Strong Momentum from Public Investment

In 2024, the construction industry’s growth reached approximately 7.8 – 8.2%, surpassing the government’s target of 6.4 – 7.3%. This was the highest result since 2020, serving as a driving force for the overall economic growth. The industry’s growth rate heavily relies on the recovery of the real estate market and the progress made in resolving obstacles and implementing public investment projects.

The cumulative disbursement of public investment capital for the year exceeded 548.5 trillion VND, achieving over 80% of the plan assigned by the Prime Minister.

Public investment was significantly strengthened as 2025 marks the final year of the medium-term public investment plan for 2021-2025, with a record investment of 791 trillion VND approved by the National Assembly.

The government’s 2025 public investment plan introduces several innovations, including a focus on investing in key sectors and areas critical to the economy. Capital will be allocated to important national transportation projects, such as the North-South high-speed railway and nuclear power, attracting “big players” in the technology field.

These programs are expected to have a far-reaching impact on the economy. Infrastructure construction and building materials companies are anticipated to benefit from these public investment projects. Additionally, the civil and industrial construction sector is viewed positively, mainly due to the broad recovery of the real estate market and stable FDI capital.

Notably, the Land Law, the Real Estate Business Law, and the Housing Law are expected to resolve legal obstacles for stalled projects, facilitating the development of new projects and providing opportunities for construction companies.

The favorable information mentioned above is reflected in the financial performance of construction companies over the past year.

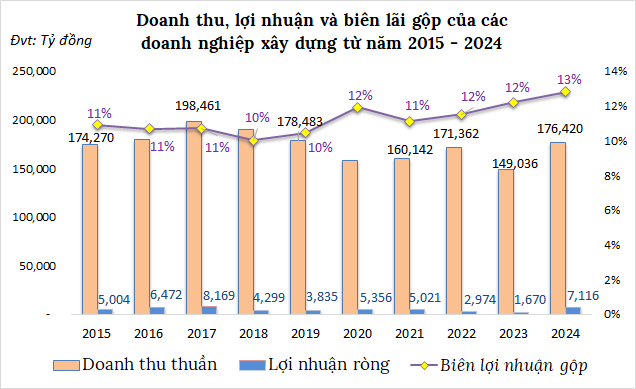

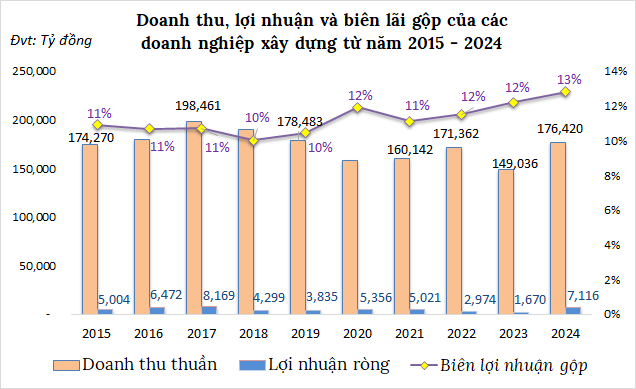

According to VietstockFinance, 108 construction companies listed on the stock exchange (HOSE, HNX, UPCoM) published their financial statements for Q4/2024, reporting a total revenue of nearly 56.9 trillion VND and a net profit of approximately 2.2 trillion VND, increasing by 5% and 30%, respectively, compared to the same period last year.

For the full year 2024, the industry’s results were promising, with revenue exceeding 176.4 trillion VND, a rise of 18% – the highest in four years (since 2020). The net profit surpassed 7.1 trillion VND, quadrupling the previous year’s figure and reaching the highest level in six years (since 2018).

The gross profit margin for these companies ranged from 10 – 13% over the past decade, with 2024 achieving the highest level.

Source: VietstockFinance

|

Many Companies Showcase Significant Profit Increases

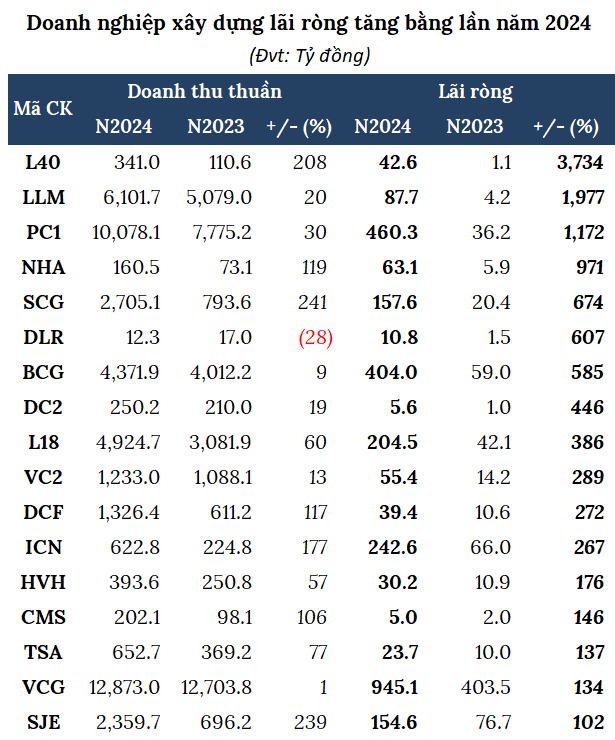

Out of the 108 construction companies that published their financial statements for 2024, 46 firms increased their profits (accounting for 43%), 28 decreased profits, 16 turned losses into profits, 6 turned profits into losses, and 12 continued to incur losses.

