“Vietbank Strengthens Financial Position and Expands Nationwide Network”

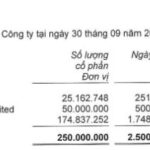

On November 14, 2024, Vietbank received confirmation from the State Securities Commission regarding the submission of documents related to its stock dividend issuance. Based on the approval from the State Bank and confirmation from the State Securities Commission, Vietbank will proceed with the necessary steps to complete its charter capital increase as per the plan approved at the 2024 Annual General Meeting of Shareholders.

Specifically, Vietbank will increase its charter capital by VND 1,428 billion by issuing 142.8 million shares as stock dividends from retained earnings as of December 31, 2023, equivalent to a dividend allocation rate of 25% of the total outstanding common shares, including shares issued to existing shareholders under Resolution 01/2023/NQ-ĐHĐCĐ.

The additional capital is expected to be utilized for investing in assets, supplementing capital for business development, expanding its network, ensuring compliance with safety ratios, and enhancing the profitability of Vietbank’s operations. The expected completion date for this capital increase is December 31, 2024.

With this capital increase, Vietbank’s charter capital will rise to VND 7,139 billion, a 36-fold increase compared to its establishment in 2007, reflecting the bank’s continuous efforts to enhance its financial strength. Vietbank remains committed to safe, sustainable, and efficient growth, striving for excellence in governance and compliance with international standards, and the requirements of the Law on Credit Institutions, Enterprise Law, and Securities Law as a large-scale public company.

To strengthen the role of the Board of Directors and enhance flexibility in governance and operations, on November 15, 2024, Vietbank completed the process of obtaining shareholder approval via written resolutions to amend and supplement the Bank’s Charter in accordance with regulations. This move facilitates the bank’s focus on its network expansion strategy and the introduction of new services for customers, thereby actively contributing to the country’s economic growth.

Nationwide Network Expansion with a Focus on Digital Transformation

In November, Vietbank will consecutively inaugurate two new branches in Ca Mau and Binh Phuoc, marking a significant step forward in its southern market expansion strategy. The management team is confident that Vietbank Ca Mau and Vietbank Binh Phuoc will meet the diverse financial needs of individual and corporate customers, especially their capital requirements, thereby fostering local and national economic development.

Along with the opening of the Ca Mau and Binh Phuoc branches, Vietbank will also establish new transaction offices, including Vietbank Bai Chay (Quang Ninh province), Vietbank Thanh Hoa (Thanh Hoa province), Vietbank Ben Cat (Binh Duong province), Vietbank Buon Ho (Dak Lak province), and Vietbank Lam Dong (Lam Dong province). By the end of 2024, Vietbank is expected to have 132 branches and transaction offices, confidently meeting the financial needs of a growing customer base. This expansion connects various economic sectors and contributes to growth in localities across the country.

In addition to network development, Vietbank is channeling its resources into digital transformation, service diversification, and quality enhancement. The bank remains committed to maintaining and strengthening its infrastructure and information technology systems to ensure uninterrupted and secure business operations.

With its focus on enhancing financial capacity, improving governance and operations, expanding its network, and embracing digital transformation, Vietbank has laid a solid foundation for its growth trajectory in 2025 and beyond.

Services

The Government Directs the State Bank of Vietnam to Finalise the Plan for SCB’s Resolution by December

The government has instructed the State Bank of Vietnam to promptly finalize and submit to the competent authority a proposal for the mandatory transfer of the remaining banks under special control. They have also been tasked with finalizing a handling plan for the Saigon Commercial Joint Stock Bank (SCB) by December 2024.

“Digital Illiteracy: The Stumbling Block to Successful Digital Transformation”

A “test-and-learn” or “fail-forward” culture is pivotal for businesses to thrive in today’s dynamic marketplace. This approach fosters an environment where innovation and creativity are nurtured, allowing organizations to stay agile and responsive to market demands. By embracing a culture that encourages calculated risks and treats failures as learning opportunities, businesses can unlock their true potential and gain a competitive edge. This mindset shift empowers employees to challenge conventions, explore new ideas, and drive meaningful change. As a result, organizations can adapt quickly, make informed decisions, and deliver exceptional products and services that meet and exceed customer expectations. Embracing a “test-and-learn” philosophy is a testament to the organization’s commitment to continuous improvement, ensuring they remain resilient and relevant in an ever-changing business landscape.

Samsung Launches BED-H Series: Tailored TV Solutions for SMEs

The Samsung BED-H Series commercial TVs are renowned for their energy efficiency and operational prowess, catering to a diverse range of business needs. From retail stores and cafes to restaurants and complex digital content management systems, these TVs offer a dynamic solution. With their exceptional performance and energy-saving capabilities, the BED-H Series TVs are the perfect choice for any enterprise seeking a seamless blend of functionality and efficiency.

“A Bank Prepares to Dish Out a Whopping 25% Dividend”

“The bank is set to release almost 142.8 million new shares as a dividend payout to its shareholders. This move underscores the bank’s commitment to returning value to its investors and underscores a strategy of sharing profits with those who have placed their trust in the institution.”

Is Kafei Securities Upping its Capital Raising Game to 5,000 Billion VND?

The company Kafi is seeking shareholder approval for a new proposal. From November 18 to November 28, 2024, Kafi will be soliciting written feedback from its shareholders regarding a proposed alternative to the previously approved plan. This new proposal aims to present a revised strategy that better aligns with the company’s long-term vision and goals.