## I. VIETNAM STOCK MARKET WEEK 11-15/11/2024

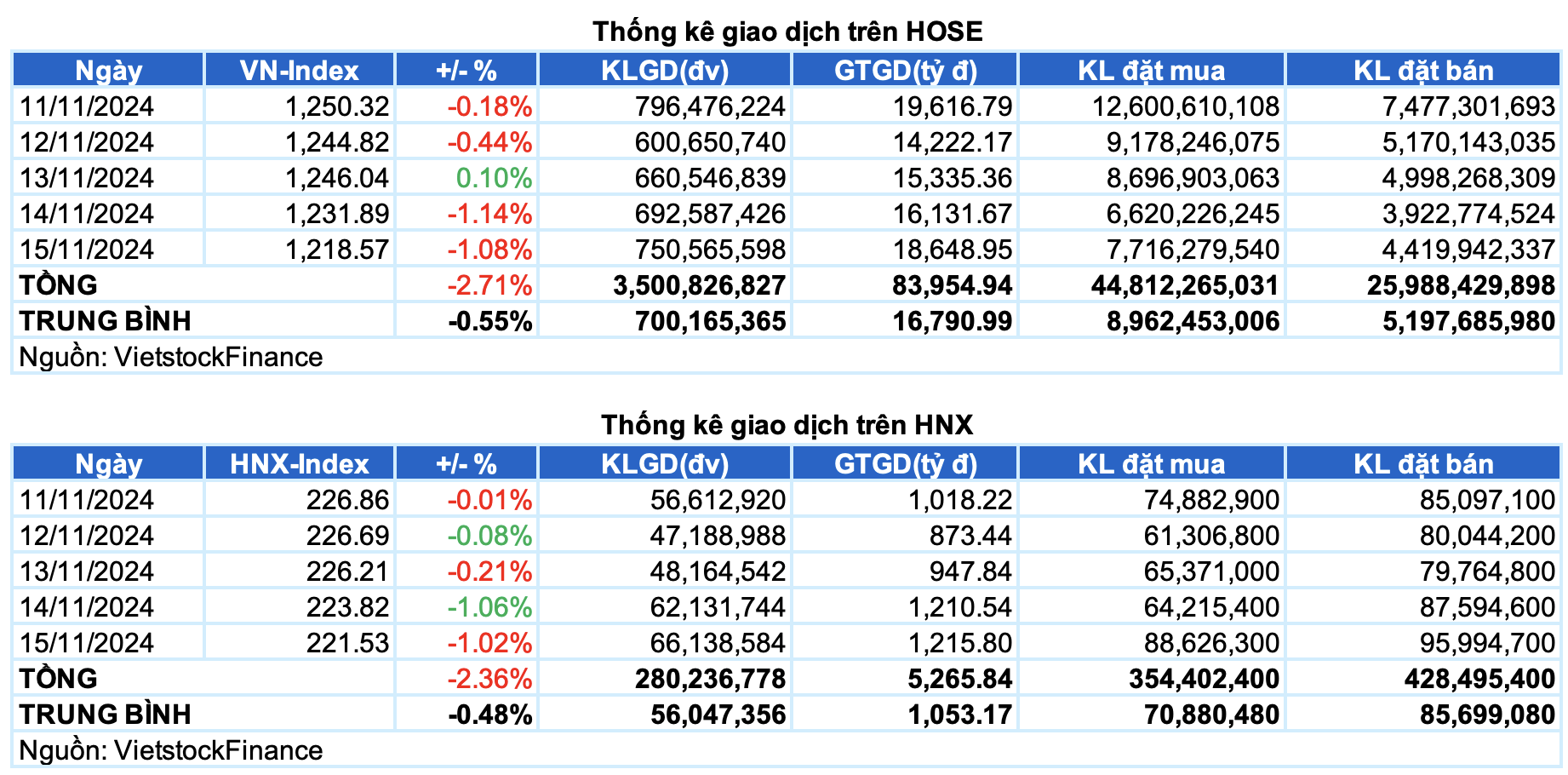

**Trading:** The main indices were in the red during the last trading session of the week. By the end of November 15, the VN-Index fell by 1.08% to 1,218.57 points, while the HNX-Index dropped by 1.02% to 221.53 points. For the whole week, the VN-Index lost a total of 33.99 points (-2.71%), and the HNX-Index decreased by 5.35 points (-2.36%).

