I. MARKET ANALYSIS OF THE STOCK MARKET FOR NOVEMBER 20, 2024

– The main indices recovered in the trading session on November 20. The VN-Index closed up 0.95%, reaching 1,216.54 points; HNX-Index ended at 221.29 points, up 0.73% from the previous session.

– Liquidity improved significantly, with the matching volume on HOSE reaching over 649 million units, up 48.4% from the previous session. The matching volume on HNX increased by 60.2%, reaching nearly 52 million units.

– Foreign investors continued to sell a net on the HOSE with a value of more than VND 1.2 trillion and sold a net of more than VND 53 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– At the beginning of the November 20 session, sellers continued to put pressure, pushing the index below the historical milestone of 1,200 points. However, from this point on, strong bottom-fishing demand reappeared, led by the real estate group. The recovery spread rapidly across the market, accompanied by improved liquidity. The VN-Index gained nearly 10 points at the end of the morning session, despite the strong net selling by foreign investors. In the afternoon session, the positive sentiment continued to push the index higher, although there was a slowdown in the latter half of the session. The VN-Index closed with an increase of 11.39 points, reaching 1,216.54 points.

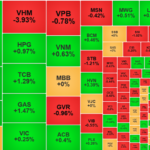

– In terms of impact, VHM, FPT, CTG, and TCB contributed the most to today’s recovery, helping the VN-Index gain more than 3.5 points. On the other hand, the 10 stocks with the most negative impact took away less than 1 point from the overall index, with MWG, GAS, and VTP being the most notable.

– The VN30-Index closed up 1%, reaching 1,271.73 points. Buyers regained a dominant position, with 24 stocks rising, 2 falling, and 4 standing. BCM, VHM, and TCB led with gains of over 2%. Meanwhile, MWG and GAS were the two codes that failed to join the market today, falling 1.2% and 0.4%, respectively.

Green returned to most industry groups. Real estate was the main highlight today, attracting strong buying interest, typically VHM (+2.61%), NVL (+4.65%), DXG (+%), PDR (+6.21%), NLG (+2.16%), DIG (+4.27%), HDG (+3.13%), CEO (+3.6%), BCM (+2.66%), KBC (+1.13%), and SZC (+1.28%).

The information technology, energy, and securities groups also recovered well, up more than 1%. The main contributors were FPT (+1.85%); BSR (+2.11%), PVD (+0.43%), POS (+11.5%); SSI (+1.89%), HCM (+2.59%), VCI (+1.4%), MBS (+1.87%), FTS (+2.1%), SHS (+1.55%), and BSI (+2.53%).

On the other hand, telecommunications and industry were the two remaining groups dominated by red, mainly due to the stocks VGI (-6.15%), CTR (-0.51%); ACV (-1.07%), MVN (-6.06%), VEA (-1.04%), VEF (-6.11%), VTP (-4.96%), and PHP (-5.14%).

The VN-Index rebounded strongly after continuous selling pressure in recent sessions. At the same time, the trading volume exceeded the 20-day average, indicating that money is flowing back into the market. Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If, in the near future, the indicator leaves this region, the situation will become even more positive.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator indicator has given a buy signal in the oversold region

The VN-Index rebounded strongly after continuous selling pressure in recent sessions. At the same time, the trading volume exceeded the 20-day average, indicating that money is flowing back into the market.

Currently, the Stochastic Oscillator indicator has given a buy signal in the oversold region. If, in the near future, the indicator leaves this region, the situation will become even more positive.

HNX-Index – Re-testing the old bottom of April 2024

The HNX-Index rebounded strongly and re-tested the old bottom of April 2024 (equivalent to the 219-222-point region). At the same time, the trading volume exceeded the 20-day average, indicating that investors are starting to trade more actively.

However, the MACD and Stochastic Oscillator indicators are still giving sell signals, reflecting that the short-term outlook remains pessimistic.

Money Flow Analysis

Fluctuations in smart money flow: The Negative Volume Index indicator of the VN-Index cut down below the 20-day EMA. If this state continues in the next session, the risk of a sudden drop (thrust down) will increase.

Fluctuations in foreign investment flow: Foreign investors continued to sell a net in the trading session on November 20, 2024. If foreign investors maintain this action in the coming sessions, the situation will be less optimistic.

III. MARKET STATISTICS FOR NOVEMBER 20, 2024

Economic Analysis and Market Strategy Department, Vietstock Consulting

The Stock Market Week of November 18-22, 2024: Anticipating a Return of Capital Flows

The VN-Index ended the week on a slightly negative note, but this did not dampen the positive recovery seen over the past week. Looking ahead, an increase in trading volume above the 20-day average, coupled with a return to net foreign buying, would boost expectations for the VN-Index’s growth.

Technical Analysis for the Afternoon Session on November 21st: Market Sentiment Clouded by Indecision

The VN-Index and HNX-Index both climbed, forming a Doji candlestick pattern, indicating investor indecision. This pattern suggests a potential shift in market sentiment, as investors appear uncertain about the future direction of the market. With the indices hovering at these levels, it’s a pivotal moment for Vietnam’s stock market, leaving investors wondering if this is a mere pause or a sign of things to come.

The Market Beat: A Resilient Market Bounces Back, Easing Traders’ Concerns.

The market is finally showing signs of recovery, with a rebound of over 20 points in the last two sessions, offering a glimmer of hope after a challenging period of consistent losses. However, this recovery is not without its concerns, as trading volume has noticeably dropped, indicating a potential lack of conviction in the market’s upward trajectory.

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.