On November 20, the real estate investment group No Va (Novaland, stock code: NVL) announced the termination of its audit contract with PwC Vietnam Co., Ltd. The company has signed a contract with Moore AISC Audit and IT Services Co., Ltd. to audit its financial statements for the year 2024.

Novaland assessed that the audit services provided by PwC Vietnam in the past did not meet the necessary requirements to perform and ensure the progress of auditing and reviewing financial statements as required by the information disclosure regulations for listed companies. This directly led to Novaland’s delay in its information disclosure obligations at certain times in 2023 and 2024. At the same time, Novaland and PwC could not agree on a work schedule to issue the 2024 audit report as required by law. This caused NVL shares to be cut margin and put on warning.

Regarding the new audit firm, according to Novaland, the selection of Moore AISC was based on the following criteria: a reputable audit firm; capable and experienced in providing audit services to real estate companies; and no conflict of interest when providing services to the Group.

Moore AISC is an independent member of Moore Global Network Limited – a global network of consulting and auditing firms of independent companies – headquartered in London, and ranked by International Accounting Bulletin as one of the largest accounting and auditing networks in the world.

Moore AISC was one of the first three audit firms established in Vietnam. The company was founded in 1994 and was managed by the Ho Chi Minh City Department of Finance. In 2022, Moore AISC became an independent member of Moore Global Network Limited.

Moore AISC currently has more than 200 employees working at its head office and branches and representative offices in Vietnam. The company has provided services to more than 1,000 customers, including many listed companies, public interest entities, banks, and large corporations.

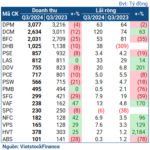

In 2023, Moore AISC recorded a revenue of 62.7 billion VND. Of this, revenue from financial statement audit services for public interest entities was 12 billion VND, and the remaining 50 billion VND came from other services.

After deducting expenses, Moore AISC recorded a corporate income tax expense of over 452 million VND.

The company’s Professional Indemnity Fund balance was nearly 6.7 billion VND.

According to the 2023 transparency report, Moore AISC has 23 audit professionals approved to audit public interest entities in 2024.

Recently, on November 12, the State Securities Commission (SSC) issued Decision No. 1226/QD-UBCK suspending the qualification of auditor Phan Duc Danh of Moore AISC to audit public interest entities in the securities sector.

This is not the first time that Moore AISC Audit and IT Services Company Limited has had an auditor disqualified to audit public interest entities in the securities sector.

Previously, on September 16, 2024, the SSC issued Decision No. 996/QD-UBCK suspending the qualification of auditors Do Thi Hang and Doan Nguyen Minh Tam of Moore AISC from September 16, 2024, to December 31, 2024.

In late October 2023, the SSC issued a decision to suspend the qualification of auditor Le Hung Dung of Moore AISC from October 31, 2023, to December 31, 2023.

“Novaland Appoints Two New Deputy CEOs”

Novaland (HOSE: NVL) has announced the appointment of two new Vice Presidents, Mr. Cao Tran Duy Nam and Ms. Tran Thi Thanh Van.

“A Decade of Shareholder Woes: The SCID-Novaland Saga”

For a decade, the Saigon Co.op Investment and Development Joint Stock Company (SCID), a subsidiary of the Ho Chi Minh City Union of Trade Cooperatives (Saigon Co.op), has been reporting on its utilization of 255 billion VND raised from a public offering in 2013. While these reports detail the progress of capital usage, questions remain about the efficiency of these investments and the feasibility of the company’s projects.