The State Bank of Vietnam has issued Circular No. 50/2024/TT-NHNN on safety and security regulations for online banking services. The circular will come into effect on January 1, 2025.

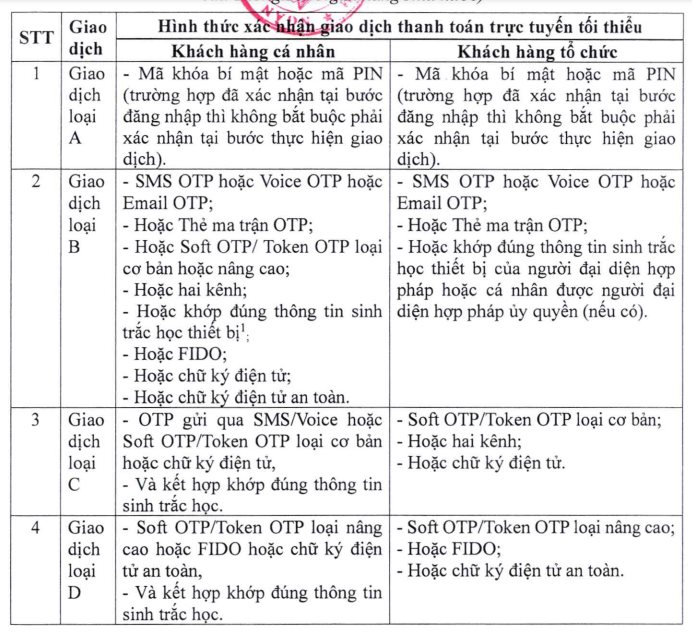

It categorizes online payment transactions into four types: Type A, Type B, Type C, and Type D, each with corresponding transaction confirmation methods.

Among these, transactions involving transfers between different accounts, cards, or e-wallets exceeding VND 10 million are classified as Type C transactions. The minimum online payment confirmation methods for this type include: OTP sent via SMS/Voice or Soft OTP/Basic Token OTP, or electronic signature; combined with matching biometric information.

Previously, in Decision No. 2345, effective from July 1, 2024, the SBV required Type C transactions to be authenticated by matching biometric information and encouraged the combination of OTP sent via SMS/Voice or Soft OTP/Token OTP.

According to the circular, the form of confirmation by matching biometric information involves comparing and ensuring the match of the customer’s biometric information during the transaction with the biometric information previously collected and stored by the unit as per the regulations of the Governor of the State Bank.

The form of matching biometric information using facial recognition must have accuracy determined by international standards and be capable of detecting biometric information spoofing of living objects to prevent fraud and impersonation of customers through images, videos, or 3D masks.

In cases where other forms of matching biometric information are applied, measures must be in place to prevent fraud and impersonation of customers according to equivalent standards.

The maximum time for performing biometric information matching is 03 minutes.

The circular also provides detailed regulations on other forms of confirmation such as OTP, Soft OTP/Token OTP, electronic signature, etc. Specifically, the maximum validity period for SMS OTP is 5 minutes, Voice OTP is 3 minutes, Email OTP is 5 minutes, Matrix Card OTP is 2 minutes, Soft OTP is 2 minutes, and Token OTP is 2 minutes.

“Abolishing Non-Primary Bank Accounts: A Step Towards Financial Security”

“Recently, a slew of banks have urged customers to update their personal information and biometric data. This means that individuals will be unable to perform electronic transactions without complying with the biometric data requirements. According to experts, this move will help eradicate non-primary bank accounts and curb online fraud, thereby enhancing the security of the banking system and protecting customers’ interests.”

“Beware of Phishing Scams: Fake Messages Claiming to be from the State Bank of Vietnam”

The State Bank of Vietnam (SBV) has issued a warning about a recent spate of phishing attacks. Fraudsters are impersonating the SBV by creating fake email interfaces that dupe unsuspecting individuals into providing their biometric data for alleged bank transactions. The SBV urges citizens to be vigilant and not fall prey to such deceitful tactics.

“Beware of Imposters: Phishing Scams Targeting Biometric Data Updates”

Recently, there have been scams impersonating the State Bank of Vietnam to send links for biometric information updates. The State Bank has affirmed that this is a fraudulent act. The State Bank only disseminates information to the public through its official website (https://www.sbv.gov.vn) and does not send emails directly to customers of credit institutions requesting biometric updates.