**Investors** experienced a turbulent trading week as the VN-Index fell in four out of five sessions, with the last two sessions plunging by more than 1% each. Losing the main support from the large-cap stocks, the index gradually broke through the support levels amid widespread selling pressure. Additionally, the prolonged net selling trend by foreign investors also increased the pessimism in the market. At the close of November 15, the VN-Index stood at 1,218.57 points, a decrease of 13.32 points from the previous session.

**In terms of impact**, the top 10 codes with the most negative impact on the market today were all in the VN30 group, taking away more than 6 points from the VN-Index, led by BID, FPT, VNM, CTG, and HPG. On the opposite side, VTP, KBC, and VRE had a positive impact but their contribution was insignificant.

**The red color dominated all industry groups**, with more than half of the groups falling by over 1%. The energy group was at the bottom with a drop of more than 3%. This was mainly influenced by stocks like BSR (-4.06%), PVS (-2.86%), CST (-1.8%), and PVC (-4.63%).

**The materials, information technology, industrial, non-essential consumer goods, and financial groups** declined by 1-1.5%. The strong sell-off caused many stocks to plunge, notably HPG (-1.52%), GVR (-1.59%), DGC (-2.67%), DCM (-2.14%); FPT (-1.54%); ACV (-1.01%), HVN (-1.97%), HVN (-2.48%); MWG (-2.28%), PNJ (-1.72%); BID (-1.76%), CTG (-1.49%), HDB (-2.18%), SSI (-3.04%), etc. However, there were a few bright spots that went against the market trend in these groups, such as VTP, which hit the ceiling price, VGC (+1.15%), PTB (+1.29%), CMG (+1.58%), and GEX (+1.1%), etc. as well as stocks in the real estate group like KBC (+2.44%), SZC (+2.3%), DXG (+0.94%), and SCR (+1.17%), etc.

