Platinum Victory Pte. Ltd. (Singapore) has filed to purchase 30 million REE shares of Refrigeration Electrical Engineering Corporation (HoSE: REE) through agreements or matching orders on the exchange, or through the Vietnam Securities Depository. The transaction is expected to take place from November 22, 2024, to December 20, 2024.

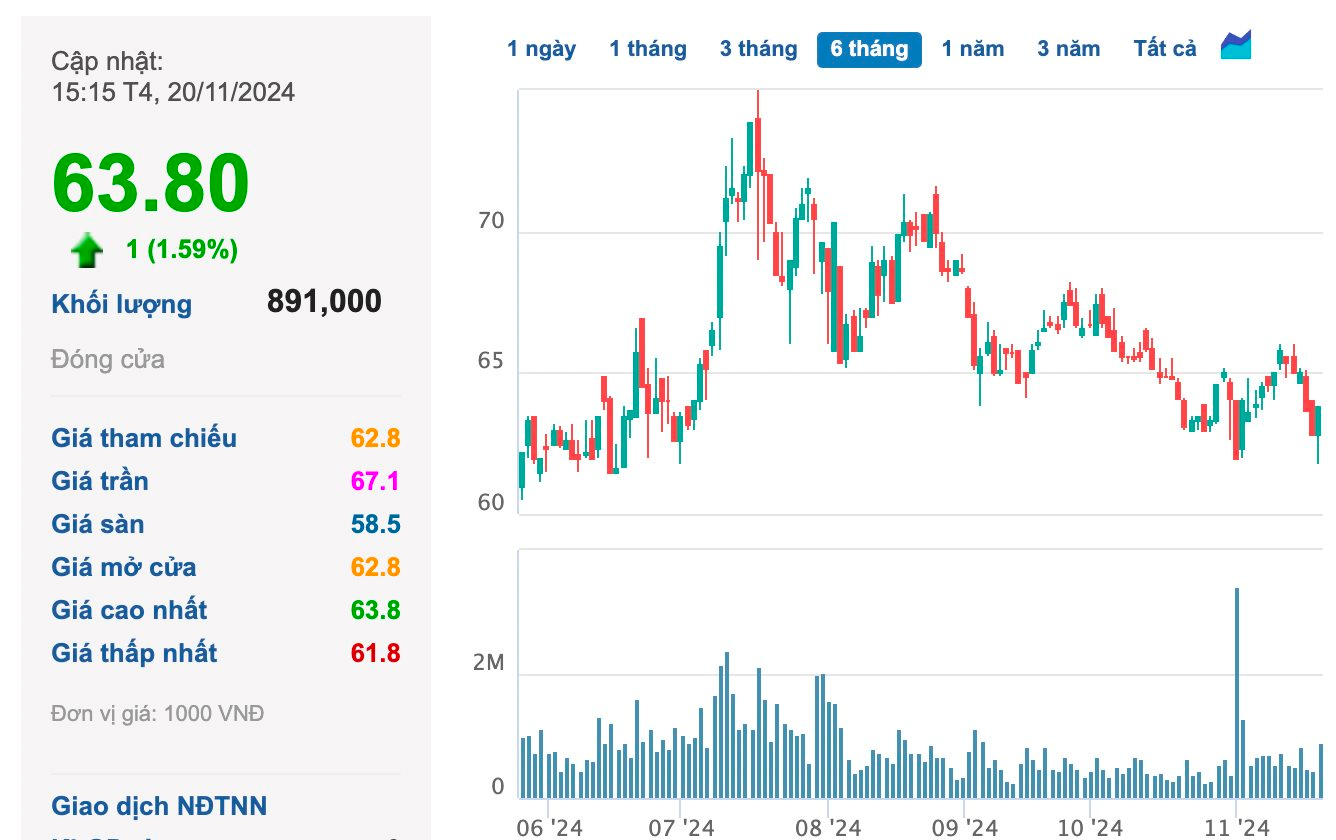

Based on REE’s current market price, Platinum Victory Pte. Ltd. is estimated to spend nearly VND 1,900 billion to complete the above purchase.

This foreign fund has just completed a public offering to purchase 4 million REE shares from September 11 to October 22, 2024, at a purchase price of VND 80,000 per share, equivalent to a total value of VND 320 billion. The number of REE shares held by Platinum Victory Pte. Ltd. has increased to more than 168 million units.

The purpose of the public offering was to increase their ownership in REE to above 35%, giving them a veto power over important decisions within the competence of the General Meeting of Shareholders. This also means that no shareholder can achieve a controlling interest of 65%, allowing for strategic control and decision-making.

In contrast to the actions of Platinum Victory Pte. Ltd., another foreign shareholder of REE, Apollo Asia Fund Ltd., recently sold more than 1.2 million REE shares, reducing their ownership to 4.75% and thus exiting their position as a major shareholder as of October 23, 2024.

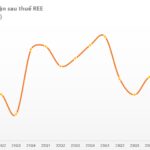

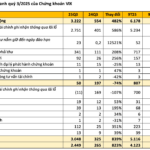

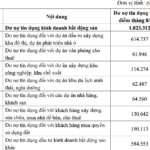

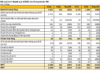

In terms of business performance, in Q3 2024, REE recorded revenue of VND 2,031 billion (up 3%) and after-tax profit of VND 561 billion (up 21%) due to improved performance in the energy segment as unfavorable weather conditions subsided, along with reduced financial expenses with lower interest rates. Additionally, the recognition of revenue from the The Light Square project also contributed significantly to REE’s financial results.

In the stock market, REE’s share price has been on a downward trend. Currently, REE is trading at VND 63,800 per share, down more than 12% in the past four months.

The Fickle Nature of Foreign Investors: What are the Thai Billionaire and Singaporean Shark Plotting in their Vinamilk Stock Shenanigans?

(NLĐO) – With less than eight months into 2024, Singapore’s investment fund Platinum Victory Pte. Ltd. and F&N Dairy Investment Pte. Ltd., owned by Thai billionaire Charoen Sirivadhanabhakdi, have made 11 purchases of Vinamilk shares.