The trading market was very slow during the morning session as investors awaited the derivatives expiration in the afternoon. The total matched order value on HoSE and HNX decreased by 58% compared to yesterday morning, reaching just over VND 3,368 billion, the lowest level since April 2023. Despite this, the breadth data still showed a balanced differentiation.

In the context of such low liquidity, stock prices are not very reliable. Only 64 stocks on the HoSE floor had liquidity of VND 10 billion or more, with 30 stocks rising and 24 falling. This correlation is also consistent with the overall breadth of 166 gainers and 153 losers of the VN-Index.

The sudden drop in trading is not due to a problem with capital flow, but rather investors temporarily limiting their activities. After a highly volatile session yesterday, the market needs to calm down for supply and demand to be clearly revealed. Buying capital this morning was very small, and if selling pressure continues to increase, similar to yesterday morning, stock prices will surely fall in droves.

On the other hand, the balance in this situation reveals the calmness of both sides, especially when foreign investors are still selling a lot. The total value of stocks dumped on HoSE was about VND 1,093 billion, and the net selling value reached VND 663 billion. In fact, this selling volume accounted for approximately 31% of the total trading value on the HoSE floor in the morning. Not all stocks that were heavily net sold performed poorly: VHM inched up 0.12% with a net sell value of VND 207.3 billion; HPG rose 0.59% with a net sell of VND 73.1 billion; MWG climbed 0.35% with a net sell of VND 43.3 billion; MSN gained 0.14% with a net sell of VND 20.9 billion. The losers were SSI, down 0.82% with a net sell value of VND 68.3 billion; FPT fell 0.83% with a net sell value of VND 53.8 billion; KBC dropped 1.3% with VND 44.3 billion.

Statistics also show that a large proportion of stocks are in the group with small fluctuations of less than 1%. Specifically, out of the 166 green ticks of the VN-Index, only 44 stocks rose more than 1% with liquidity accounting for 8% of the floor’s trading value. Of the 153 losing stocks, 38 fell more than 1%, focusing on 5.8% of the floor’s liquidity. Thus, even with extremely poor overall liquidity, the capital allocation remains suitable for a narrow-range fluctuating state.

The stocks that rose the most this morning were based on the advantage of not having enough liquidity. Notably, only VTP rose 4.16% matching VND 87.7 billion; TCB increased by 1.43% matching VND 61.5 billion; VRE climbed 1.4% matching VND 47.8 billion; CTR rose 1.29% matching VND 16.4 billion. Stocks such as TCO, TDH, LSS, D2D, FIR, CIG… also rose sharply, but liquidity is not guaranteed to stabilize these prices. The losers were similar, with only a few notable stocks: KBC fell 1.3% matching VND 72.6 billion; CMG dropped 1.67% matching VND 19.3 billion; EIB fell 1.38% matching VND 11.8 billion; CTD decreased by 1.53% matching VND 10.8 billion. CTF, QCG, NO1, ACC, and KSB fell sharply with liquidity below VND 10 billion.

The blue-chip group this morning also did not play a clear role. Although in terms of points, VCB, BID, HPG, GAS, VNM, and VPB are still supporting VN-Index the most, but the increase is very weak. The weakest, FPT, fell only 0.83%. VN30-Index rose slightly by 1.01 points with record low liquidity, reaching only VND 1,797 billion, even less than VHM and FPT’s trading value yesterday. In return, the breadth of 14 gainers and 7 losers also showed that in the context of weak liquidity, there was no significant selling pressure.

VN-Index rose slightly by 1.21 points (+0.1%) this morning and continued to maintain a distance from the sensitive 1200-point zone. After three highly volatile sessions, the market is looking for a “supply depletion” signal in this support area. The extremely low liquidity this morning is also a good condition to evaluate this signal.

The First Public Land in Ba Ria-Vung Tau Eligible for Auction

On November 17, the Department of Natural Resources and Environment in Ba Ria-Vung Tau province announced that a 1.8-hectare land plot in Phu My town, designated for healthcare purposes, will be auctioned on December 12. This is the first provincial land plot that meets all legal and planning requirements for auction.

The Cash Flows Strongly into the Banks

According to the latest data released by the State Bank of Vietnam, resident deposits reached over VND 6,920 trillion by the end of August 2024, a 6% increase compared to the end of 2023. This significant growth showcases the thriving economy and the confidence of residents in the country’s financial system.

What Does the SBV’s Net Injection Move Mean?

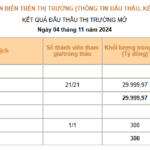

The recent net injection by the SBV on November 4th is a strong move to support liquidity, especially amidst the surging USD/VND exchange rate in both the official and free markets. The SBV’s intervention sends a clear message of their commitment to stabilizing the currency market and shielding the domestic financial sector from excessive volatility.