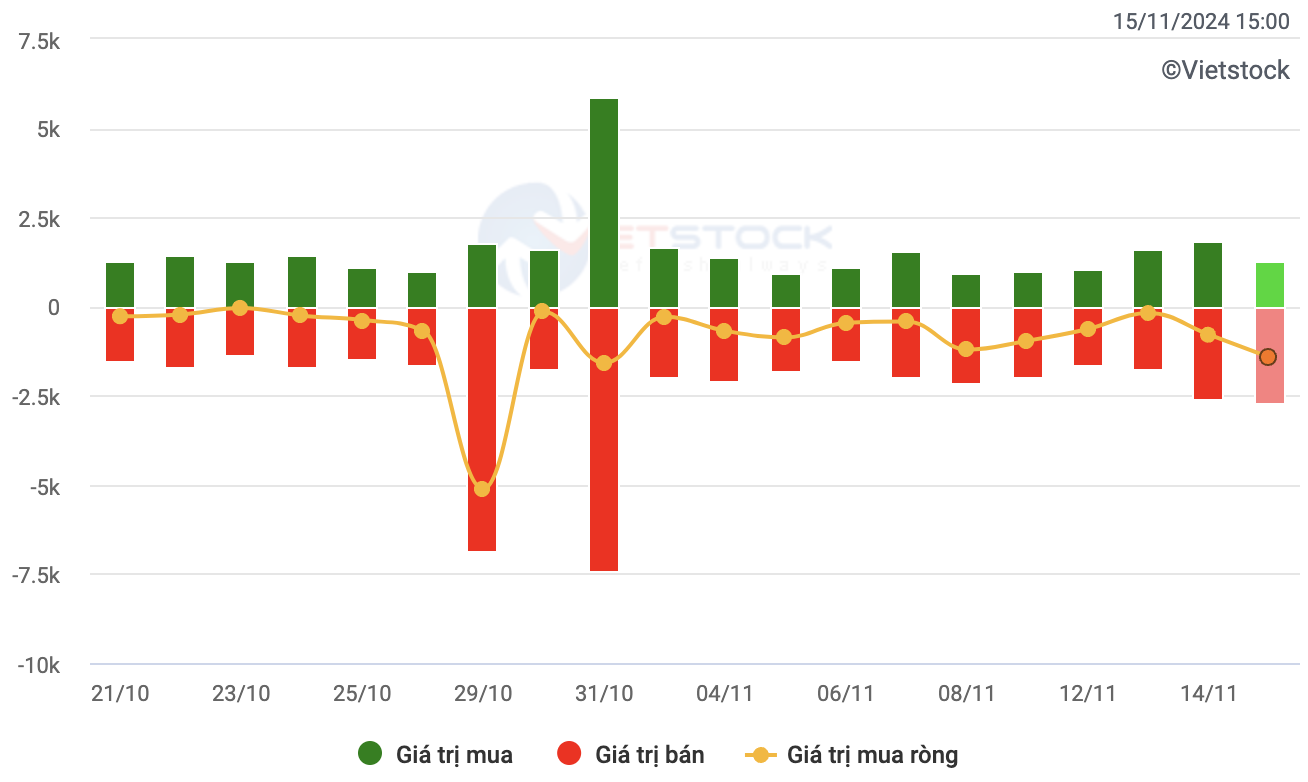

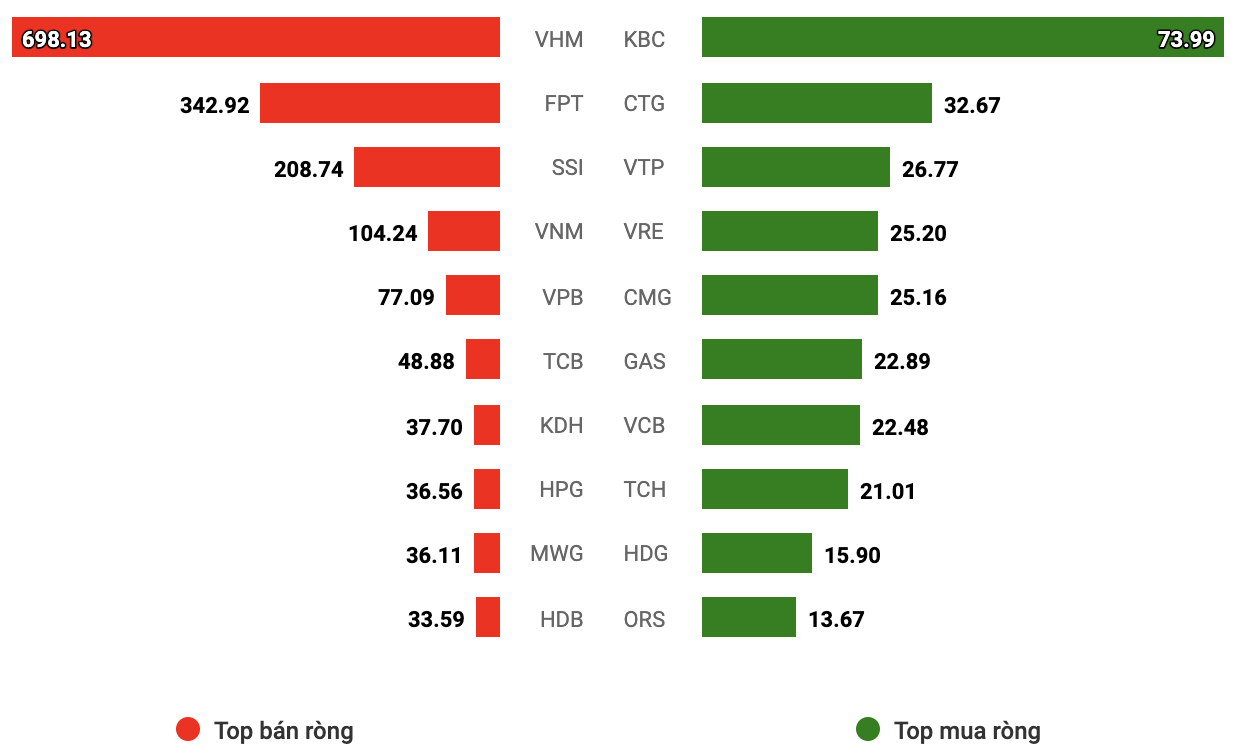

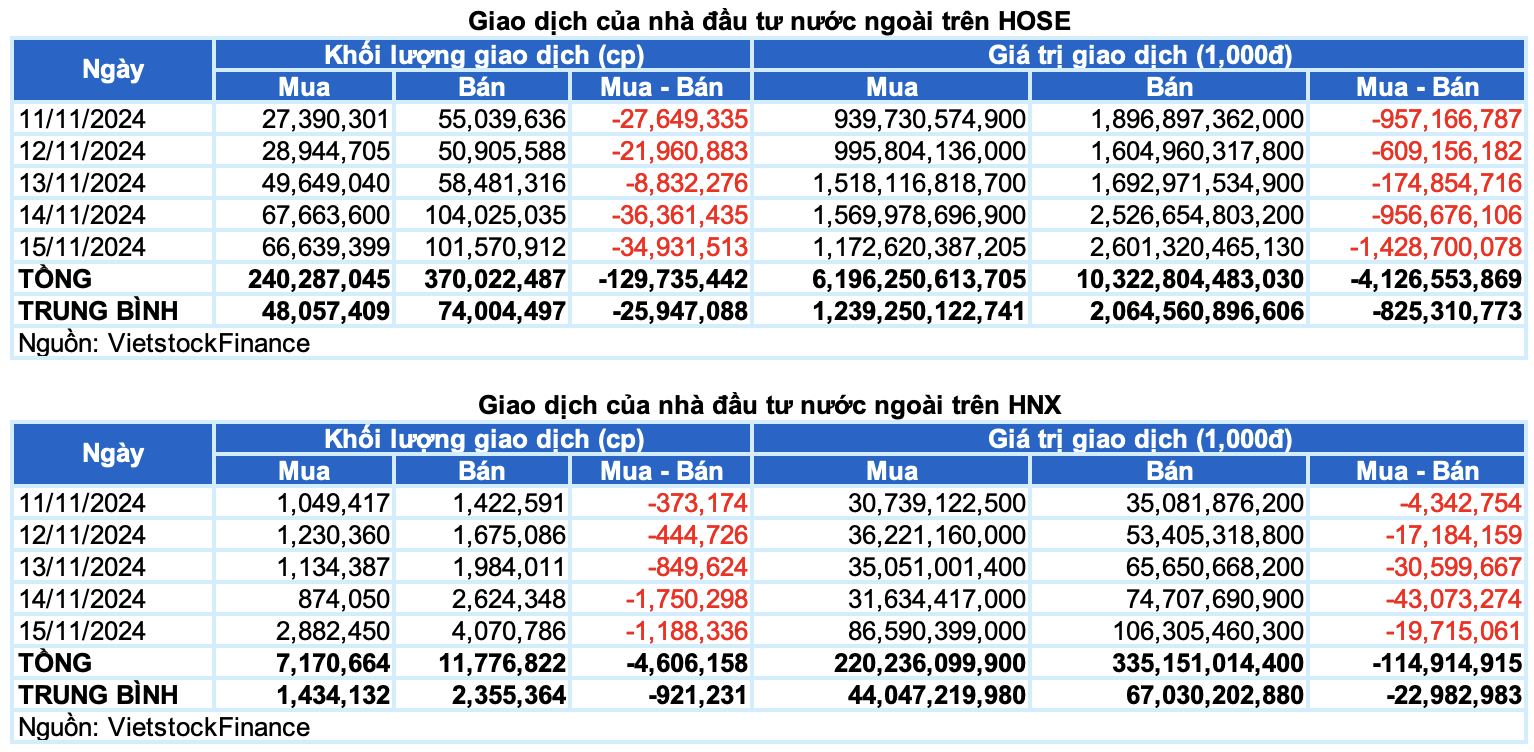

**Foreign investors** continued to be net sellers, with a value of more than VND 4.2 trillion on both exchanges this week. Of this, foreign investors net sold more than VND 4.1 trillion on the HOSE and nearly VND 115 billion on the HNX.

