Market breadth remained slightly higher in terms of the number of gainers. The financial stock group performed positively with a series of gainers, notably SSB up 5.13%, SSI up 0.75%, and HCM up 1.33%… while the real estate group also saw gains with KBC up 3.76%, PDR up 2.76%, CEO up 2.6%, and DXG up 1.28%…

In terms of percentage change, the VN-Index is up only 0.23%, significantly lower than the performance of many Asian markets, especially the Hang Seng, which is up 2.28%, and the Nikkei 225, up 2.15%. Meanwhile, other major indices also posted gains, with the Singapore Straits Times up 1.05% and the Shanghai Composite up 0.71%.

According to the latest update, the Hong Kong Monetary Authority (China) has followed the Fed in cutting interest rates for the first time in four years, with a 50-basis point cut. Asian central banks are also expected to follow the Fed’s monetary policy lead in the coming period, which means cutting interest rates after the Fed’s cut.

The market breadth remained slightly higher in terms of the number of gainers. The financial stock group performed positively, with a series of stocks posting gains. Notably, SSB rose 5.13%, SSI increased by 0.75%, and HCM gained 1.33%. Meanwhile, the real estate sector also witnessed positive momentum, with KBC surging 3.76%, followed by PDR at 2.76%, CEO with a 2.6% gain, and DXG, which climbed 1.28%.

In terms of percentage change, the VN-Index is laggingsection of text is only a small fraction of the full text> up by a modest 0.23%. This is significantly lower than the performance of many other markets in the Asian region. Notably, the Hang Seng index soared 2.28%, while the Nikkei 225 rallied 2.15%. Other major indices also posted solid gains, including the Singapore Straits Times, which climbed 1.05%, and the Shanghai Composite, which advanced 0.71%.

In a recent update, the Hong Kong Monetary Authority (HKMA) in China has followed the lead of the Fed, cutting interest rates for the first time in four years. This cut amounted to a significant 50 basis points. It is anticipated that central banks across Asia will emulate the Fed’s monetary policy stance in the upcoming period. This means that they will likely reduce interest rates following any cuts initiated by the Fed.

Source: VietstockFinance

|

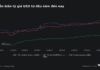

Morning Session: Persistent Tug-of-War

VN-Index started the day on September 19th with enthusiasm but quickly entered a tug-of-war phase, even dipping into negative territory at one point. It recovered towards the latter half of the morning session, ultimately closing the morning with a gain of 2.22 points to reach the 1,267.12 level. The HNX also rose, climbing 0.34 points to 233.29, while the UPCoM index declined by 0.06 points to 93.41.

The trading value of the three exchanges reached 7,486 billion VND, a noticeable increase from the previous session and slightly higher than the 10-session average.

The market breadth tilted towards gainers, with 334 stocks advancing, including 22 stocks that hit the daily limit. On the other hand, 263 stocks declined, of which 10 stocks fell to their daily limit, and 1,009 stocks remained unchanged.

Source: VietstockFinance

|

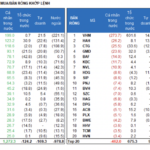

The slight market gain can be largely attributed to VCB, which contributed a significant 0.82 points to the rise. This was followed by a host of other large-cap stocks, including SSB, VIC, and HPG, each contributing over 0.3 points.

In terms of sector performance, media and entertainment led the market with a gain of 8.56%, driven primarily by a 12.94% jump in VNZ. However, this sector also witnessed a stock hitting the daily limit down, namely CAB.

Aside from media and entertainment, the telecommunications and specialized services, and trade sectors also performed well, rising 2.44% and 1.25%, respectively.

On the flip side, the household and personal goods sector experienced the sharpest decline, falling 2.52%. No other sector declined by more than 1%.

Foreign investors net bought nearly 130 billion VND, but this buying activity was concentrated mainly in SSI, accounting for over 151 billion VND. If foreign investors continue this net buying trend today, it will mark the fourth consecutive session of net buying, a rare occurrence in recent times.

| Foreign Investors’ Net Buying and Selling Activity (as of the morning session on September 19, 2024) |

10:30 AM: Enthusiasm Wanes

Contrary to the initial enthusiasm, the market soon faced corrective pressure and quickly turned red. As of 10:30 AM, the VN-Index dipped 0.06 points to 1,264.84, while the UPCoM index fell 0.22 points to 93.25. The HNX index, however, managed to stay in positive territory, rising 0.13 points to 233.08.

