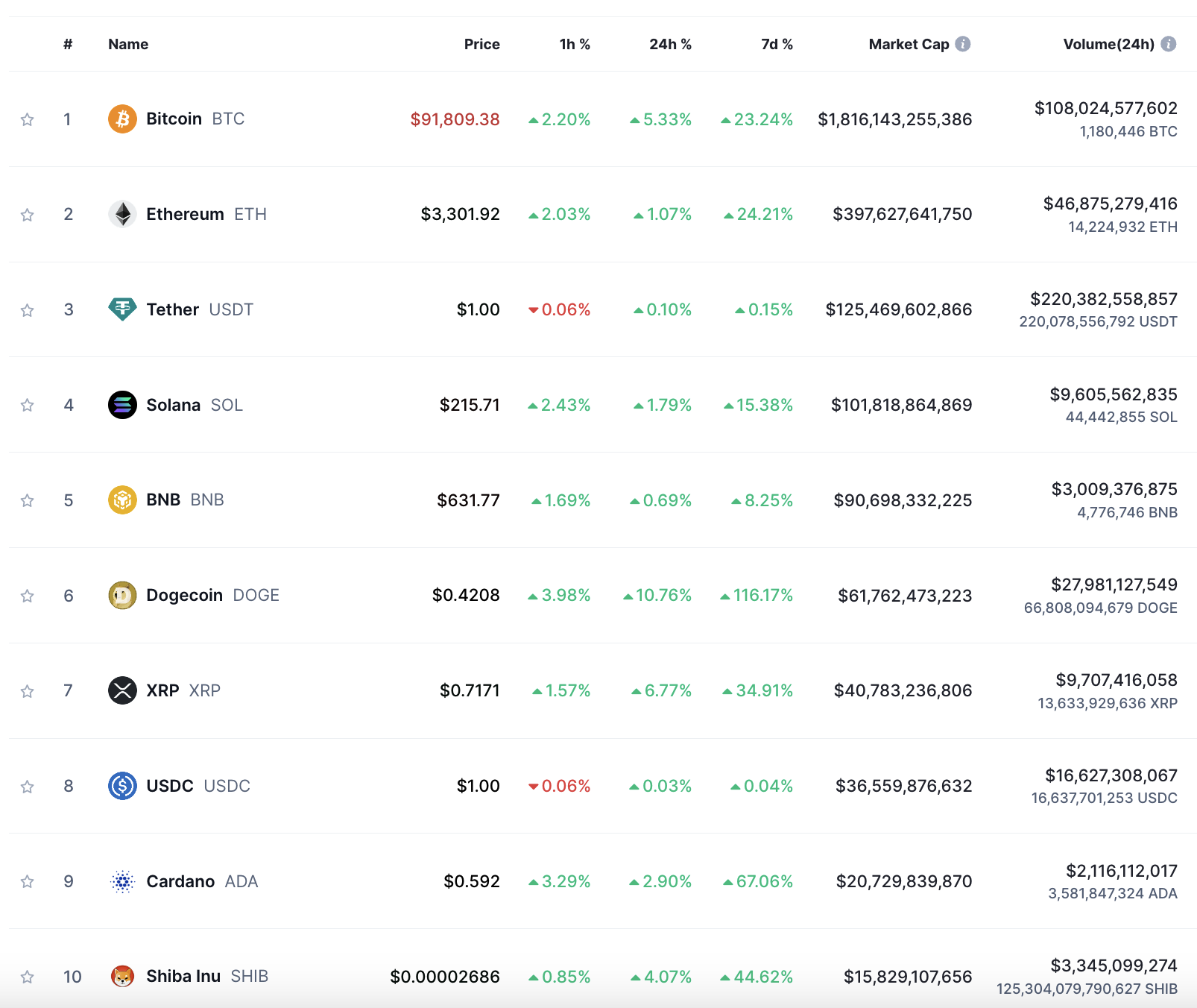

Bitcoin’s price had surged over 2% to $91,800 at the time of writing, reaching a new high as investors digested the October US inflation data. The report showed that the Consumer Price Index (CPI) rose 0.2% from the previous month and 2.6% from a year earlier, in line with market expectations.

Source: CoinMarketCap

|

“With concerns about new fiscal policies potentially triggering inflation, Bitcoin is being seen by many investors as an effective hedge,” remarked a digital market analyst. The cryptocurrency has significantly benefited from the risk-on sentiment following the US presidential election outcome.

Notably, Dogecoin, the meme cryptocurrency once endorsed by Elon Musk, surged over 8% after news broke that the Tesla CEO would be part of the incoming president-elect, Donald Trump’s, new cabinet. Other major cryptocurrencies like Ether and Solana also recorded modest gains of around 1%.

Gold, Bitcoin Hit All-Time Highs, Soaring USD, Stocks Take a Hit?

The recent surge in the prices of other assets such as gold, Bitcoin, and the USD/VND exchange rate is putting a dampener on the stock market.