## The Water and Securities Sector Entrepreneur: Unraveling the Success of Mr. Dương Tiến Dũng

The Man Behind a Series of Enterprises in the Water and Securities Industries

Mr. Dương Tiến Dũng (born in 1954), a native of Tien Giang and born in Dong Thap, is well-known as the father of runner-up Duong Truong Thien Ly, the wife of Mr. Nguyen Quoc Toan, the former chairman of a bank.

Few people know that Mr. Dung used to be a lecturer and head of the department at the University of Natural Sciences under Vietnam National University, Ho Chi Minh City, from 1978 to 2014. After retiring, Mr. Dung, together with his daughter, built a thousand-billion-dollar ecosystem spanning industries such as water, securities, real estate, and energy.

The core business of Mr. Dương Tiến Dũng’s family is in the water industry with the legal entity, Joint Stock Company Cap Thoat Nuoc Thuy Anh, established in 2014. Mr. Dung holds 91% of the charter capital (equivalent to VND 455 billion), while his daughter, Ms. Duong Thi Duyen Hai, holds 4.5%, and Ms. Nguyen Thi Kim Phuong holds the remaining 4.5%.

Mr. Dương Tiến Dũng (furthest left) at the wedding of runner-up Duong Truong Thien Ly.

In 2015, Mr. Dung and Cap Thoat Nuoc Thuy Anh became major shareholders in Binh Dinh Water Supply and Drainage Joint Stock Company, with ownership ratios of 5% and 24.9%, respectively. In November of that year, the businessman born in 1954 became a member of the Board of Directors of Binh Dinh Water Supply and Drainage JSC.

In August 2016, Mr. Dung and his daughter transferred 91% of the capital in Cap Thoat Nuoc Thuy Anh to Ms. Tran Thi Y, who shares the same registered address as Mr. Dung.

In 2017, the Board of Directors of Cap Thoat Nuoc Thuy Anh nominated Mr. Dương Tiến Dũng, representing 17.38% of the ownership ratio in Ben Tre Water Supply and Drainage Joint Stock Company, to the Board of Directors of the company. That same year, Ms. Tran Thi Y handed over the position of Chairman of the Board of Directors and General Director of Cap Thoat Nuoc Thuy Anh to Mr. Dung.

By 2018, Mr. Dung’s wife, Ms. Truong Thi My An, along with Cap Thoat Nuoc Thuy Anh, continued to become a major shareholder in Lam Dong Water Supply and Drainage Joint Stock Company. Mr. Dương Tiến Dũng served as a member of the Board of Directors from June 2018 until May 27, 2023.

In the securities industry, Mr. Dương Tiến Dũng and his wife, along with related legal entities, hold up to 70% of the charter capital of Bao Minh Securities Joint Stock Company. Specifically, as of June 30, 2024, Rong Ngoc Joint Stock Company, in which Mr. Dương Tiến Dũng holds 23% and Ms. Truong Thi My An holds 23%, is a major shareholder.

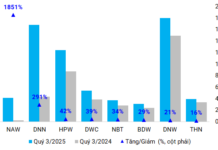

Mr. Dương Tiến Dũng’s shareholder group holds up to 70% of Bao Minh Securities

Rong Ngoc Joint Stock Company was established on July 14, 2016, with a charter capital of VND 500 billion, comprising three founding shareholders: Ms. Duong Truong Thien Ly owning 80% of the shares, Ms. Nguyen Thi Ngoc Tram holding 10% of the shares, and Mr. Tran Ngoc Nhat holding the remaining 10%.

Data also shows that in 2020, the parents of runner-up Duong Truong Thien Ly had pledged their shares in Bao Minh Securities at a bank.

## Close Relationship with the Hoan Cau Group

Mr. Dương Tiến Dũng’s family also invests in several banks through the legal entity, Dust Control Technology Company Limited (currently inactive and with a closed tax code).

Notably, in 2017, Mr. Dương Tiến Dũng replaced Mr. Nguyen Chan, the husband of the late businesswoman Tu Huong, to own 98% of the charter capital (equivalent to VND 1,146.6 billion) at Hoan Cau Company Limited (Hoan Cau Group).

At that time, Mr. Nguyen Chan’s transfer of shares worth more than VND 1,100 billion to his in-laws raised many questions in public opinion. However, in July 2018, Mr. Dung’s portion of the capital was transferred to Mr. Phan Dinh Tan. Mr. Tan then became the owner of 99% of Hoan Cau’s capital, with the remaining 1% held by another individual.

Regarding Mr. Dương Tiến Dũng’s relationship with his in-laws, it is worth mentioning the legal entity named Pacific Dragon Company Limited, established in October 1999, with a charter capital of VND 90 billion.

The founding shareholder, holding 99.67% of the shares, was Mr. Nguyen Quoc Toan (Mr. Dung’s son-in-law). By the end of 2012, Mr. Toan’s wife, runner-up Duong Truong Thien Ly, owned 99.94% of the shares. However, this shareholding was later transferred to Ms. Dao Thi Dieu until June 2016.

In early 2015, Pacific Dragon was announced to hold 14.26% of the charter capital of a bank. By August 2018, Mr. Dương Tiến Dũng became the owner of 80% of Pacific Dragon’s shares, while Ms. Nguyen Thi Kim Phuong held the remaining 20%.

However, just three months later (November 2018), Mr. Dương Tiến Dũng divested. The new shareholders were Mr. Nguyen Van Hoang and Ms. Kim Phuong, each holding 50% of Pacific Dragon’s shares.

It is evident that the businessman born in 1954 only directly held shares in enterprises for a short period. A similar situation occurred with Hoan Cau Solar LA Joint Stock Company, the enterprise known as the investor of the Solar Park Energy Park project in Duc Hue district, Long An province.

Hoan Cau Solar LA was established in April 2018. The founding shareholders included Hoan Cau Long An One-Member Limited Liability Company (contributing VND 50 billion, or 20% of the capital), Hoang Gia Hotel Management Joint Stock Company (contributing VND 50 billion, or 20%), and Mr. Dương Tiến Dũng (contributing VND 150 billion, or 60%). Nonetheless, just one month later, he no longer held these shares.

Additionally, the father of runner-up Duong Truong Thien Ly is a founding shareholder, holding 96% of the capital of Vinaland Valuation Joint Stock Company.

Currently, Mr. Dương Tiến Dũng is the only representative of Diamond Nha Trang One-Member Limited Liability Company. This company was established in 2017 and operates in the field of short-term accommodation services. With a charter capital of VND 500 billion, Mr. Dung owns 97%, equivalent to VND 485 billion, while the remaining 3% belongs to Ms. Tran Thi Truc Linh.

Ha Ly