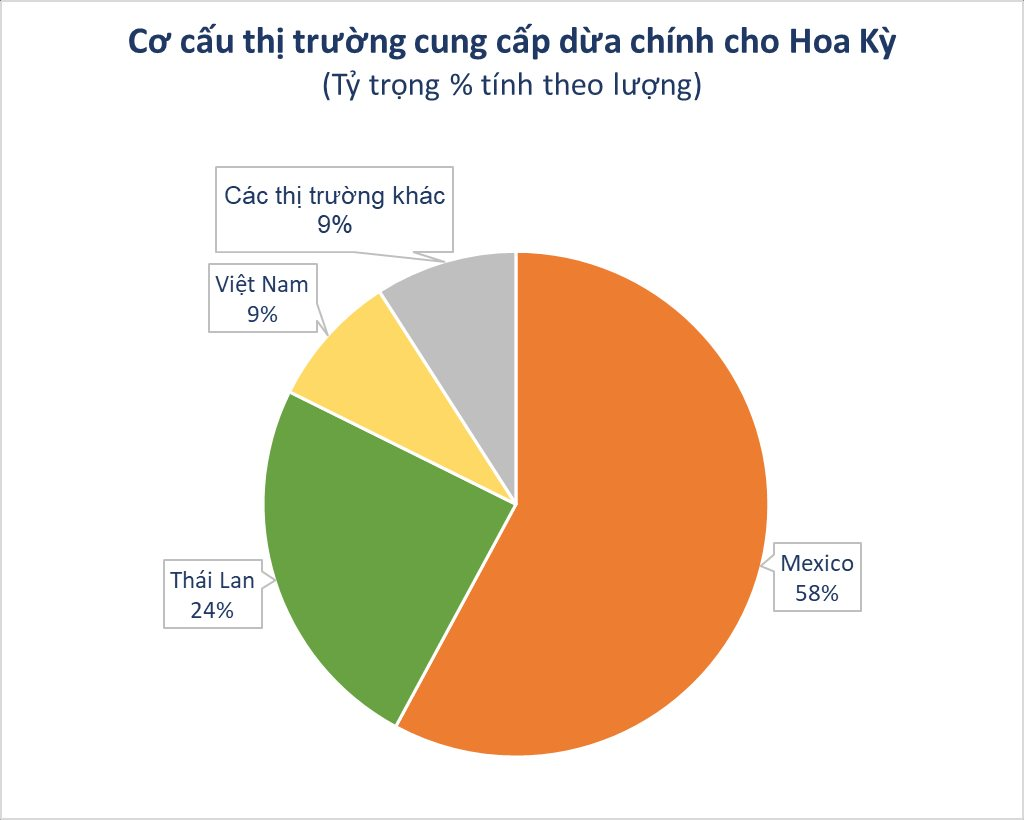

In the first eight months of 2024, the US imported fresh, peeled or unpeeled coconuts (excluding the inner shell) from 17 countries and territories around the world. The main sources of coconuts for the US include Mexico, Thailand, Vietnam, Costa Rica, and Dominica.

According to the ITC, in the first eight months of 2024, Thailand’s market share in the total US import volume decreased from 31.99% in the first eight months of 2023 to 24.44% in the same period in 2024.

On the other hand, the US significantly increased its imports of coconuts from Vietnam in the first eight months of 2024, with a surge of 1,155.6% in volume and 933.6% in value compared to the same period last year, reaching approximately 3,860 tons, worth US$3.94 million.

Vietnam’s market share in the total US import volume increased from 0.76% in the first eight months of 2023 to 8.59% in the same period in 2024. Last year, Vietnam ranked 5th, but in 2024, it has become the 3rd largest coconut supplier to the US.

Contrary to output and turnover, Vietnam is the only country with a decrease in selling price, reaching US$1,020/ton. This price is cheaper than most other markets, except for Mexico.

In 2023, the US officially opened its market to fresh coconuts from Vietnam. The US requires that fresh young coconuts from Vietnam exported to the US market must have the entire green shell removed and at least 75% of the coconut husk removed. Meeting the stringent requirements of the US market has opened up prospects for Vietnam’s coconut industry.

In addition to coconuts, many other fruits and vegetables from Vietnam are becoming popular in the US market, such as passion fruit, mangoes, etc.

The potential for Vietnam’s coconut products is still significant. Currently, Vietnam’s coconut industry holds an important position in the world with an area of over 188,000 hectares. Vietnam’s coconut area accounts for 1.67% of the world’s coconut area and 2.07% of Asia’s coconut area. The rate of increase in Vietnam’s coconut area is quite high. In 2010, Vietnam’s coconut area ranked 6th in the world, but by 2021, it had moved up to 5th place.

Coconut trees are currently a source of income for about 389,530 households, and the export value of coconuts and coconut products has reached over US$900 million. Vietnam’s coconut industry is ranked 4th in the world in terms of total value.

Currently, there are about 854 enterprises in Vietnam that produce and process coconut products in various forms and scales, such as processing coconut shells, coconut bowls, coconut meat, and coconut water… providing jobs for more than 15,000 laborers.

The Rise of a Chinese Coffee Powerhouse: A Super-Affordable Brand with Over 20,000 Stores in its Domestic Market, Set to Challenge the US and Southeast Asian Beverage Industries.

China’s largest coffee chain is planning a comeback in the US market, setting its sights on challenging competitors, including Starbucks.

The Silver Lining for Pangasius Fish Exports: A 20-Year Journey to Overcome Anti-Dumping Lawsuit in the US Market

The U.S. Department of Commerce (DOC) has determined that many Vietnamese exporters of tra fish fillets did not dump their products in the U.S. market.