Illustrative image

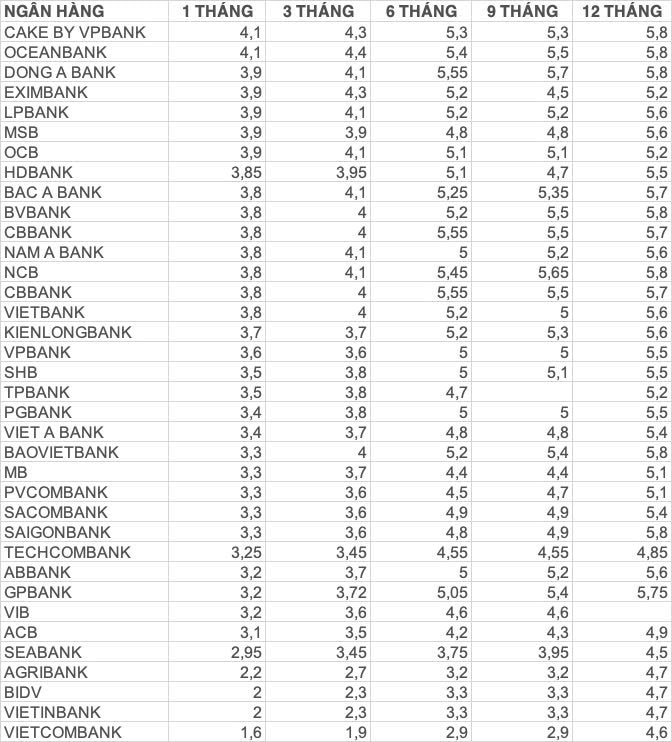

Digital bank Cake by VPBank has recently announced a new deposit interest rate framework effective from 5:00 PM on October 22. Notably, the bank has increased the interest rate for 1-month term deposits by 0.1% p.a. to 4.1% p.a.

With this adjustment, Cake by VPBank now offers the highest interest rate for 1-month term deposits in the market, on par with OceanBank and twice as much as state-owned banks such as Agribank, VietinBank, and Vietcombank.

Source: Author’s compilation from bank websites

In addition to the 1-month term, Cake by VPBank’s interest rates for other tenors are also among the highest in the market. Specifically, the bank is offering an interest rate of 4.3% p.a. for 2-5 month terms, 5.3% p.a. for 6-11 month terms, 5.8% p.a. for 12-18 month terms, and up to 6.1% p.a. for 24-36 month terms.

