Exchange rate pressure has cooled in the last two sessions, but foreign investors continue to sell, with today’s volume even higher than yesterday’s terrifying level.

The relentless and intense selling pressure has overwhelmed domestic investors, causing the Vn-Index to plunge by nearly 12 points to 1,205. The breadth was extremely negative, with 287 declining stocks compared to just 83 advancing ones. Today’s market downturn erased all the previous session’s gains, with average losses of 1-2%. Notably, MBS fell by almost 3%, while VCI and SHS dropped by 2.27%, VIX by 3.23%, and SSI by 1.85%. Among the foreign banks, while BID and CTG were propped up, VCB fell by 1.1%, VPB by 1.07%, MBB by 1.07%, and TCB by 0.22%.

Similarly, in the real estate sector, while VHM surged by 3.43%, VIC and VRE declined by 0.12% and 1.1%, respectively, and KBC fell by an additional 3.63%. DXG, KDH, and PDR also experienced aggressive selling, with QCG hitting the floor. Most other sectors faced strong selling pressure, including steel, fertilizers, chemicals, and telecommunications, which plunged by 6.05%. The trio of VGI, CTG, and FOX in this sector declined by 6.23%, 6.32%, and 5.53%, respectively. In the information technology sector, FPT tumbled by 3%, and CMG also hit the floor.

The market’s risk in the coming sessions stems from the still-weak sentiment among domestic investors. The VN-Index approached the 1,200-point mark, but buying interest was minimal, with the three exchanges’ liquidity plunging to less than VND 15,000 billion.

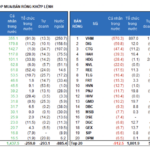

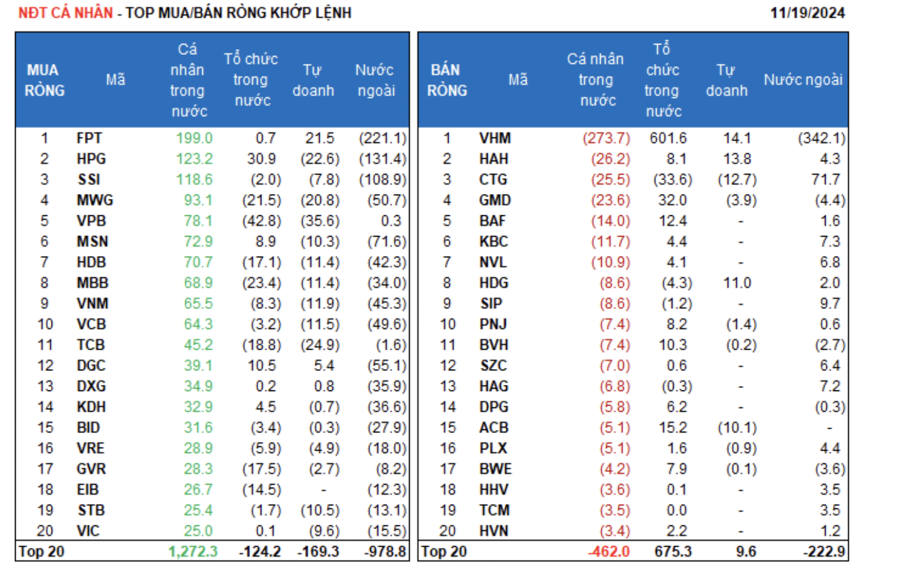

Foreign investors sold a net VND 1,522.5 billion, and their net selling on the matching board alone was VND 1,459.2 billion.

Their net buying on the matching board was mainly in the Electricity, Water & Oil Gas sector and the Personal & Household Goods sector. The top net bought stocks by foreigners on the matching board were CTG, SIP, GAS, KBC, FUEVFVND, HAG, NVL, SZC, PLX, and HAH.

On the other hand, their net selling on the matching board was focused on the Real Estate sector. The top net sold stocks by foreigners on the matching board were VHM, FPT, HPG, SSI, MSN, MWG, VCB, VNM, and HDB.

Individual investors bought a net VND 1,386.7 billion, of which VND 1,112.0 billion was net bought on the matching board.

On the matching board, they net bought 12 out of 18 sectors, mainly in the Banking sector. Their top net bought stocks were FPT, HPG, SSI, MWG, VPB, MSN, HDB, MBB, VNM, and VCB.

On the net selling side, they net sold 6 out of 18 sectors, mainly in the Real Estate and Industrial Goods & Services sectors. Their top net sold stocks were VHM, HAH, CTG, GMD, BAF, KBC, HDG, SIP, and PNJ.

Proprietary trading accounted for a net sell of VND 150.6 billion, and on the matching board alone, it was VND 192.6 billion.

On the matching board, proprietary trading net bought 6 out of 18 sectors, with the strongest being Information Technology and Industrial Goods & Services. The top net bought stocks by proprietary trading today were FPT, VHM, HAH, HDG, VHC, DGC, TLG, SAB, PVT, and APH. On the other hand, their top net sold sector was Banking. The top net sold stocks were VPB, TCB, HPG, MWG, CTG, GAS, VNM, VCB, MBB, and HDB.

Domestic institutional investors bought a net VND 439.6 billion, and on the matching board, they bought a net VND 539.7 billion.

On the matching board, domestic institutions net sold 7 out of 18 sectors, with the largest value being in the Banking sector. Their top net sold stocks were VPB, CTG, MBB, MWG, TCB, GVR, HDB, EIB, VNM, and TPB. Their net buying was most significant in the Real Estate sector. The top net bought stocks were VHM, GMD, HPG, ACB, GEX, BAF, DGC, BVH, MSN, and PNJ.

Today’s matched transactions totaled VND 2,240.2 billion, down 10.3% from the previous session and accounting for 15.2% of the total trading value.

Notable matched transactions today included nearly 5.4 million MSN shares worth VND 378.5 billion traded between individual investors.

Individual investors also transacted in the Banking sector stocks (HDB, SHB, EIB, LPB) and FPT.

The money flow allocation increased in Real Estate, Construction, Agricultural & Marine Products, Electrical Equipment, Software, Warehousing & Logistics, and Water Transport while decreasing in Banking, Securities, Steel, Chemicals, Food, and Retail.

On the matching board, the money flow allocation increased in the mid-cap VNMID and small-cap VNSML groups but decreased in the large-cap VN30 group.

The Greenback Soars to Record Highs in Bank Rates

This afternoon (November 13th), the selling price of USD at all commercial banks surged to 25,502 VND per USD, the highest level in history. The central exchange rate also reached an all-time high.

The Bottom Fishing Lure: A Tantalizing Strategy for Investors.

The market witnessed a few more minutes of price suppression at the start of the afternoon session before bottom-fishers stepped in. The breadth changed slowly, but the indices climbed quickly, indicating that large-cap stocks were leading the charge. As the momentum spread, hundreds of stocks surged past reference levels, and hundreds of others narrowed their losses significantly. The market staged a strong signaling session around the 1200-point mark.

The Capital is Crumbling: VN-Index Plunges Towards the 1200-Point Region

The large-cap stocks’ plunge today erased the gains from yesterday’s bargain hunting session. VN-Index fell sharply by nearly 12 points to 1205.15, as foreign investors offloaded a net sell of VND 1,658 billion. To make matters worse, the trading volume on the HoSE plunged to a two-week low.