The trading session on November 19 saw the stock market continue its downward trend, with the VN-Index closing at 1,205 points, an 11.97-point drop from the previous session.

In this market backdrop, shares of NVL, belonging to Novaland Group, a leading real estate investment corporation, witnessed a surprising surge. By the end of the trading session, NVL shares climbed to 10,750 VND per share, a 1.9% increase from the previous day’s closing price. The number of Novaland shares traded was over 12 million, the highest in the last four sessions.

Despite this rally, the current share price is still 36% lower than at the beginning of 2024.

Aqua City project of Novaland Group

On November 19, the Chairman of the People’s Committee of Dong Nai province, Mr. Vo Tan Duc, signed Decision No. 3479, officially approving the local adjustment of the master plan at the 1/10,000 scale. This marked a crucial step in resolving legal issues for the Aqua City project, which had been pending for over two years.

The recently announced adjustments focus on population scale and land use indicators in sub-area C4, which is part of the urban area west of the Bien Hoa – Vung Tau expressway. This legal step is significant in unblocking numerous projects of various enterprises, ensuring synchronization with subsequent planning levels, and paving the way for the completion of the sub-area C4 master plan and detailed planning at a 1/500 scale for the Aqua City project, expected by early 2025.

Currently, NVL stock is on the warning list of the Ho Chi Minh City Stock Exchange (HoSE) since September 23, 2024, due to Novaland’s delayed submission of its semi-annual reviewed financial statements for 2024, exceeding the deadline by more than 15 days as per regulations.

Towards the end of October, Novaland sent a document to the State Securities Commission of Vietnam (SSC), HoSE, and the Hanoi Stock Exchange (HNX), explaining and reporting on the progress of resolving the situation that led to the warning.

Novaland stated that regarding the semi-annual reviewed financial statements for 2024 and related explanations as required by law, the company had completed the disclosure of information on September 26, 2024.

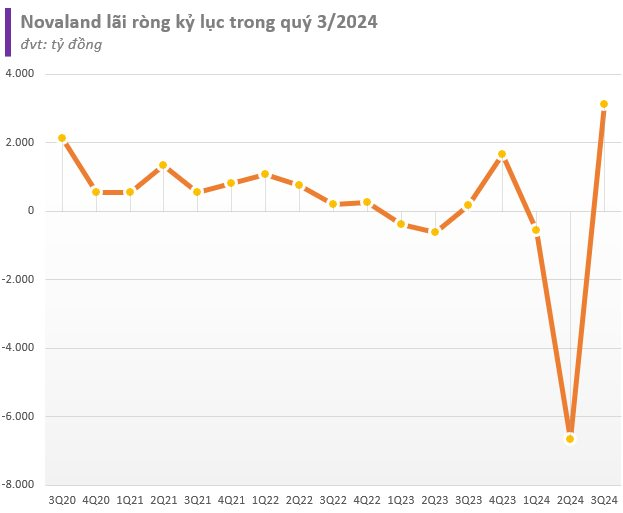

According to the recently published consolidated financial statements for the third quarter, Novaland recorded consolidated net revenue of VND 2,010 billion, nearly double that of the same period last year. Financial income also soared by 2.4 times year-on-year to nearly VND 3,900 billion.

As a result, profit after tax surged to over VND 2,950 billion, 21.5 times higher than the same period last year. Of this, profit after tax attributable to the parent company’s shareholders was over VND 3,100 billion, the highest since its listing.

However, the cumulative profit after tax for the first nine months remained heavily negative at VND 4,377 billion, mainly due to the record loss in the second quarter. The net loss attributable to the parent company’s shareholders was over VND 4,100 billion, compared to a loss of VND 841 billion in the same period in 2023.

Novaland’s consolidated financial statements for the third quarter of 2024

“The Art of the Written Word: Mastering the Craft of Compelling Content”

The VN-Index surged, slicing through the 200-day SMA resistance. For the bullish momentum to be sustainably reinforced, trading volume needs to surpass the 20-day average. The Stochastic Oscillator has already signaled a buy in oversold territory. If the MACD indicator follows suit in upcoming sessions, the short-term outlook will turn even more optimistic.

The Cautious Sentiment Rises

The VN-Index staged a mild recovery, with a slight uptick in the session, but this was accompanied by a significant plunge in trading volume, falling below the 20-day average. This indicates that investor sentiment remains cautious following the recent downturn. The Stochastic Oscillator and MACD indicators continue to trend downward after issuing sell signals, suggesting that the short-term outlook remains bearish.

The Gloomy Sentiment Subsides

The VN-Index edged higher and rebounded after a recent streak of losses. Accompanying this rebound was a trading volume that surpassed the 20-day average, reflecting a relatively optimistic sentiment among investors. However, the Stochastic Oscillator has signaled a resumption of selling, and the MACD indicator is conveying a similar message. This suggests that the short-term outlook remains pessimistic.

The Beat of the Market: Investors Sell-Off with a Wave of Pessimism

The market closed with the VN-Index down 13.32 points (1.08%), settling at 1,218.57; the HNX-Index also ended below the reference level at 221.53 points. The market breadth tilted towards sellers, with 546 declining stocks against 193 advancing ones. The VN30-Index basket was mostly red, recording 26 losses, 3 gains, and 1 stock referencing.