**The value of foreign investors’ transactions on the HOSE, HNX, and UPCOM by day. Unit: VND billion**

**Net trading value by stock code. Unit: VND billion**

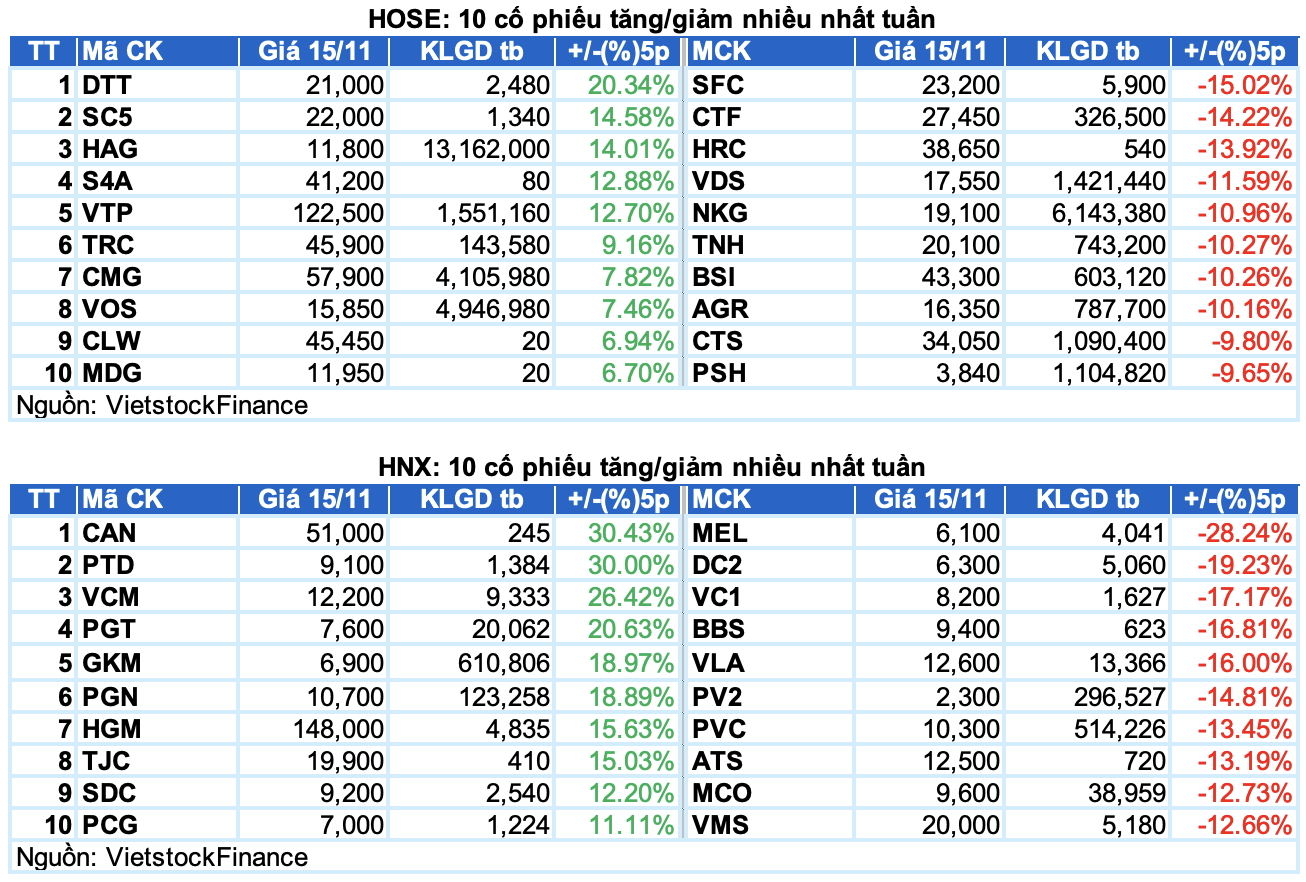

**The typical rising stock this week was HAG**

**HAG rose by 14.01%:** HAG had a brilliant trading week, gaining 14.01%. The stock has been surging strongly since breaking above the Middle line of the Bollinger Bands, with trading volume exceeding the 20-day average. This indicates that money flow is becoming increasingly strong. Currently, the Stochastic Oscillator and MACD indicators still give buy signals, suggesting that the outlook remains positive.

**The typical falling stock this week was CTF**

**CTF fell by 14.22%:** CTF experienced a rather negative trading week as the downward trend reappeared. The stock has been plummeting since it cut below the 20-day SMA and stuck close to the Lower line of the expanding Bollinger Bands. This suggests that the situation is not yet optimistic.

Moreover, the Stochastic Oscillator and MACD indicators continued to decline after giving sell signals. This indicates that the risk of short-term adjustment still exists.

## II. STOCK MARKET STATISTICS FOR THE PAST WEEK

*Economy & Market Strategy Analysis Department, Vietstock Consulting*

The Gloomy Sentiment Subsides

The VN-Index edged higher and rebounded after a recent streak of losses. Accompanying this rebound was a trading volume that surpassed the 20-day average, reflecting a relatively optimistic sentiment among investors. However, the Stochastic Oscillator has signaled a resumption of selling, and the MACD indicator is conveying a similar message. This suggests that the short-term outlook remains pessimistic.

The Beat of the Market: Investors Sell-Off with a Wave of Pessimism

