Businesses in the supporting industries sector are eager to access interest-free loans under Ho Chi Minh City’s investment stimulus program. Photo: U.Phuong |

This information was announced at a conference on deploying interest rate support policies for investment projects in key industries, supporting industries, and logistics in the city. The conference, organized by the Ho Chi Minh City Department of Industry and Trade and the Ho Chi Minh City Finance and Investment Company (HFIC), aimed to expedite the implementation of interest rate support policies for eligible investment projects, thereby reducing the financial burden on investors.

At the conference, Mr. Nguyen Quang Thanh, Deputy General Director of HFIC, shared that the loan program for projects in the four key industries, supporting industries, and logistics will span five years. The borrowers are 100% domestic enterprises implementing projects in Ho Chi Minh City and public units.

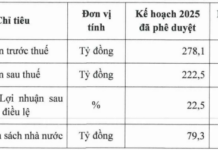

HFIC will offer an interest rate of 0% on an amount of up to VND 200 billion per project, with a loan term of seven years, to facilitate businesses’ investment in new machinery, equipment, and factories. The sectors prioritized by HFIC include high technology, digital transformation, startups, innovation, trade and agricultural production, healthcare, education and training, vocational education, culture and sports, economic infrastructure, technical infrastructure, and the environment.

The supporting industries that are eligible for interest rate support include automation mechanics, rubber and plastics, pharmaceuticals, food processing, electronics and information technology, textiles and garments, and leather and footwear. These industries will benefit from a support level of 50% or 100% and a maximum loan amount of up to VND 200 billion per project.

As for the logistics sector, the interest rate support is set at 50%, meaning borrowers will only pay interest on half of the loan amount. The interest rate is calculated using the 12-month average savings rate of four large banks (Vietcombank, Agribank, BIDV, and VietinBank) plus 2-2.2%. To access this support, businesses must meet HFIC’s project appraisal criteria and provide collateral to ensure debt repayment capability.

|

The interest rate support policy for investment projects in the four key industries and supporting industries in Ho Chi Minh City is implemented according to Resolution No. 98/2023/QH15 and Resolution No. 09/2023/NQ-HĐND. It applies to all 100% domestic enterprises, including those headquartered in other localities, provided they have investment programs or projects in the city. |

Mortgaging Future Assets

Despite the positive news, many businesses in various sectors, including supporting industries, face a significant barrier: the lack of collateral to secure the loans.

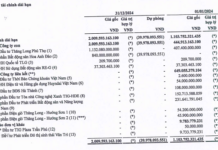

Addressing these concerns, the leadership of the Ho Chi Minh City Finance and Investment Company affirmed their willingness to accept mortgages on future assets. However, these assets will be valued at approximately 50% of the purchase price, determining the loan amount.

“Businesses with investment project ideas can contact HFIC for project feasibility advice to access the 0% interest rate. Enterprises that do not qualify for interest rate support for investment projects in the four key industries, supporting industries, and logistics but fall within the sectors that HFIC is targeting will be eligible for long-term loans at the current interest rate of 6.7% per annum,” said Mr. Thanh.

HFIC representatives also reminded project investors participating in the program to refrain from signing contracts with contractors and suppliers for construction, equipment, and technology packages. Enterprises can use the assets formed from the borrowed capital as collateral when signing the loan agreement.

According to Ms. Nguyen Thi Kim Ngoc, Deputy Director of the Ho Chi Minh City Department of Industry and Trade, the industry plays a crucial role in driving the city’s socio-economic development. The policies and solutions for industrial development are being adjusted to be more practical and aligned with the reality of enterprises. The city is focusing on developing high-tech industries and producing high-tech products, fostering research, development, and innovation, embracing smart manufacturing and regional linkage, and promoting structural transformation within the industry toward automation, intelligent production processes, and the use of clean and renewable energy.

Uyen Phuong

Why Do Businesses Still Struggle Despite 0% Long-Term Loans?

“The financial powerhouse of Ho Chi Minh City, the State Financial Investment Company, is offering an unprecedented opportunity for select priority sectors. They are committed to supporting these sectors by providing a 100% interest rate subsidy on loans for eligible projects. This bold move underscores the city’s dedication to fostering growth and development in key areas.”

The Ultimate Guide to Tay Ninh’s Inter-District Development Plan: Unveiling the Strategic Region Bordering Ho Chi Minh City

On October 31st, Mr. Nguyen Thanh Ngoc, Deputy Secretary of the Provincial Party Committee and Chairman of the People’s Committee of Tay Ninh province, along with Vice-Chairmen Nguyen Hong Thanh and Duong Van Thang, chaired the regular meeting of the Provincial People’s Committee for October. The meeting discussed several important matters.

The Hoard of ‘Staggering’ Evidence and Assets Seized in the Van Thinh Phat Group Case

As of now, the total amount held in the account of the Ho Chi Minh City Department of Civil Judgment Enforcement, transferred by the Ministry of Public Security’s Investigation Agency and deposited by individuals and organizations in the Van Thinh Phat case, stands at over VND 4,250 billion and USD 27 million (equivalent to VND 685 billion).