Hundreds of Privileges for Cardholders

From November 20 to November 31, 2024, VIB is launching a program called “6 Years of Innovation on the Journey to Leading the Card Trend” with a series of interactive activities for customers.

First is the contest “Beautiful Moments with VIB Card” with a prize of up to VND 6 million per winner. Participating is extremely simple, customers just need to share on their personal Facebook their favorite content, memorable shopping experiences with VIB credit cards in the form of videos, images, or words, along with the hashtag #VIBCardBirthday6.

Next is the contest “Vote for Your Favorite Card” with a lifetime annual fee waiver and a free annual fee for the following year. To participate, customers just need to access the VIB website, choose their favorite card, rate it by voting immediately below the card image, take a screenshot of the rating, and comment on this image on the contest post on VIB’s fanpage with a lucky code from 99 to 9999. VIB will then draw to determine the 12 luckiest customers.

Especially, 100 e-vouchers for Airport Lounge or Fast Track services worth VND 999,000 each will be given to 100 credit cardholders who register to participate in the program “6 Years of Innovation on the Journey to Leading the Card Trend” and have at least 6 transactions with a total minimum value of VND 6 million. In case there are multiple cardholders who meet the conditions, the criteria for spending from high to low will be considered.

For customers with personalized cards created with VIB’s Gen AI, VIB is organizing a contest called “Finding Unique Card Designs” from November 20 to December 18, 2024. Customers just need to access the program’s landing page, upload and call for votes for their exclusive credit card design, and they will have the chance to win a premium studio photo package along with a VIB card worth up to VND 30 million.

In addition, from now until December 31, 2024, VIB continues to offer an annual fee waiver for new cardholders who meet the spending condition of VND 1-3 million and a 10% refund on the total eligible spending within 30 days of card issuance. For existing VIB cardholders, the “Buy Now, Pay Lightly” privilege brings interest-free installment payment, no initial fee, and a discount of up to 40% when spending at VIB Privileges ecosystem partners: Up to 40% off at Traveloka, Klook, Trip.com, China Airlines, Qatar Airways, New World Phu Quoc, Legacy Yen Tu – MGallery…; Up to 40% off at Lotte Cinema, Gene Solutions, Facial Bar, Kose, Menard Spa, Nha Khoa Viet Nga…; Up to 30% off at Manwah, K-pub, Beauty In The Pot, Buzza Pizza, Sushi Tei, Maruten Sushi-Soba…; Up to 20% off at Di Dong Viet, CellphoneS, Hoang Ha Mobile, Digibox, Dyson, Galle Watch, Lazada, Shopee…

6-Year Journey Towards “Leading the Card Trend” Position

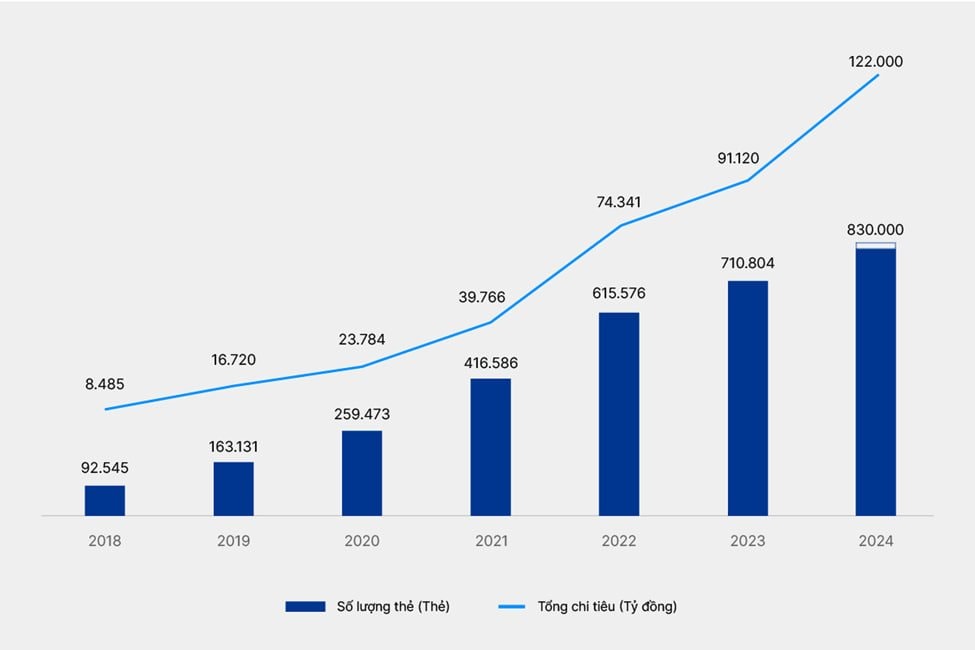

The period from 2018 to 2024 witnessed breakthrough strides in VIB’s credit card segment, with the number of cards in circulation increasing ninefold to 810,000, and total card spending reaching nearly 15 times growth, estimated at $4.9 billion by the end of 2024, maintaining a top market share and Mastercard card spending in Vietnam. These impressive growth figures are the most concrete testament to the endorsement and affirmation of users with VIB’s strategy to Lead the Card Trend, which the bank has consistently implemented through three pillars: Leading in Technology, Leading in Experience, and Leading in Benefits, throughout the 6 years of innovation in the card segment from November 20, 2018, to November 20, 2024. At the same time, VIB is also one of the most prominent banks in the journey of renewing the card market in Vietnam in recent times.

Kicking Off the AI Race

At VIB, credit cards are not just a tool for “spending now, paying later” but have become a financial companion in modern life. From applying for a card online within 3-5 minutes to enjoying cash-back, point accumulation, and installment payment benefits that can be customized and optimized according to needs.

Recently, through the Personalized Card Design feature supported by Gen AI, VIB has allowed customers not only to customize the functionality of their cards but also their appearance. This flexibility has marked a turning point in how users approach and use credit cards in Vietnam.

Ms. Winnie Wong, Country Manager of Mastercard in Vietnam, Cambodia, and Laos, shared: “Mastercard and VIB, long-term partners since 2005, have jointly implemented many important initiatives to meet the diverse needs of customers. In the context of AI Technology creating a revolution in the way businesses and consumers interact, VIB’s latest pioneering initiative once again affirms the influence of AI in optimizing personalized experiences and interactions for consumers.”

Ms. Tuong Nguyen, Director of VIB’s Card Division, shared: “In the future, the application of AI will not stop at personalizing card designs but also opens up the potential for smarter services such as automatically suggesting products and services that match each customer’s financial needs, optimizing benefits based on spending habits, and helping customers manage their finances effectively and securely.”

AI technology will play a pivotal role in shaping and developing modern card services. The 6-year journey is just the beginning; VIB will continue to listen, accompany, and bring the most optimal card products to enhance the living and financial experiences of Vietnamese customers, added Ms. Tuong Nguyen.

Celebrating Our Customers: VIB Reaches 750,000 Credit Card Milestone

VIB has reached a remarkable milestone of over 750,000 credit cards, solidifying its leadership in the Vietnamese market. To celebrate this achievement and express their gratitude, the bank has launched a rewarding customer appreciation program, offering valuable gifts to their cardholders as a token of their appreciation.