Inside a garment factory. Illustration

|

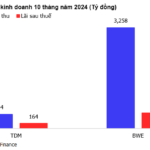

According to the General Statistics Office, in the first ten months of 2024, the total export turnover of Vietnam’s textile and garment industry reached $30.57 billion, up 10.5% over the same period in 2023, with all major markets experiencing growth, especially in the US and EU.

The production activities of enterprises also prospered, with many places reporting that they had enough orders for the whole year and the beginning of 2025. This positive result is somewhat reflected in the business picture of textile and garment enterprises in the stock market.

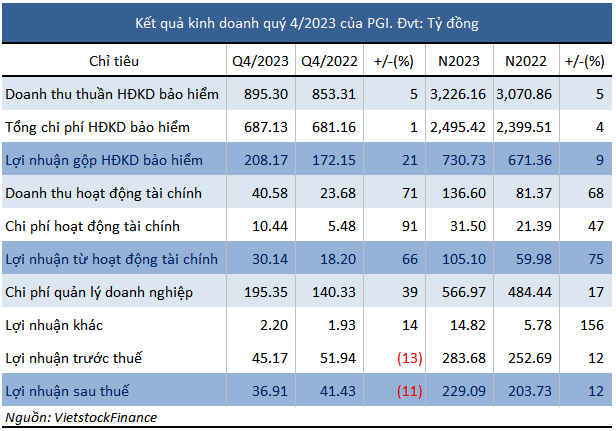

Data from VietstockFinance shows that, of the 33 textile and garment enterprises announcing their business results for the third quarter of 2024, 16 enterprises increased profits, 7 enterprises decreased profits, 6 enterprises made profits again, and 4 enterprises suffered losses.

Total revenue and net profit of enterprises reached nearly VND 23,100 billion and VND 969 billion, up 17% and 133% respectively over the same period in 2023. The gross profit margin improved to 13%, up 1 percentage point from the same period.

Most are “blooming”

There were 11/33 textile and garment enterprises that achieved a growth rate of over 50% in profit in the third quarter compared to the same period, and even increased by times like May House Corporation (MNB) more than 8 times over the same period, reaching VND 32 billion, the highest in the past 2 years.

MNB said that due to the positive transformation of the main export market, revenue in the third quarter increased by 36% to over VND 1,300 billion. In addition, some subsidiary and associated companies increased profits by reducing costs, thereby increasing consolidated profit.

Century Fiber (STK) set a record profit of VND 82 billion, more than 5 times the same period, although revenue fell by 19%, mainly due to the reversal of exchange rate differences. This result offset the loss of VND 55.5 billion in the previous quarter.

| Century Fiber has the highest quarterly net profit in its operating history |

The “elder” of the textile and garment industry Vinatex (VGT) grew in both revenue and profit, reaching 12% and 385% over the same period, respectively, at nearly VND 4,600 billion and VND 129 billion, both the highest in the past 2 years.

Vinatex leaders assessed that in the third quarter, the garment industry improved in both price and order volume, thanks to taking advantage of the shift from the markets of China, Bangladesh, and Myanmar. For the fiber industry, the market is still facing many difficulties, but the fiber units have had many times to fix good cotton and fiber prices.

The champion of quarterly profit was called May Song Hong (MSH), reaching VND 130 billion, more than 2.5 times over the same period. This is also the highest level in 20 quarters since the fourth quarter of 2019. The company said that it has signed many orders and some orders for production in the second quarter were exported in early July.

| May Song Hong has the highest quarterly profit in the last 5 years |

The profit of hundreds of billions of dong was also made by May Viet Tien (VGG) and Garment TNG, reaching VND 117 billion and VND 111 billion, up 126% and 60% over the same period, respectively, thanks to improving gross profit margin by controlling input costs well.

Information from TNG said that with enough orders to produce until the end of the year, along with the recent addition of 45 sewing lines, this enterprise is recruiting about 3,000 laborers, ready to receive more orders in the future.

The bright color also appeared in the group of fiber enterprises, belonging to the upstream segment in the value chain of the textile and garment industry, such as Vu Dang Fiber (SVD) and Phu Bai Fiber (SPB) both made profits again; or Vietnam Victory Corporation (TVT) profit growth of up to 145%, reaching nearly VND 7 billion, the highest in the past 2 years.

