Mr. Vincent Tan

According to Thanh Nien newspaper, at the appellate trial of the accused, Truong My Lan, on November 18, the defendant’s lawyer stated that regarding the 6A project, covering an area of 26 hectares in Binh Chanh, Ho Chi Minh City, which is neither sequestered nor mortgaged, a Malaysian tycoon, Mr. Vincent Tan, has agreed to invest in the project. After deducting expenses, the accused has 20,000 billion VND left to remedy the consequences.

The 6A project is located in Trung Son, Binh Chanh District, Ho Chi Minh City, with a total area of 26.4 hectares and a total investment of up to 13,400 billion VND. The investor is Van Thinh Phat Investment Group Joint Stock Company.

Ms. Truong My Lan shared that previously, many investors offered prices ranging from 30,000 to 50,000 billion VND to purchase the project. However, to compensate the bondholders, Ms. Lan agreed to sell it at a lower price, from 10,000 to 20,000 billion VND, as long as she has enough money to compensate the bond purchasers.

During the court session on September 24, a friend of Ms. Lan from the United States expressed interest in negotiating the purchase of the 6A Trung Son project. This individual is willing to deposit money into a temporary account held by the prosecution, and Ms. Lan will transfer the project to them. Additionally, this person intends to represent three major shareholders of the building at 29 Lieu Giai, Hanoi, to repay 250 million USD to the bank and lend Ms. Lan an additional 130 million USD for compensation.

Mr. Vincent Tan (born 1952) is a Malaysian entrepreneur and the founder of Berjaya Corporation, a large conglomerate operating in diverse industries. Berjaya Corporation’s current business interests include retail, real estate, hotels, resorts, and entertainment, gaming and lottery management, financial services, food and beverages, automotive sales and distribution, environmental services, and education.

As of the end of the 2023 financial year (ending June 30, 2023), Berjaya’s total assets amounted to 4.7 billion USD. Mr. Vincent Tan stepped down from his position as non-independent and non-executive chairman of Berjaya Corp in March 2023. He currently serves as an advisor to the company’s board of directors.

According to Berjaya Corp’s 2024 annual report, Mr. Vincent Tan is the chairman of Berjaya Hills Resort Berhad and U Mobile Sdn Bhd. He also serves as the executive director of STM Lottery Sdn Bhd. Concurrently, he holds directorship roles in several other companies within the Berjaya Corporation Berhad group.

In addition to his involvement with the Berjaya Corp group of companies, Mr. Vincent Tan also holds stakes in various businesses across different sectors, including retail, hotels, real estate, and services.

As per Forbes data, as of April 15, 2024, Mr. Vincent Tan’s net worth stood at 730 million USD, ranking him 29th among the top 50 richest people in Malaysia. He was listed on the Forbes Billionaires list for six consecutive years from 2010 to 2015, with his highest net worth reaching 1.6 billion USD in 2014.

Furthermore, Mr. Vincent Tan owns shares in three football clubs: Cardiff City (England), Koninklijke Kortrijk (Belgium), and FK Sarajevo (Bosnia and Herzegovina).

Investments in Vietnam

Berjaya Corporation began its journey in Vietnam in 2006, and by February 2007, it had become the first Malaysian conglomerate to obtain a license for real estate investment and development in the country. Since then, the group has invested in numerous large-scale projects. However, during the period from 2017 to 2019, Berjaya had to sell off several of these ventures.

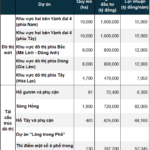

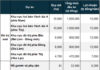

In 2018, Vinhomes announced its acquisition of 97.9% of the capital contribution in Berjaya Vietnam International University Town Joint Stock Company, the investor of the Berjaya Vietnam International University Town (BVIUT) project, with a total investment of 3.5 billion USD. The transaction amounted to 11,748 billion VND. Subsequently, Vinhomes transferred this capital contribution to its subsidiary, Thai Son Construction Investment Joint Stock Company.

Berjaya Vietnam International University Town Project

Berjaya also transferred another project to Vinhomes, the Vietnam Financial Center (BVFC) project, with a total investment of 930 million USD. Specifically, in March 2018, Vinhomes contributed nearly 2,009 billion VND to the charter capital of Berjaya Vietnam Financial Center Company Limited (BVFC), reducing Berjaya’s ownership to 32.5%. Berjaya disclosed that on June 4, 2018, it signed an agreement to transfer the remaining 32.5% stake in BVFC to Vinhomes and Can Gio Tourism Urban Development Joint Stock Company for a total expected amount of 884.93 billion VND. Berjaya received a refundable deposit of 15 million USD.

Vietnam Financial Center Project

Aside from the two aforementioned projects, Berjaya sold its entire 70% stake in Berjaya Long Beach LLC Vietnam, the investor of the Long Beach Resort Phu Quoc project, to Sulyna Service Company Limited for 65.32 million ringgit, equivalent to 333.25 billion VND. In 2019, Berjaya also divested its entire 75% stake in InterContinental Hanoi Westlake to a company related to the BRG Group for approximately 53.37 million USD, or about 1,240 billion VND. In addition to the sale proceeds, Berjaya received a refund of approximately 71.63 million USD, which was a loan from the Làng Nghi Tàm company, bringing the total amount received to 125 million USD.

Despite these divestments, Berjaya Corp still holds significant assets in Vietnam. These include a 50% stake in the joint venture company Berjaya-Ho Tay Limited Liability Company (Sheraton Hanoi Hotel), an 80% stake in Berjaya-Handico12 Joint Stock Company, the investor of the Hanoi Garden City urban area project in Long Bien District, Hanoi, spanning 32 hectares, and 100% ownership of Berjaya-D2D Limited Liability Company, the investor of the 5-star hotel and high-end commercial apartment project Bien Hoa City Square in Dong Nai, with a total investment of 230 million USD.

Through Berjaya Lottery Vietnam Limited, Berjaya Corp holds a 51% stake in Berjaya Gia Thinh Technical Investment Joint Stock Company, which collaborates with Vietnam Computerized Lottery One Member Limited Liability Company (Vietlott) under a Business Cooperation Contract (BCC). As per this agreement, Berjaya Gia Thinh is responsible for developing and operating the computerized lottery system, as well as providing training and technology transfer during the cooperation period with Vietlott.

In its home country of Malaysia, Berjaya owns several large shopping centers, including Berjaya Megamall, Kuantan, Pahang; Plaza Berjaya, Kuala Lumpur; and Kota Raya Complex, Kuala Lumpur.

The Confessions of SCB’s Former CEO: How the Debt Swelled Like a “Flood that Swept Everything Away”

The former CEO of SCB revealed that accused Truong My Lan used assets solely as collateral for loans without any actual funds to repay the debts upon maturity.

Unveiling the Secrets: A Proposal for the Ministry of Public Security to Continue Verification of Assets in the Truong My Lan Case

The official website of the People’s Court of Ho Chi Minh City has published the First Instance Criminal Verdict on the case of Truong My Lan and accomplices, Phase 2. The verdict includes a recommendation for the Investigation Agency of the Ministry of Public Security (C03) to investigate and verify the ownership of numerous assets involved in the case.

The Bondholder’s Silver Lining: Unraveling the Van Thinh Phat Case

The deadline for victims of the bond-buying scam to come forward and amend their information has been extended, as per the latest announcement on September 27th.