Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 453 million shares, equivalent to a value of more than 10.5 trillion VND; HNX-Index reached over 44 million shares, equivalent to a value of more than 690 billion VND.

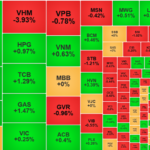

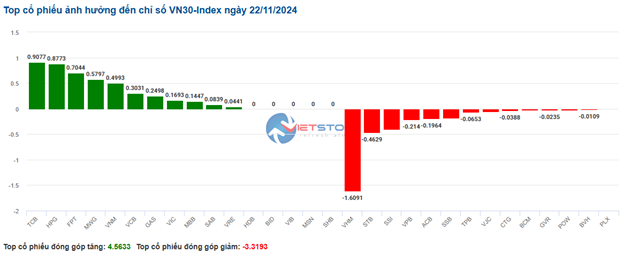

VN-Index opened the afternoon session with gradually increasing selling pressure, causing the index to weaken and fluctuate around the reference level, closing in the red. In terms of impact, VHM, GVR, VPB, and STB were the most negative stocks, taking away more than 2.4 points from the index. On the other hand, GAS, TCB, HVN, and BID were the most positive stocks, contributing more than 2 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on November 22, 2024 |

Similarly, the HNX-Index also witnessed a lackluster performance, with negative influences from stocks such as DTK (-3.23%), KSV (-2.16%), SHS (-1.52%), and CEO (-2.07%)…

|

Source: VietstockFinance

|

The real estate industry was the only sector that witnessed a significant decline of -1.13%, mainly due to VHM (-3.93%), DXG (-2.61%), PDR (-1.43%), and NVL (-2.22%). On the other hand, the telecommunications sector witnessed the strongest recovery in the market, achieving a growth of 2.11% with green signals from VGI (+2.85%), ELC (+0.2%), FOX (+0.11%), ICT (+0.39%), and VNB (+1.94%). Following this recovery trend, the industrial and healthcare sectors also witnessed increases of 0.86% and 0.64%, respectively.

In terms of foreign investors’ transactions, they returned to net buying with a value of more than 10 billion VND on the HOSE exchange, focusing on stocks such as HDG (241.75 billion VND), TCB (100.78 billion VND), MWG (45.36 billion VND), and FPT (34.52 billion VND). On the HNX exchange, foreign investors net bought more than 6 billion VND, focusing on DHT (17.44 billion VND), VFS (5.22 billion VND), VGS (4.65 billion VND), and TIG (860 million VND).

| Foreign investors’ net buying and selling activities |

Morning session: The market gained slightly but lacked excitement

The market traded rather slowly during the morning session of November 22, with the indices fluctuating around the reference level and liquidity remaining low. At the midday break, buyers temporarily gained the upper hand, pushing the VN-Index up by 3.45 points to 1,231.78 points, while the HNX-Index edged up slightly by 0.09% to 221.97 points. The market was mixed, with 304 stocks rising and 287 falling by the end of the morning session.

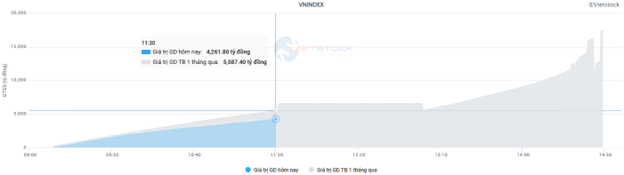

The matching volume of the VN-Index in the morning session reached over 173 million units, equivalent to a value of more than 4.2 trillion VND, slightly higher than the low level of the previous morning but still significantly lower than the average volume of the past month. Liquidity on the HNX exchange recorded a matching volume of nearly 21 million units, with a value of approximately 302 billion VND.

Source: VietstockFinance

|

GAS, VCB, and HPG were the main pillars contributing to the index’s green signal, helping the VN-Index gain more than 2.5 points. On the other hand, VHM exerted the greatest pressure on the market in the morning session, taking away 1.2 points, while the remaining stocks had a less significant impact.

The telecommunications group led the market with a gain of nearly 2%, thanks mainly to the contribution of the industry’s largest-cap stock, VGI (+2.61%). Meanwhile, the remaining stocks in the group fluctuated around the reference level. This dynamic was also observed in other industry groups, with most sector indices donning green signals, but the stocks within each group exhibited strong divergence.

Real estate was the only sector that remained in the red, facing selling pressure from stocks such as VHM (-2.54%), KDH (-1.07%), SNZ (-3.46%), NVL (-0.44%), PDR (-0.48%),…

Foreign investors reduced their selling pressure significantly in the morning session; however, buying activity also remained subdued, resulting in a net selling trend. Foreign investors were net sellers of nearly 169 billion VND on the HOSE exchange and more than 4 billion VND on the HNX exchange. There were no notable trading activities in any particular stock, and SSI was the most heavily sold stock, with a net selling value of more than 66 billion VND.