A few are still “deadlocked”

In contrast, the crisis still haunts Fortex (FTM) when it lost an additional VND 30 billion, extending the chain of losses for 23 consecutive quarters since the first quarter of 2019, thereby increasing accumulated losses to VND 1,216 billion, owner’s equity is negative VND 707 billion.

| Fortex has been “struggling” with losses since 2019 up to now |

Equally dismal, Everpia (EVE) lost a record VND 29.5 billion due to having to stop production and business activities in the towel industry because revenue has continuously decreased in the past 3 years when customers turn to competitors with lower prices. Everpia said it is building a recovery and development plan for 2024-2025 to preserve resources, focus on industries with higher profits and better development potential such as bedding and cotton sheets.

The business situation of Garmex (GMC) is completely out of sync with the general situation of the industry. By the end of October, the enterprise, which used to have more than 4,000 laborers, was still “white” in orders, which has lasted since May 2023, that is, for the past one and a half years. GMC now has only 31 employees, is researching investment in new industries, reducing costs and liquidating unused assets. Accumulated loss increased to nearly VND 82 billion.

| Garmex’s quarterly business results in the period 2021-2024 |

Can you reach the destination successfully?

Given the positive developments in export activities, the Vietnam Textile and Apparel Association (VITAS) assessed that the textile and garment industry’s export target of $44 billion in 2024 is very feasible because the end of the year is the peak season for Christmas and New Year holiday orders.

Although the export picture is quite bright, in the opinion of Mr. Cao Huu Hieu – General Director of Vietnam Textile and Garment Corporation (Vinatex), enterprises are still under a lot of pressure when the market has not improved significantly. For the garment industry, there is pressure on delivery time, unit prices have not improved, and product quality requirements are stricter than before.

“It is expected that garment orders in the fourth quarter of 2024 and the first quarter of 2025 will continue to be abundant, however, unit prices have not improved significantly. In the long term, when the interest rate reduction policy in major markets really has a positive impact on the economy, creating stable jobs and purchasing power, unit prices will improve”, said Mr. Hieu.

Vinatex General Director Cao Huu Hieu shared at the October workshop. Photo: Vinatex

|

For the fiber industry, although the loss has been reduced by 80-85% compared to 2023, enterprises are still facing many difficulties and disadvantages due to having to face the ups and downs of cotton prices and the lack of improvement in fiber selling prices…

The Vinatex General Director expected that by the end of 2024, cotton prices will go up stably and are unlikely to increase sharply. It is expected that in the fourth quarter, the demand for fiber in general will not be able to recover strongly, while the increase in freight rates, fierce competition with domestic fiber in China… will cause the efficiency of the fiber industry not to show significant signs of improvement.

Don’t rely on market luck

Commenting on the industry’s prospects, Mr. Le Tien Truong – Chairman of the Board of Directors of Vinatex forecasted that orders would benefit when US consumer demand improved during the holiday shopping season (but unit prices did not improve). Demand and unit prices will only really improve from 2025 in the best-case scenario.

Vinatex Chairman of the Board of Directors Le Tien Truong shared at an event in May 2024

|

The Chairman of Vinatex also reminded enterprises to be cautious, especially those producing raw materials facing difficulties for the past 30 months.

“Enterprises need to tightly manage production and business activities, closely follow the set plan, identify and prevent risks well, and not let any unexpected situations happen to complete the plan for the year and catch the trend in 2025”, Mr. Truong said.

|

Regarding the event that Mr. Donald Trump was re-elected as President of the US, investors expect a number of industries to have great opportunities for development, especially industries such as textiles, seafood, and wood, due to the replacement of Chinese goods in the US market. Accordingly, the US protectionist policy will create a large gap for Vietnamese products to penetrate this market, thereby increasing exports and promoting growth. In the long term, SSI Securities Center (SSI Research) predicts that Vietnam’s textile and garment industry will continue to benefit from the shift of orders from China thanks to lower labor costs, the advantage of having a higher skilled labor force than India and Bangladesh. |

The Insurance Company’s Ploy Against Car Owners

In recent times, many car owners have been complaining about being “bullied” by their motor vehicle insurance companies, who are demanding additional unexpected payments.

The Ultimate SUV: Ford Everest Reigns Supreme in the D-Segment, Leaving Santa Fe and Fortuner Behind.

The Ford Everest has cemented its position as the undisputed sales leader in the D-SUV segment in Vietnam. With an impressive 8,434 units sold in the first ten months of 2024, it has left its competitors, including the Hyundai Santa Fe and Toyota Fortuner, trailing in its wake.