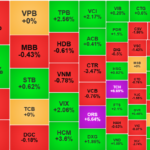

The number of gainers and losers was not significantly different, with 291 stocks advancing and 258 stocks declining, while 1,057 stocks remained unchanged. This mixed sentiment was evident in the financial stocks, which typically have a significant impact on the market. While stocks like EIB, TPB, VPB, and SSI rose, others like VCI, MBB, TCB, and HDB declined.

Foreign investors were net buyers to the tune of nearly 40 billion VND, but this buying activity was largely concentrated in SSI, accounting for over 91 billion VND. On the other hand, selling pressure, though weaker, was gradually increasing in stocks like VPB, with net selling of over 25 billion VND, HPG with over 20 billion VND, and VND with more than 16 billion VND.

Market Open: A Mildly Positive Start to a Potentially Eventful Day

Vietnam’s stock market began the new day on a positive note, with all three exchanges sporting green. Today’s market performance is of particular interest due to several factors that are expected to have a significant impact. The Fed has officially cut interest rates by 50 basis points, creating turmoil in the US stock market. Additionally, today marks the maturity date for derivatives and the trial of Truong My Lan and her accomplices, phase 2.

As of 9:30 AM, the VN-Index had climbed 2.33 points to 1,267.23, the HNX-Index had risen 0.5 points to 233.45, and the UPCoM-Index had gained 0.06 points to reach 93.53. Liquidity showed improvement compared to the previous session.

Several “hot” events are expected to influence the performance of the Vietnamese stock market today.

On the global front, US stocks declined during a volatile session after the Federal Reserve (Fed) cut interest rates by 50 basis points. While investors applauded the larger-than-expected rate cut, it also raised concerns that the Fed might be trying to get ahead of a potential economic downturn.

In a notable shift in US monetary policy, Federal Reserve Chair Jerome Powell signaled a significant change in the Fed’s approach to the economy. The Fed is now considering both sides of its dual mandate: price stability and maximum employment, rather than focusing primarily on controlling inflation.

Asian markets opened on a positive note, with green dominating many indices, such as the Hang Seng, Singapore Straits Times, and especially the Nikkei 225, which surged over 2.6%.

Today’s performance of the Vietnamese stock market is of particular interest due to the anticipated reaction to the Fed’s 50-basis point rate cut and the maturity of derivatives and the trial of Truong My Lan and her accomplices, phase 2.

Looking ahead to the broader capital flow trend after the Fed’s rate cut, Mr. Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBS), believes that capital tends to flow from overheated markets to markets with higher growth expectations.

Recently, Southeast Asian and Asian markets have successfully raised capital, with notable examples including Thailand, the Philippines, Malaysia, Indonesia, and India. In contrast, strong selling pressure has been observed in Japan, South Korea, and Taiwan, leading to a divergence among indices. The positive signal from capital flows in the Southeast Asian region is expected to attract capital back to Vietnam in the near future, possibly towards the end of 2024 or early 2025.

“Interest Rates: Sustaining Stability to Support Economic Growth”

The macroeconomic stability and consistent results, coupled with the growth in deposits and credit expansion, attest to the effectiveness of the State Bank’s monetary and credit policy framework and its implementation. This solid performance is a testament to the State Bank’s successful navigation of the economic landscape, fostering an environment conducive to business growth and financial stability.

The VN-Index Retreats to Near 1,200 Points, Domestic Individuals and Institutions Seize the Opportunity to Snap Up Nearly VND2,000 Billion.

Individual investors bought a net amount of 1,386.7 billion VND, of which 1,112.0 billion VND was net bought in matched orders. Domestic institutional investors also net bought 439.6 billion VND, with 539.7 billion VND net bought in matched orders.

The Bottom Fishing Lure: A Tantalizing Strategy for Investors.

The market witnessed a few more minutes of price suppression at the start of the afternoon session before bottom-fishers stepped in. The breadth changed slowly, but the indices climbed quickly, indicating that large-cap stocks were leading the charge. As the momentum spread, hundreds of stocks surged past reference levels, and hundreds of others narrowed their losses significantly. The market staged a strong signaling session around the 1200-point mark.