The market closed with the VN-Index down 13.32 points (1.08%), settling at 1,218.57; the HNX-Index also ended below the reference level at 221.53 points. The market breadth tilted towards sellers, with 546 declining stocks against 193 advancing ones. The VN30-Index basket was mostly red, recording 26 losses, 3 gains, and 1 stock referencing.

The Market Beat: Green Wave Extends, VN-Index Recovers Over 15 Points

The market closed with strong gains, seeing the VN-Index surge by 1.25% to 1,261.28; a substantial increase of 15.52 points. Meanwhile, the HNX-Index also witnessed a healthy boost, rising by 1.29% to 227.76, an increase of 2.9 points. The market breadth tilted heavily in favor of bulls, with 536 tickers advancing against 147 declining names. The large-cap basket, VN30, painted a similar picture, with 29 constituents climbing and only 1 remaining unchanged.

The Market Beat: Foreigners Continue Their Selling Spree

At the end of the trading session, the VN-Index climbed 1.22 points (0.1%) to reach 1,246.04, while the HNX-Index dipped 0.48 points (0.21%), settling at 226.21. The market breadth tilted towards decliners, with 358 stocks falling versus 311 gainers. The VN30 basket, however, painted a greener picture, as 15 constituents rose, 11 fell, and 4 remained unchanged, tipping the scale in favor of the bulls.

The Ultimate Headline:

“Vietstock Weekly: Navigating the Short-Term Risks”

The VN-Index witnessed a significant drop, plunging by over 33 points, accompanied by the emergence of a bearish Black Marubozu candlestick pattern. Adding to the gloom, the index sliced below the SMA 200-week support, indicating a decidedly negative investor sentiment. Furthermore, the MACD and Stochastic Oscillator indicators continue their southward journey, reinforcing the sell signal and painting a picture of a short-term outlook that remains devoid of optimism.