10:30 am: Investor sentiment became uncertain

The market returned to a mixed performance, with investor sentiment turning uncertain, causing the main indices to fluctuate strongly around the reference level. As of 10:30 am, the VN-Index fell slightly by 0.72 points, trading around the 1,227 level. The HNX-Index dropped by 0.65 points, trading around the 221 level.

The breadth of the VN30-Index basket showed a balanced mix of green and red signals. Specifically, on the positive side, TCB rose by 0.91 points, HPG by 0.88 points, FPT by 0.7 points, and MWG by 0.58 points. Conversely, only a few stocks continued to face selling pressure, with VHM, STB, SSI, and VPB taking away more than 2.6 points from the overall index.

Source: VietstockFinance

|

Real estate stocks faced the strongest selling pressure in the market, with most stocks in the sector declining by 0.86%. Within this group, residential real estate stocks such as VHM fell by 2.66%, DXG by 0.87%, NVL by 1.33%, PDR by 0.71%… Additionally, industrial real estate stocks also witnessed a slight decline, including KBC (-0.37%), TIG (-0.79%), SZC (-0.88%), and SIP (-0.26%) … Only a small portion of stocks managed to hold on to their gains, including VRE, VIC, KHG, and FIR, but their increases were not significant.

On the other hand, the telecommunications group continued the positive momentum from the previous session, recording a strong gain from the start of the session. Specifically, buying interest focused mainly on VGI, which rose by 3.97%, along with CTR (+0.92%), TTN (+1.79%), and ELC (+0.2%)…

The utilities sector also witnessed a decent recovery, although strong divergence persisted within the group. On the buying side, green signals were observed in GAS (+2.93%), CNG (+3.59%), PPC (+0.45%), and GHC (+1.42%)… Meanwhile, a large number of stocks in the group remained slightly in the red, including REE, POW, VCP, and NT2…

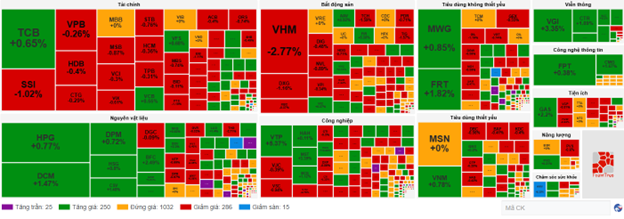

Compared to the opening, the market continued to diverge, with a balanced mix of green and red signals. The number of reference stocks dominated (over 1,000 stocks). There were 250 rising stocks (25 of which hit the ceiling) and 286 falling stocks (15 of which hit the floor).

Source: VietstockFinance

|

Opening: A mild gain at the start of the session

At the opening of the November 22 session, as of 9:30 am, the VN-Index rose by more than 3 points to 1,231.91 points, with 16 stocks hitting the ceiling, 295 rising, 1,160 standing, 128 falling, and 8 hitting the floor.

The Dow Jones and S&P 500 indices advanced on Thursday (November 21) as investors flocked to cyclical stocks poised to benefit from an accelerating economy, shifting away from technology stocks.

At the close of the November 21 session, the Dow Jones index added 461.88 points (equivalent to a 1.06% gain) to reach 43,870.35 points. The S&P 500 index rose by 0.53% to 5,948.71 points. The Nasdaq Composite index inched up by 0.03% to 18,972.42 points.

Green signals temporarily prevailed in the VN30 basket, with 6 falling stocks, 19 rising stocks, and 5 standing stocks. Among them, VHM, STB, and SSB were the most negative stocks. Conversely, GAS, VNM, and HPG were the stocks with the strongest gains.

The telecommunications services sector led the group of gainers, achieving a growth of 3.63% at the beginning of the session. Notably, this performance was driven by stocks such as VGI, which rose by 4.59%, along with CTR (+1.34%), YEG (+0.45%), and MFS (+2.47%)…

The Optimistic Outlook: Can We Expect a Positive Shift?

The VN-Index surged amidst a recent spate of losses, indicating a strong rebound. Accompanying this rise was a surge in trading volume, surpassing the 20-day average, signifying a return of liquidity to the market. The Stochastic Oscillator, a key technical indicator, has now entered oversold territory and is signaling a buy. Should this indicator continue to climb, we can expect a further positive shift in market sentiment.

Technical Analysis for the Afternoon Session on November 21st: Market Sentiment Clouded by Indecision

The VN-Index and HNX-Index both climbed, forming a Doji candlestick pattern, indicating investor indecision. This pattern suggests a potential shift in market sentiment, as investors appear uncertain about the future direction of the market. With the indices hovering at these levels, it’s a pivotal moment for Vietnam’s stock market, leaving investors wondering if this is a mere pause or a sign of things to come.

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.