In its latest revision, the bank has adjusted the interest rate on a specific type of deposit. For a 24-month term deposit with a balance of 500 billion VND or more, the interest rate has been increased from 5.8% to 6% per annum, with interest paid at maturity.

The bank has maintained the interest rates on other types of regular deposits. Currently, the interest rates on savings accounts with terms ranging from 1 to 36 months, with interest paid at maturity, are listed between 3.6% and 6.2% per annum for individual customers.

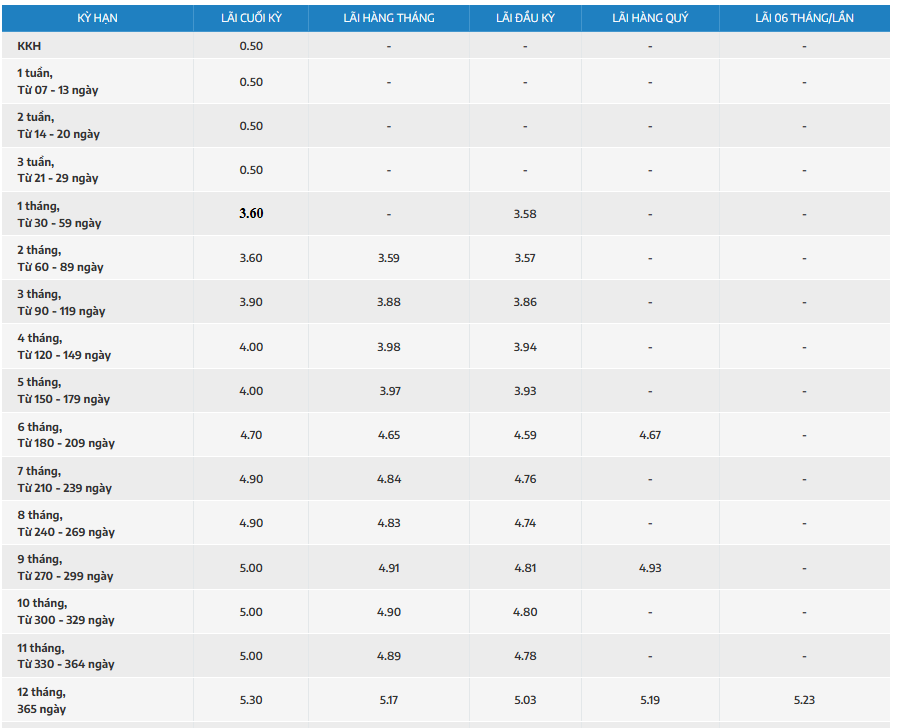

The savings interest rates for 1 to 2-month terms are set at 3.6% per annum, while the rate for a 3-month term is 3.9%. For 4 to 5-month terms, the rate is 4% per annum, and for a 6-month term, it is 4.7%. The interest rates for 7 to 8-month terms are 4.9%, and for 9 to 11-month terms, the rate remains at 5% per annum.

Nam A Bank’s counter deposit interest rates.

For 12 to 13-month terms, the interest rate is listed at 5.3% per annum, while for 14 to 17-month terms, it is 5.4%. The savings interest rate for 18 to 35-month terms is set at 5.6% per annum.

Customers who opt for a 24-month term with a balance below 500 billion VND will be offered the interest rate applicable to a 23-month term, which is 5.6% per annum. Similarly, customers with a 36-month term and a balance below 500 billion VND will receive the interest rate for a 35-month term.

For balances of 500 billion VND or more in a 36-month term, an interest rate of 6.2% per annum will be applied, subject to the approval of the General Director. Nam A Bank also mentions that for deposits with terms of 6 months or more, customers have the option to negotiate specific interest rates with the bank, based on the published interest rate tables and market supply and demand for capital.

Prior to this, Nam A Bank had also adjusted its online savings interest rates, effective from November 15. The online rates for 1 to 36-month terms currently range from 4.5% to 5.9% per annum.

The Financial Currency Market: A Stable Investment Haven

According to a report by the Ministry of Planning and Investment, despite facing challenges and difficulties, the economy in October and the ten-month period showed a strong recovery. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.

The Bank That Offers the Highest Savings Rates on the Market

Introducing our bank’s highly competitive interest rates that are sure to catch your eye. With our diverse range of term options, we’re proud to offer market-leading rates that go beyond the standard 1-month maturity period. Discover a world of financial opportunities where your money works harder and smarter, unlocking the path to a secure and prosperous future.

Gold Prices Plunge as Fed Rate Cut Hopes Fade

Investors are cautiously awaiting the Fed’s September meeting minutes and the latest inflation data from the US Labor Department.