Within the group of profit-increasing companies, 17 businesses witnessed profit increases of several folds in 2024. Leading the pack was Investment and Construction 40 (HNX: L40) with a record profit of nearly 43 billion VND, more than 38 times higher than the previous year. The impressive performance in Q4 alone contributed 38 billion VND, a 127-fold increase compared to the same period last year, accounting for 89% of the full-year profit. With these remarkable results, L40 far exceeded its annual plan of 4.8 billion VND.

The company attributed this success to the resumption of construction work on projects after a long period of site clearance issues, as well as the implementation of newly won contracts. Additionally, their non-core business activities, such as warehouse and office rentals, were fully utilized. Furthermore, during Q4, the company sold three real estate properties, significantly boosting the quarterly profit.

PC1 Group (HOSE: PC1) concluded 2024 with a record revenue of over 10 trillion VND, marking a 31% increase compared to the previous year, while their net profit increased by nearly 13 times, reaching 460 billion VND. However, this surge was partly due to PC1‘s retroactive adjustment of comparative figures in Q4/2023 related to VAT and environmental taxes at its subsidiaries, resulting in a decrease in the consolidated net profit for 2023 from 140 billion VND to over 36 billion VND. With these results, the company surpassed its profit plan by 34%.

Vinaconex, Total Corporation (HOSE: VCG), topped the industry with a net profit of over 945 billion VND, 2.3 times higher than the previous year and the highest in four years.

Source: VietstockFinance

|

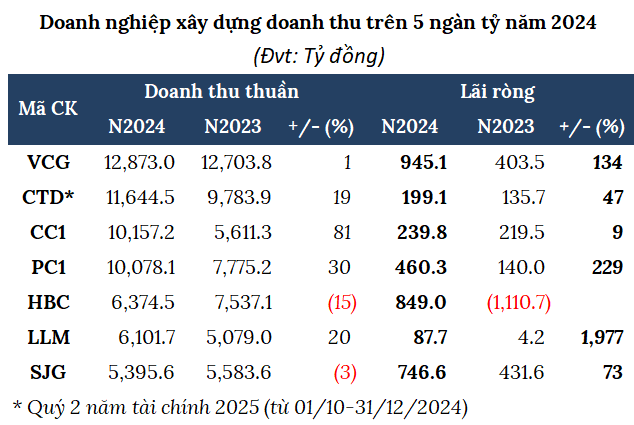

Additionally, the industry’s leading companies with revenue exceeding 5 trillion VND also experienced profit growth in 2024.

In the first half of the 2025 fiscal year (from July 1 to December 31, 2024), CTCP Construction Coteccons (HOSE: CTD) recorded a net profit of nearly 200 billion VND, a 47% increase compared to the same period, achieving 46% of its annual plan. CTD further disclosed that the value of newly signed contracts reached 16,800 billion VND in the first six months of the 2025 fiscal year, pushing the total backlog from the second half of the 2025 fiscal year to nearly 35,000 billion VND.

After two consecutive years of business losses, thanks to other income of over 600 billion VND (not specified), Hoa Binh Construction Group (UPCoM: HBC) concluded 2024 with a net profit of 849 billion VND (second highest in the industry), compared to a loss of over 1,100 billion VND in the previous year. This performance exceeded the profit plan by 97%.

Construction Number One Corporation (UPCoM: CC1) recorded revenue surpassing 10 trillion VND for the first time, an increase of 81%, while its net profit reached nearly 240 billion VND, a 9% rise. However, CC1 has only accomplished 55% of its annual profit plan.

