CONNECTING FINANCIAL RESOURCES FROM THE MIDDLE EAST AND THE WORLD

During the Prime Minister’s recent visit and work in the Middle East at the end of October, one of the topics discussed by the high-level leaders caught the attention of investors.

It was about the potential to connect significant financial resources from the Middle East to invest in Vietnam’s strategic infrastructure, healthcare infrastructure, and educational infrastructure.

Not only are there financial resources from the Middle East, but there are also opportunities to attract investment capital from developed economies such as the US, Europe, and Asia if Vietnam has a specific investment project portfolio. Infrastructure is often a bottleneck for the economy, and unlocking it can be a key to significant progress.

The State Capital Investment Corporation (SCIC) is currently considered an important organization in connecting the world’s financial resources with Vietnam in this field.

However, according to experts, there should be drastic reforms to further enhance SCIC’s effectiveness in its role as a market-oriented investment tool of the Government rather than a state administrative agency.

In fact, the vision of an SCIC with new roles has been expressed in Resolution No. 68/NQ-CP dated May 12, 2022, of the Government, which sets out the requirement: “Study and enhance the role of SCIC, especially as the Government’s investor to attract more financial resources into large and important enterprises and projects.”

Decision No. 690/QD-TTg dated July 17, 2024, approving the “Plan for rearrangement and Proposal for restructuring the State Capital Investment Corporation until the end of 2025,” also sets the goal of “Consolidating SCIC to ensure sufficient financial resources, with the orientation that after 2025, it will become a leading financial investment organization in Vietnam in terms of owner’s equity.”

In the SCIC Development Strategy approved by the Prime Minister, for the next five years (2026-2030), the Prime Minister has directed SCIC to concentrate resources to promote capital investment and business activities, fulfill the role of the Government’s investor, and prioritize investment in efficient sectors and critical and essential fields that the State needs to hold and where SCIC has advantages, creating a spillover and leading effect, paving the way for other economic sectors to invest and develop together.

When discussing this issue, Mr. Nguyen Ba Hung, Chief Economist of the Asian Development Bank (ADB), recommended that it is time to promote and strengthen the role of state investment tools like SCIC, not only for domestic investment but also for overseas investment, in line with the State’s strategic objectives.

International experience shows that promoting these “steel fists” will create significant advances for the economy.

LESSONS FROM INTERNATIONAL EXPERIENCE

In China, the China Investment Corporation (CIC) was established with a capital of over $200 billion provided by the State Administration of Foreign Exchange (SAFE). In CIC’s investment portfolio structure, the largest proportion is financial assets abroad (33.1%) and long-term domestic stocks (61.9%).

Mr. Nguyen Ba Hung analyzed the Temasek model, suggesting that it is “very suitable and worth referring to for Vietnam.” At its establishment, Temasek had a market value of SGD 354 million, comprising shares in Singapore’s state-owned companies that played a crucial role in the economy in real estate, finance, aviation, and telecommunications.

After completing its divestment activities, Temasek has boosted its investment activities, maintained a flexible liquidity ratio, and built a solid but flexible investment portfolio to allow for structural changes when necessary.

As of March 2023, Temasek’s investment portfolio value reached SGD 382 billion, with domestic companies in the portfolio generating consolidated revenue of approximately SGD 145 billion, providing Temasek with sustainable profits. The total annual shareholder profit since its establishment in 1974 has been 14%, with 47% of Temasek’s portfolio comprising liquid and listed assets, and the remaining 53% being unlisted assets and funds.

Recently, the Indonesian Government Investment Fund (INA) model has emerged as a highly efficient and dynamic investment tool. INA was established in 2021 with a charter capital of $5.2 billion, aiming to optimize investment values and attract foreign capital for economic development. INA has attracted the interest of many international financial investors, including those from the US, Japan, the Arab Emirates, and China, with commitments of capital injections amounting to tens of billions of dollars.

So far, INA has carried out several significant investments, such as partnering with DP World of the United Arab Emirates (UAE) to invest in port infrastructure worth $7.5 billion; establishing a toll road investment fund of up to $3.75 billion with the Canada Pension Plan Investment Board and a unit under the Abu Dhabi Investment Authority in 2021; purchasing shares during the IPO of Mitratel (managing 16,000 telecommunication towers across Indonesia); and collaborating with the American asset management company BlackRock to invest $300 million in Traveloka, an Indonesian online travel unicorn.

As these strategic investment tools receive substantial funding from their respective governments, the latter also adopt a “market-oriented” approach in assessing the funds’ performance to encourage proactiveness and dynamism. Specifically, the evaluation of Temasek and GIC is based on the overall portfolio performance rather than individual investments.

For INA, profits are used to set up a mandatory reserve fund (until it reaches 50% of INA’s capital), and the remainder is retained for reinvestment. The INA Board of Directors (in consultation with the Supervisory Board) determines the allowable limit for INA’s investment losses.

