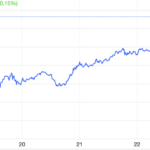

Global gold prices surged for the fourth consecutive session on Thursday (November 22), reaching a one-week high, as the war between Russia and Ukraine witnessed worrying new developments. After losing the $2,600/oz mark last week, the precious metal is now inching closer to reclaiming the key $2,700/oz level.

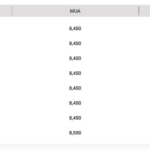

At the close of trading in New York, spot gold rose by $19.1/oz compared to the previous session’s close, equivalent to a 0.72% increase, reaching $2,669.7/oz – according to data from the Kitco exchange.

More than 8 hours earlier in the day in Vietnam, spot gold prices in the Asian market climbed by $7.8/oz compared to the US session close, equivalent to a 0.29% gain, trading at $2,677.5/oz. Converted at Vietcombank’s selling exchange rate, this price is equivalent to nearly VND 82.3 million/troy ounce, up VND 700,000/troy ounce from the previous day.

Since the beginning of the week, global gold prices in VND have increased by VND 3.2 million/troy ounce, recovering most of the loss of over VND 5 million/troy ounce in the previous two weeks.

Vietcombank quoted the USD exchange rate at VND 25,170 (buying) and VND 25,504 (selling) at the beginning of the day, unchanged from the previous day.

“Geopolitical factors have been the dominant influence on the gold market in recent days. The escalating tensions between Russia and Ukraine are noteworthy,” said David Meger, director of metal trading at High Ridge Futures, in an interview with Reuters.

On Wednesday, Ukraine fired British-made cruise missiles into Russia. This is the latest Western weapon that Kiev is allowed to use to strike Russian territory. Prior to this, on Tuesday, the US gave Ukraine the green light to use American-made long-range missiles to attack Russia.

The Ukrainian Air Force stated that Russia retaliated on Thursday morning by firing an intercontinental ballistic missile at Ukraine. This is the first time since the outbreak of the Russia-Ukraine war that Moscow has used such a powerful long-range missile.

Russia has stated that Ukraine’s use of Western weapons to attack Russian territory from afar would be a significant escalation of the conflict. Ukraine, for its defense, argues that it must be able to strike the bases that Russia uses to prosecute the war, which has now entered its 1000th day this week.

Geopolitical crises have significantly contributed to the surge in gold prices over the past year. Investors have been flocking to safe-haven assets like gold since the war between Israel and the Palestinian Hamas movement erupted in the Gaza Strip in October last year. Now, worrying new developments in the Russia-Ukraine war are once again fueling gold’s rally, after the precious metal took a hit following Donald Trump’s re-election as US President.

This week, spot gold prices climbed by 4%, heading towards completing the strongest weekly gain since April. The previous week saw gold prices post their biggest weekly decline in more than three years.

Currently, downward pressure on gold prices persists due to the strengthening US dollar. Along with gold, the greenback and US Treasury bonds are also attracting investors seeking safe-haven assets.

The US Dollar Index, which measures the strength of the USD against a basket of six other major currencies, closed Thursday at 106.97 points, up from 106.68 points in the previous session. This morning, the index continued to climb, surpassing 107 points, nearing the one-year high recorded last week.

Senior analyst Jim Wyckoff of Kitco Metals believes that the next target for gold bulls is to achieve a firm close above the $2,700/oz level.

Looking at the longer term, analysts suggest that Trump’s policies could lead to higher inflation, prompting the Federal Reserve to maintain higher interest rates for longer – an environment that is typically unfavorable for gold. However, on the other hand, the US government’s growing budget deficit also introduces fiscal risks, which could enhance gold’s appeal.

In a Reuters survey, most economists predicted that the Fed would cut interest rates at its December meeting and that rate cuts would occur at a slower pace in 2025.

According to data from the FedWatch Tool on the CME exchange, traders are betting on a 56% chance of the Fed lowering rates at its upcoming meeting, down sharply from over 80% last week.

The Golden Rush: Gold Prices Surge Past $2,700 per Ounce on November 22nd Evening

Gold has been on a consistent upward trajectory in recent sessions, as market risk appetite has shifted.