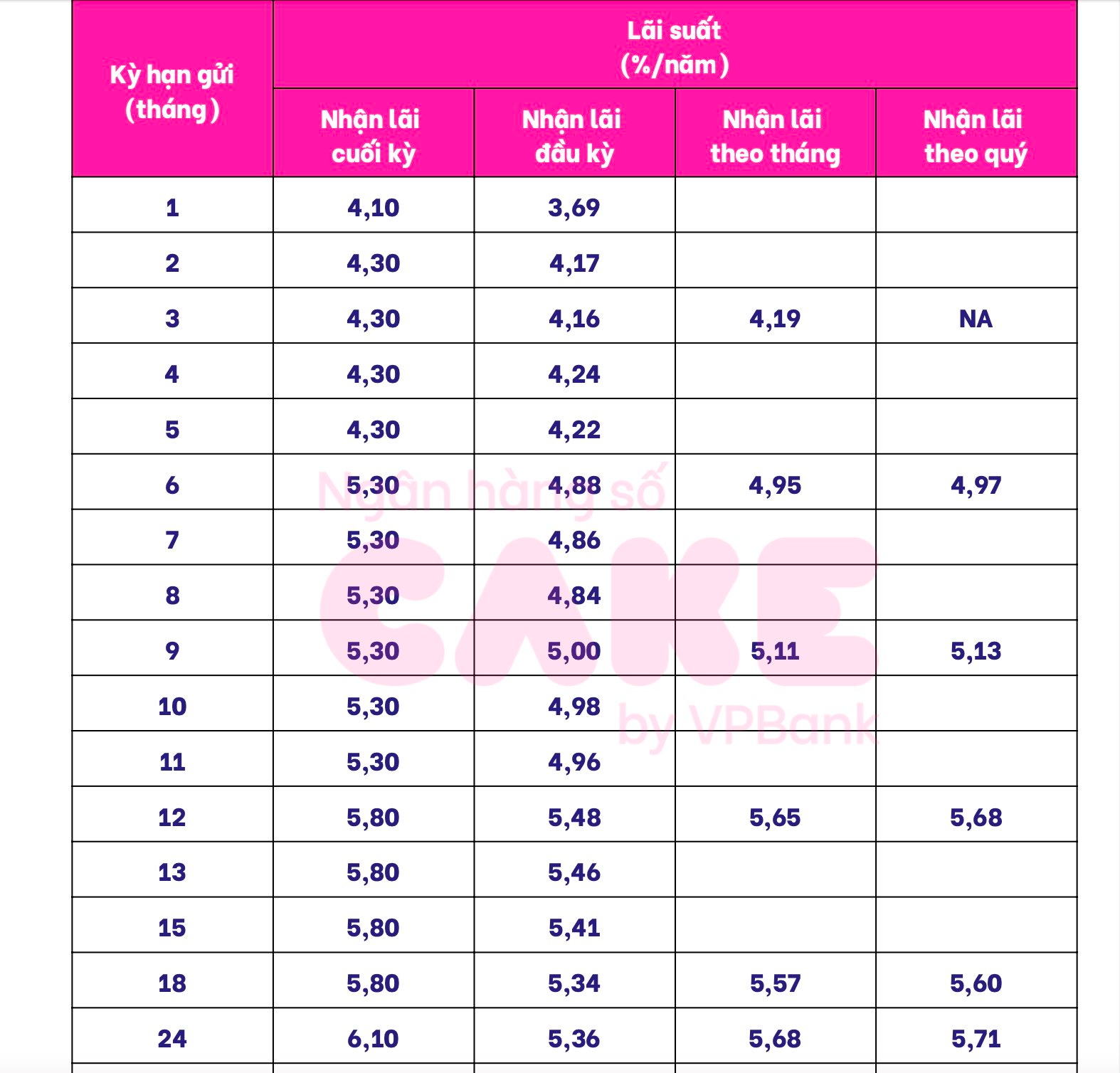

Source: Cake by VPBank

Apart from the traditional option of receiving interest at maturity, Cake by VPBank also offers three other interest payment options: upfront interest payment, monthly interest payment, and quarterly interest payment.

For the upfront interest payment option, Cake by VPBank offers interest rates ranging from 3.69% to 5.48% per annum.

For the monthly interest payment option, Cake by VPBank offers interest rates ranging from 4.19% to 5.68% per annum for deposits with a tenor of 3 months or more. As for the quarterly interest payment option, the bank offers interest rates ranging from 4.97% to 5.71% per annum for deposits with a tenor of 6 months or longer.

Additionally, the digital bank has recently launched a new savings product called “cumulative term deposits.” With this product, customers can make multiple contributions to a single savings account and receive interest at maturity.

The interest rates offered by Cake by VPBank for this product range from 3.5% to 5.5% per annum.

Source: Cake by VPBank

Cake by VPBank is a digital-only bank in Vietnam, with technology and artificial intelligence as its core foundations. Despite not having any physical branches, the bank offers essential traditional banking services such as opening payment accounts, transferring/receiving money, and issuing ATM cards. Its customer base mainly comprises young, tech-savvy individuals from Generations Y and Z, mostly located in large cities like Hanoi and Ho Chi Minh City.

“Banking Sector Makes Sacrifices for the Greater Economic Good”

As of the State Bank of Vietnam’s regular press conference for August 2024, Deputy Governor Dao Minh Tu revealed that as of September 7th, credit growth had reached 7.15% compared to the end of 2023. This indicates a healthy and steady expansion of the country’s credit market, showcasing the resilience and potential of Vietnam’s economy.

The Sparkling 30-Year Journey of DOJI

With a superior gene, DOJI has consistently demonstrated its prowess across diverse industries, be it jewelry and precious metals, finance and banking, or real estate. The key to their success lies in their long-term vision and pioneering steps, always executed with a unique blend of scientific methods, creativity, and artistic flair. Their achievements speak for themselves, leaving an indelible mark of excellence.

KienlongBank: Vietnam’s Best Workplace & Customer Service Bank 2024

KienlongBank is proud to announce that it has once again been recognized as one of the “Best Places to Work in Vietnam” for 2024 by World Economic Magazine. This prestigious accolade reflects the bank’s unwavering commitment to creating a positive and rewarding work environment for its employees. In addition, the bank has also been lauded in the “Best Customer Service Bank in Vietnam 2024” category, a testament to its exceptional service and dedication to customer satisfaction.

TNEX Launches T Boss: Financial Freedom for E-Commerce Sellers

TNEX, a leading digital bank, harnesses the power of Fintech to introduce T Boss, a bespoke lending product for e-commerce sellers. This innovative offering empowers online business owners to overcome financial hurdles and seize growth opportunities in the highly competitive world of e-commerce.