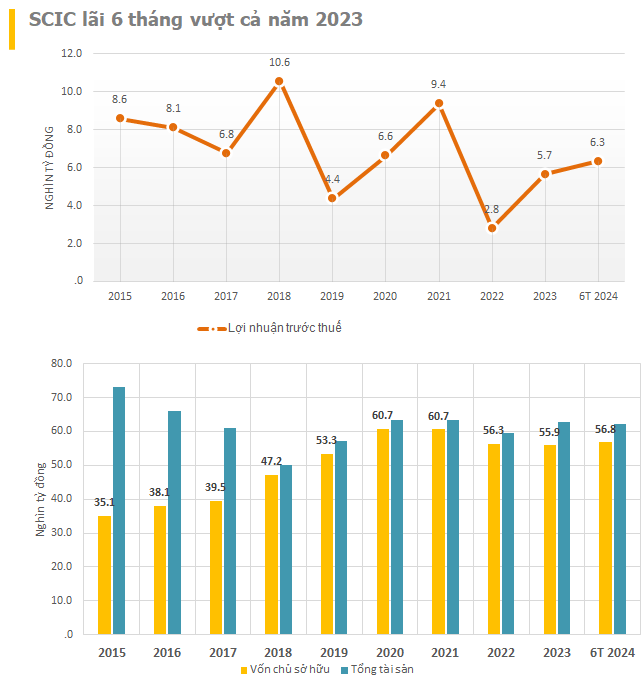

SCIC: DISBURSED INVESTMENT CAPITAL OF VND 37,600 BILLION IN OVER 18 YEARS

According to statistics, in over 18 years, SCIC has received 1,080 enterprises with state capital of more than VND 32,339 billion. It has successfully divested from 1,054 enterprises, collecting VND 51,668 billion, 4.1 times the book value. It has also arranged the equitization of 31 enterprises.

- SCIC achieved an average ROE of 13%/year during this period. It contributed VND 92,245 billion to the state budget and disbursed VND 37,600 billion in investment capital.

Compared to its establishment, as of the end of 2023, SCIC’s revenue increased by 52 times, after-tax profit by 72 times, owner’s equity by 17 times, and total assets by 12 times. The main business indicators have grown continuously, with each year surpassing the previous one.

The achievements of SCIC are significantly contributed by its system of Representatives. They are the “extended arms” of SCIC, helping the Corporation become a dynamic shareholder and an effective investor in enterprises.

“While the economic efficiency has been proven by data, what is more important is what we can achieve through this model in the new phase to do even better,” said expert Vo Tri Thanh.

Mr. Vo Tri Thanh assessed that SCIC has been approved for a development strategy that includes many good ideas, such as evaluating the overall results rather than individual projects… For organizations like SCIC, it is necessary to separate the highly market-oriented “game” from the tasks assigned by the State…

To make SCIC a “professional investor,” reforming it according to the approved strategy requires institutional reforms applicable to the Corporation, enabling the enterprise to restructure and enhance its capacity.

One of SCIC’s two critical roles is investing and doing business with capital, which needs to be promoted and prioritized in efficient sectors and critical and essential fields that the State needs to hold and where investment can “pave the way.” SCIC has the advantage of attracting investment capital, creating spillover and leading effects, and opening doors for other economic sectors to invest and develop together.

The 200-Year-Old Engineering Marvel That Could Save the Mekong Delta from Salinity Intrusion and Set a Record in Vietnam

The engineering marvel has been a stalwart of national defense and economic prosperity over the last two centuries. This structure has the potential to save the Mekong Delta from the ravages of natural disasters and bring about a new era of resilience and prosperity for the region.

The Prime Minister: Vietnam’s Focus on Iconic Mega-Projects

Addressing the Vietnamese community in Brazil, Prime Minister Pham Minh Chinh emphasized Vietnam’s current focus on large-scale, transformative projects. These include the ambitious North-South high-speed rail project, which aims to revolutionize transportation across the country, as well as explorations into nuclear energy development and the pursuit of new avenues for growth and progress.

High-Speed North-South Railway: A Massive Opportunity, but…

The upcoming high-speed rail project presents an enormous opportunity for Vietnamese businesses to undergo a significant transformation. Experts believe that local enterprises must collaborate and invest in technology to take on this iconic national project. If Vietnamese businesses fail to unite and embrace technological advancements, we risk losing out on our home turf.

The Evolution of Trade Figures Between Vietnam and Russia

Vietnam’s trade with the Russian Federation has reached 3.52 billion USD in the first three quarters of this year, a significant 41% increase compared to the same period last year. This has sparked a growing interest from Vietnamese enterprises, with many delegations traveling to Russia to explore market opportunities.