Source: VietstockFinance

|

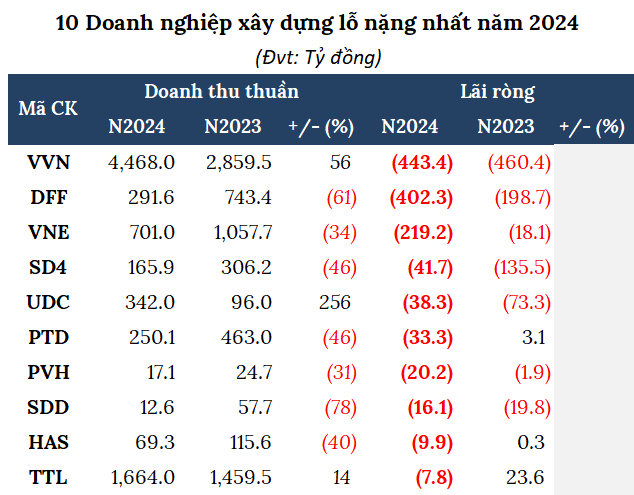

Historic Losses

Despite the economy’s gradual recovery, not all construction companies benefited. A notable example is the Vietnam Industrial Construction Joint Stock Corporation (UPCoM: VVN), which continues to rank last with a hefty loss of over 443 billion VND, compared to a loss of over 460 billion VND in the previous year. This marks the eighth consecutive year of unprofitability for VVN (since 2017). As of the end of 2024, VVN has accumulated losses of over 2,910 billion VND, with negative equity of more than 2,065 billion VND.

| Net Profit of VVN from 2016-2024 |

Dua Fat Group (UPCoM: DFF) experienced its second consecutive year of poor performance, incurring a historic loss of over 400 billion VND, compared to a loss of nearly 200 billion VND in the previous year. The company’s accumulated losses reached nearly 502 billion VND as of the end of 2024, while its charter capital stood at 800 billion VND. The company explained that the ongoing challenges faced by the domestic economy, particularly in the real estate sector, directly impacted their business operations.

Vietnam Electrical Construction Joint Stock Corporation (HOSE: VNE) continued to be among the loss-making companies, reporting a loss of over 219 billion VND – the highest in its history, compared to a loss of 18 billion VND in the same period last year. Consequently, VNE accumulated losses of over 95 billion VND as of the end of 2024.

Source: VietstockFinance

|

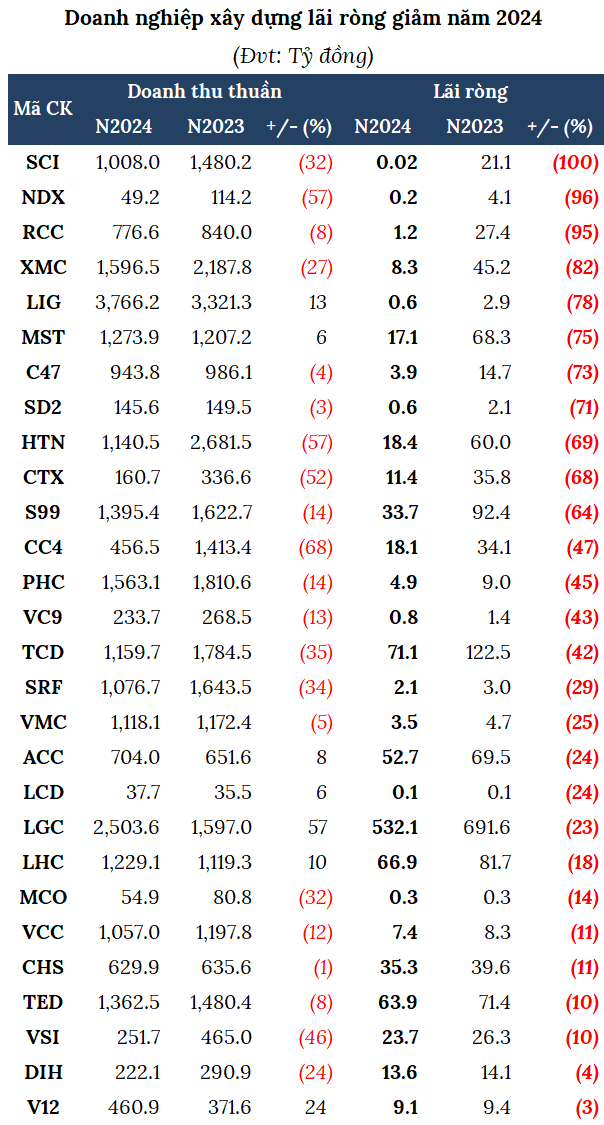

Statistics show that 28 companies witnessed a drop in profits for 2024. Among them, CTCP SCI E&C (HNX: SCI) reported a profit of just over 23 million VND – the sharpest decline in the industry. CTCP Licogi 13 (HNX: LIG) experienced a 78% decrease, resulting in a profit of over 600 million VND.

Hung Thinh Incons (HOSE: HTN) recorded a profit of over 18 billion VND, and CTCP Dau Tu Cau Duong CII (HOSE: LGC) posted a profit of 532 billion VND, representing decreases of 69% and 23%, respectively.

Source: VietstockFinance

|

– 08:13 26/02/2025

Unleashing Public Investment to Spur 2025 Growth

Public investment is seen as the spearhead to boost growth this year, supporting a scenario of declining international trade and affected domestic consumption.

Unlocking Vietnam’s Economic Potential: The Bold Vision for 2025

Prime Minister Pham Minh Chinh has instructed ministries, agencies, and local authorities to vigorously pursue the three strategic breakthroughs, six key tasks, and twelve major solutions to strive for double-digit economic growth in 2025.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)