Inside a pangasius processing factory. Illustration

|

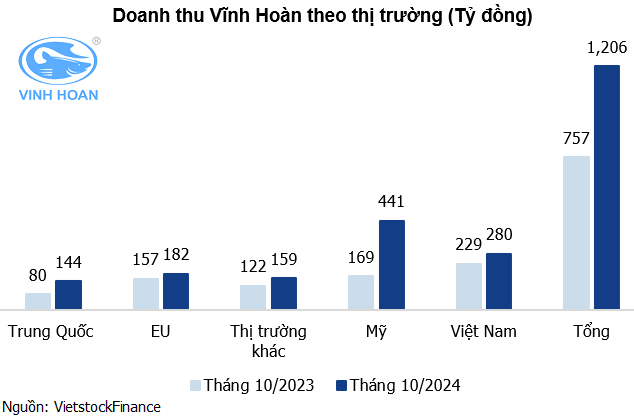

In October, Vinh Hoan’s revenue from the US market increased by up to 161% over the same period to VND 441 billion; followed by the domestic market revenue contributing VND 280 billion (up 22%); and the Chinese market contributed the most modestly with only VND 144 billion, up 80%.

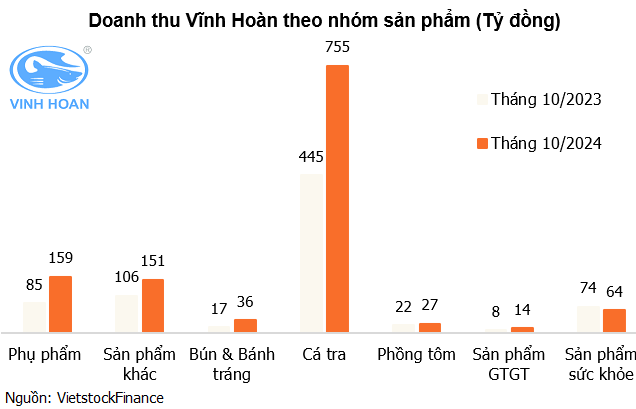

Going into each product group, the pangasius segment continued to contribute the most with VND 755 billion, up 70% over the same period last year and accounting for 63% of the Company’s total revenue. All other segments, including by-products, rice vermicelli and shrimp crackers, showed growth, with only the healthcare segment experiencing a decline in revenue.

Previously, the consolidated financial statements for Q3/2024 of Vinh Hoan showed revenue of nearly VND 3,300 billion, up more than 21% over the same period last year. Gross profit margin was over 17%, an improvement from the bottom of 8.15% in Q4/2023, the most challenging period in many years of operation. As a result, net profit reached VND 320 billion, up 68%, bringing the nine-month cumulative net profit to VND 808 billion.

In 2024, the company of “pangasius queen” Truong Thi Le Khanh set two business scenarios. In the low scenario, the minimum net profit plan is VND 800 billion, which was completed after three quarters; and in the high scenario, the target is VND 1,000 billion, of which Vinh Hoan achieved 80% of the annual goal.

As of September 30, 2024, the Company had VND 2,700 billion in bank deposits, accounting for 20% of total assets. Meanwhile, retained earnings totaled nearly VND 6,200 billion.

Concluding a promising business period, the Board of Directors of VHC decided to pay an interim dividend for 2024 at a rate of 20% in cash (VND 2,000/share), equivalent to a payout of VND 449 billion. The ex-dividend date is December 5, and the payment date is December 18, 2024.

In recent years, Vinh Hoan has regularly paid cash dividends at a rate of 20%; in 2022, the Company paid a total dividend rate of 40% (including 20% in cash and 20% in shares).

In the stock market, VHC shares have increased by nearly 22% since the beginning of the year, closing at VND 73,800/share on November 14.

| VHC Share Price Movement since the Beginning of 2024 |

|

According to statistics from the Ministry of Agriculture and Rural Development, the seafood export turnover of Vietnam in the first ten months of 2024 reached USD 8.33 billion, up 12% over the same period in 2023. Of this, shrimp export turnover reached USD 3.23 billion, up 13.9%; pangasius reached USD 1.54 billion, up 8.7%. In October 2024 alone, Vietnam’s seafood export turnover reached USD 1.1 billion, up nearly 31% over the same period. According to the Vietnam Association of Seafood Exporters and Producers (VASEP), this is the first time in 27 months (since June 2022) that seafood exports on a monthly basis have returned to the level of USD 1 billion. The United States, China, and Japan are the three largest consumers of Vietnamese seafood. With the growth in recent months, the seafood industry is confident of achieving and exceeding the export target of USD 10 billion in this year. |

The High Stakes of Stock Market Investing: When Businesses Gamble and Lose

Investing in the stock market is a popular alternative to idle cash sitting in banks for many businesses, as they seek to grow their wealth. However, when market conditions turn unfavorable, these same businesses often find themselves burdened with losses amounting to tens or even hundreds of billions of dong.

The Queen of Catfish Vinh Hoan Prepares for a High Cash Dividend After a Roaring Quarter

With over 224.45 million shares outstanding, the company will have to shell out approximately VND 449 billion to pay dividends.