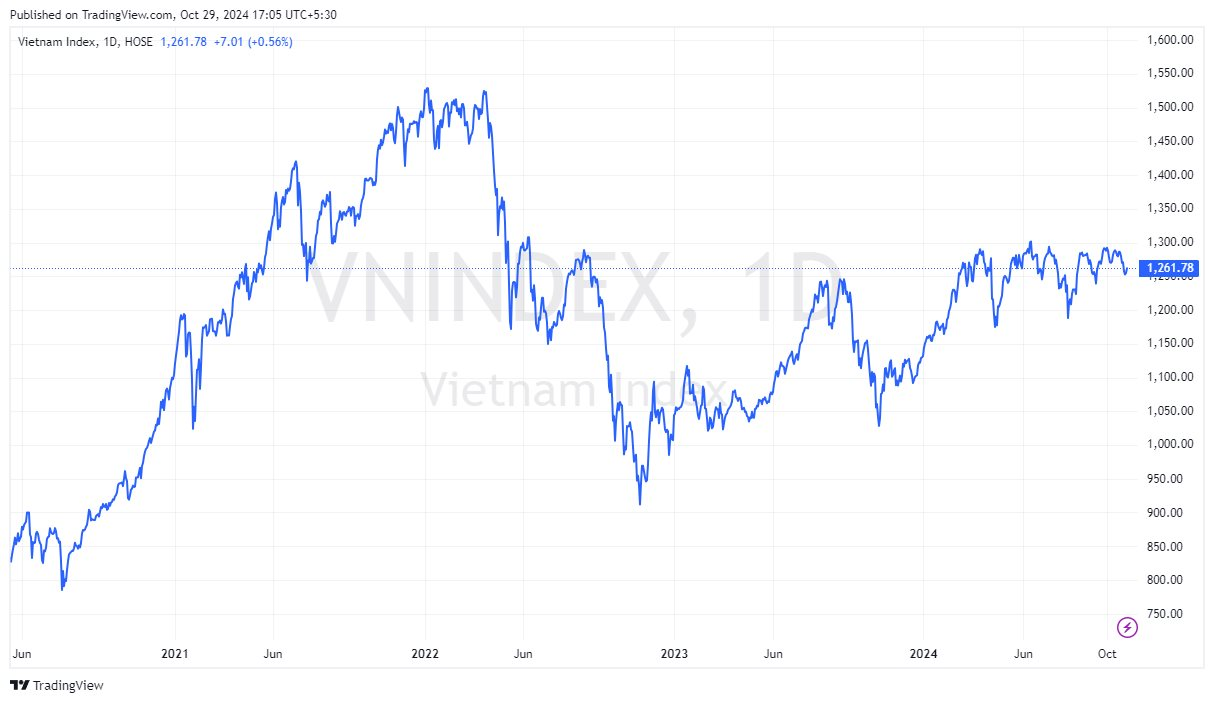

The Vietnamese stock market witnessed a positive session on October 29th. The VN-Index maintained its upward trajectory throughout the trading day, closing with a gain of over 7 points to reach 1,261.78. However, foreign trading activities were less optimistic, as they net sold with a value of 5,242 billion VND on the entire market. It is important to note that this statistic includes a large block trade of VIB shares worth more than 5,500 billion VND.

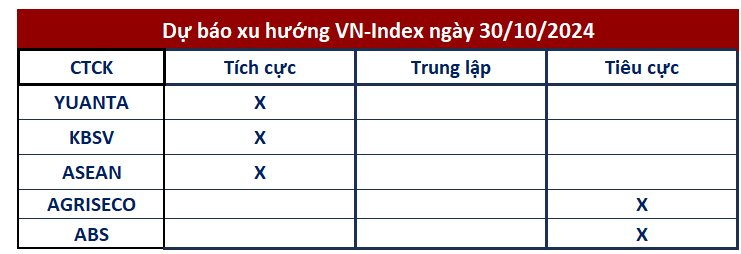

While some securities companies maintained a positive outlook and believed that the main index could continue its upward momentum in the next session, they also agreed that market risks remained high and advised investors to trade cautiously.

Yuanta Securities Vietnam suggested that the market could continue its recovery in the next session, with the VN-Index likely to retest the resistance level of 1,270 points. Additionally, the market showed signs of entering a short-term accumulation phase, indicating a slowdown in the rate of decline, which translates to a slight reduction in short-term risks, but they remain elevated.

Yuanta recommended that investors could maintain a low stockholding ratio of 30-40% in their short-term portfolios. Furthermore, investors should only consider buying new stocks with a low ratio if short-term buy points emerge.

Similarly, KB Vietnam Securities assessed that the VN-Index still had a probability of technical recovery after a series of sharp declines. However, the high supply at the above resistance regions posed a risk of creating corrective pressure on the index.

Investors are advised to employ a flexible two-way trading strategy, buying at support and selling at resistance, while also restructuring and adjusting their holdings to a safe level.

ASEAN Securities believed that the market could witness short-term rebounds in the coming sessions, but investors should remain cautious and avoid chasing purchases or panic selling in short-term trades.

ASEAN Securities maintained a positive outlook for the medium and long-term market prospects. Therefore, investors should closely monitor exchange rates, oil prices, and global markets to await clearer recovery signals. They should also focus on holding long-term stocks and prepare cash reserves to invest when these stocks become attractively priced.

According to Agribank Securities, buying power remained cautious and mainly focused on large-cap stocks, indicating a relatively cautious investor sentiment. Agriseco Research suggested that the rebounds during the early week were more technical in nature, and the index could still retreat to the support level around the 1,245 (+/-5) point region to stimulate new buying interest.

Agriseco recommended that investors refrain from opening new buying positions during the early rebounds of the market and maintain a high cash balance in their portfolios to ensure proactiveness in scenarios where the market offers discountedsection discounts to more attractive price regions.

ABS Securities shared a similar viewpoint, noting that buying power was still weak. Therefore, investors should continue to be defensive, and short-term buying should be limited until the index finds a balance.

The current support level for the VN-Index is 1,235 points. A breakdown below this level could lead to a test of the 1,207-point region.

The Bottom Fishing Lure: A Tantalizing Strategy for Investors.

The market witnessed a few more minutes of price suppression at the start of the afternoon session before bottom-fishers stepped in. The breadth changed slowly, but the indices climbed quickly, indicating that large-cap stocks were leading the charge. As the momentum spread, hundreds of stocks surged past reference levels, and hundreds of others narrowed their losses significantly. The market staged a strong signaling session around the 1200-point mark.

The Proactive Investor: Navigating the Stock Market

The market is experiencing significant volatility around the 1200 mark for the VNI, indicating that this area is a key supply-demand battleground. Today’s bottom-fishing efforts were more effective than those on November 18th, with a notable improvement in buying power.